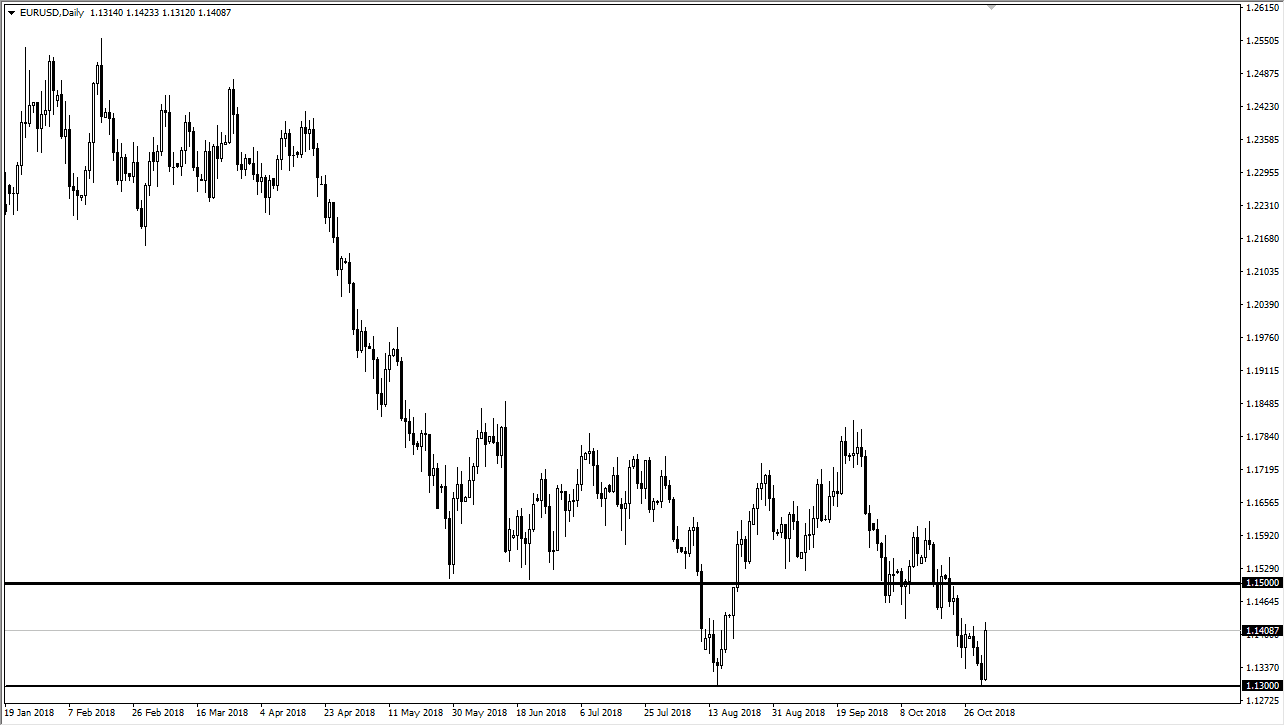

EUR/USD

The Euro broke higher during the trading session on Thursday, slamming into the 1.14 handle. This is a market that has had a nice bounce, perhaps in preparation for the jobs number coming out tomorrow. This of course will create a lot of volatility in the currency markets, so obviously it makes sense that in and oversold condition we might get a bit of a bounce. Beyond that, I suspect that a lot of traders continue to be hopeful that interest rates may not rise as quickly as predicted in America, but quite frankly I think the Federal Reserve has made up its mind. Expect a lot of volatility around 8:30 AM New York time tomorrow morning, with the 1.13 level on the bottom being the “floor” in the 1.15 level on the top being a bit of a “ceiling.”

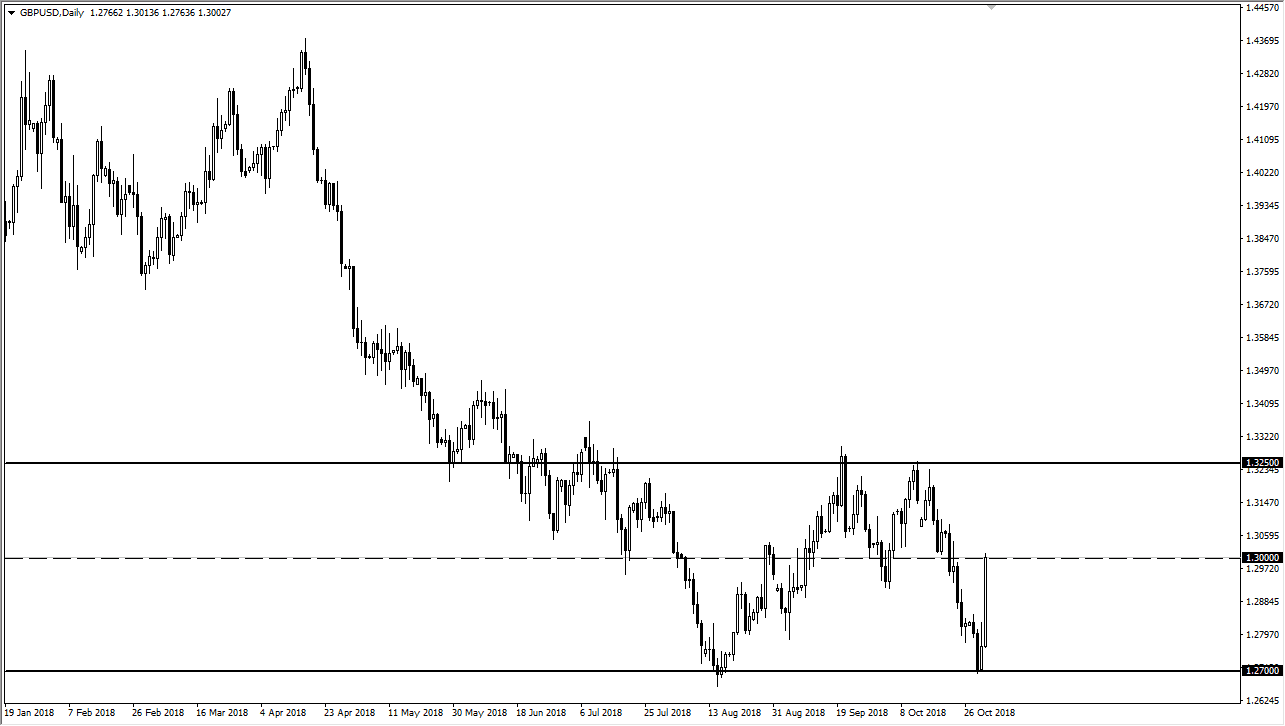

GBP/USD

The British pound shot higher after word got out that perhaps there could be some type of deal involving banking in the EU by British banks. Ultimately, I think that the 1.30 level of course is going to cause a lot of psychological importance, and noise. I think with the jobs number coming out this is a market that is going to be susceptible to a significant shift in momentum at 8:30 AM New York time, so ultimately I think that the market stays within the larger consolidation level that I have marked on the chart, but at this point I think we are going to sit still for the most part between now and the jobs number. I believe that the 1.3250 level is a massive “ceiling” in the market, while the 1.27 level underneath is essentially the “floor.”