EUR/USD

The Euro broke down significantly during the trading session on Tuesday, forming a massive bearish candle. I believe at this point we are going to continue to grind, meaning that we should go lower and towards the 1.13 level, perhaps the 1.1250 level after that. If we do turn around, I’m more than willing to fade rallies as they appear, as the 1.15 level has proven itself to be rather resistive. I don’t have any interest in buying this pair right now, at least not until we close above the 1.15 level on the daily chart. I think at this point, we are decidedly in a bearish trend, and with the amount of risk out there it makes sense that the US dollar continues to climb, not only based upon safe haven trading but also the fact that there are several interest rate hikes coming.

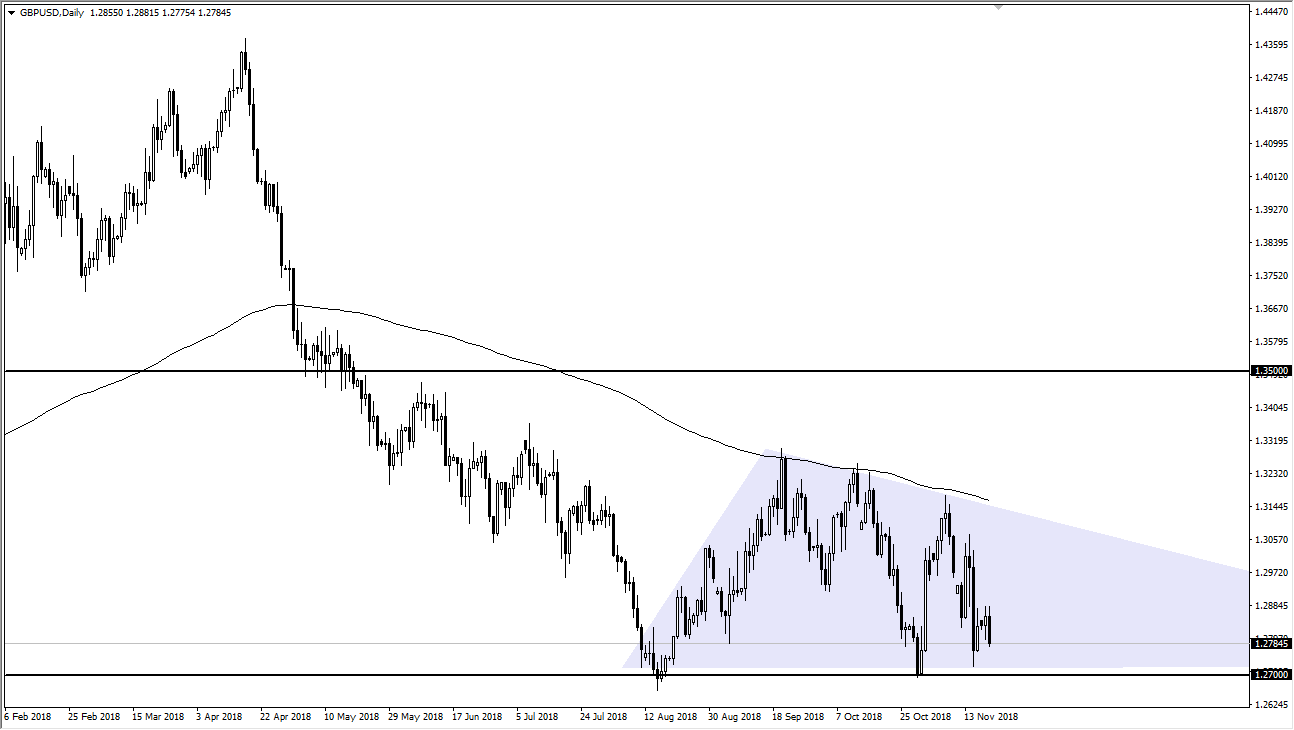

GBP/USD

The British pound fell during the day as well, and it looks as if it is destined to test the 1.27 level underneath. If we can break down below that level the market will more than likely unwind down to the 1.22 handle, as we have that measured move based upon the descending triangle. The 200 day EMA is just above the downtrend line, and I think that at this point we will not get above it. The Brexit headlines continue to be relatively negative, so it makes sense that the British pound continues to struggle. We basically needed some type of Brexit agreement that everybody agrees on before the British pound can pick up any serious momentum to the upside. At one point, it looked as if the value hunters are coming back in to pick up the Pound, but they’ve left.