EUR/USD

The Euro went lower initially during trading on Monday, but then rallied towards the 1.1455 level, as hope burns eternal. The 1.15 level above is massive resistance, and I believe that the sellers will continue to defend that area, as we are most certainly in a negative trend. If we roll over from here, the market then goes to the 1.13 level after that which of course has been a bit of a magnet for price. I think the pair has gotten a bit ahead of itself, and I think that it is only a matter of time before the US dollar starts to strengthen again. Overall, if we can break above the 1.15 handle, then the market probably finds itself struggling all the way to the 1.16 level after that. I don’t have any interest in buying this pair, at least not right now.

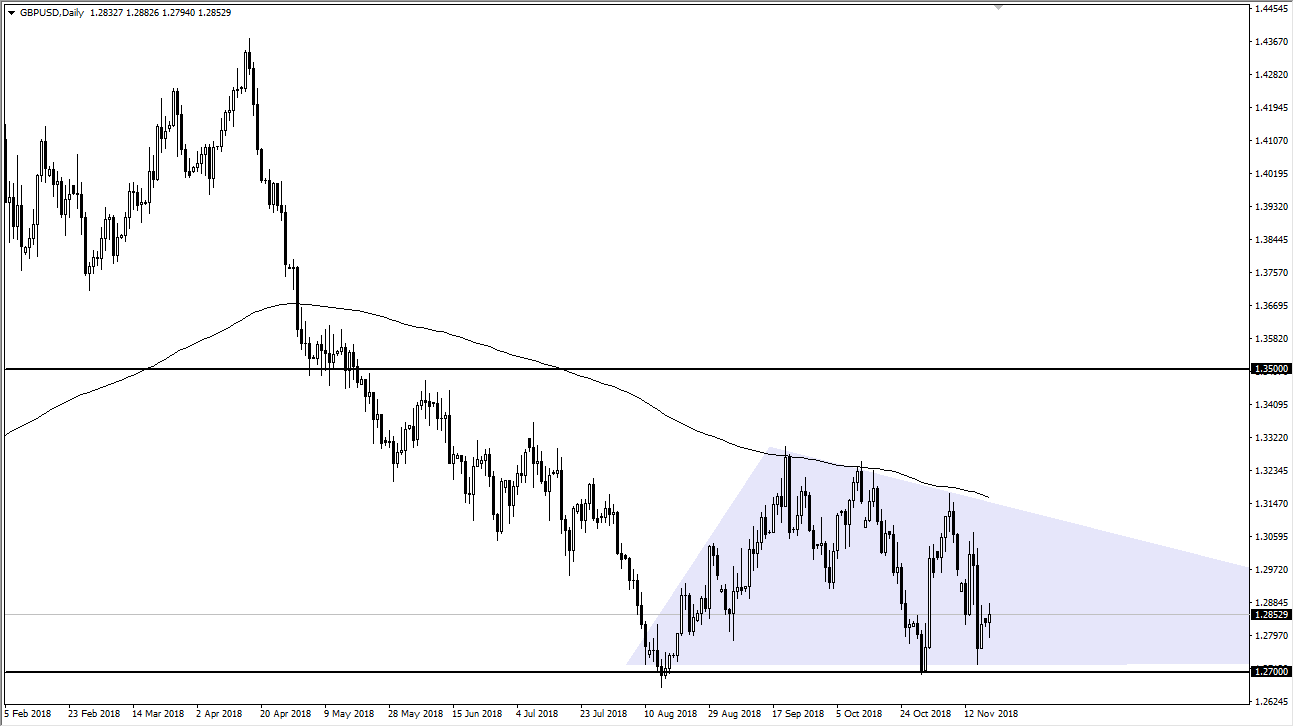

GBP/USD

The British pound has gone back and forth during the session on Monday, as we continue to see a lot of confusion involving the Brexit and the nonsense that’s going on in the United Kingdom. Because of this, I would expect rallies to offer selling opportunities given enough time, and I don’t have any interest in buying. The 200 day moving average continues to offer resistance above at the downtrend line, so it’s only a matter time before the sellers get involved.

If we did break above the 200 day EMA, then we could possibly see an opportunity to start buying but that would obviously be with a certain amount of good news that just has income. Every time we rally, the sellers come back in and I don’t expect that the change in the short term.