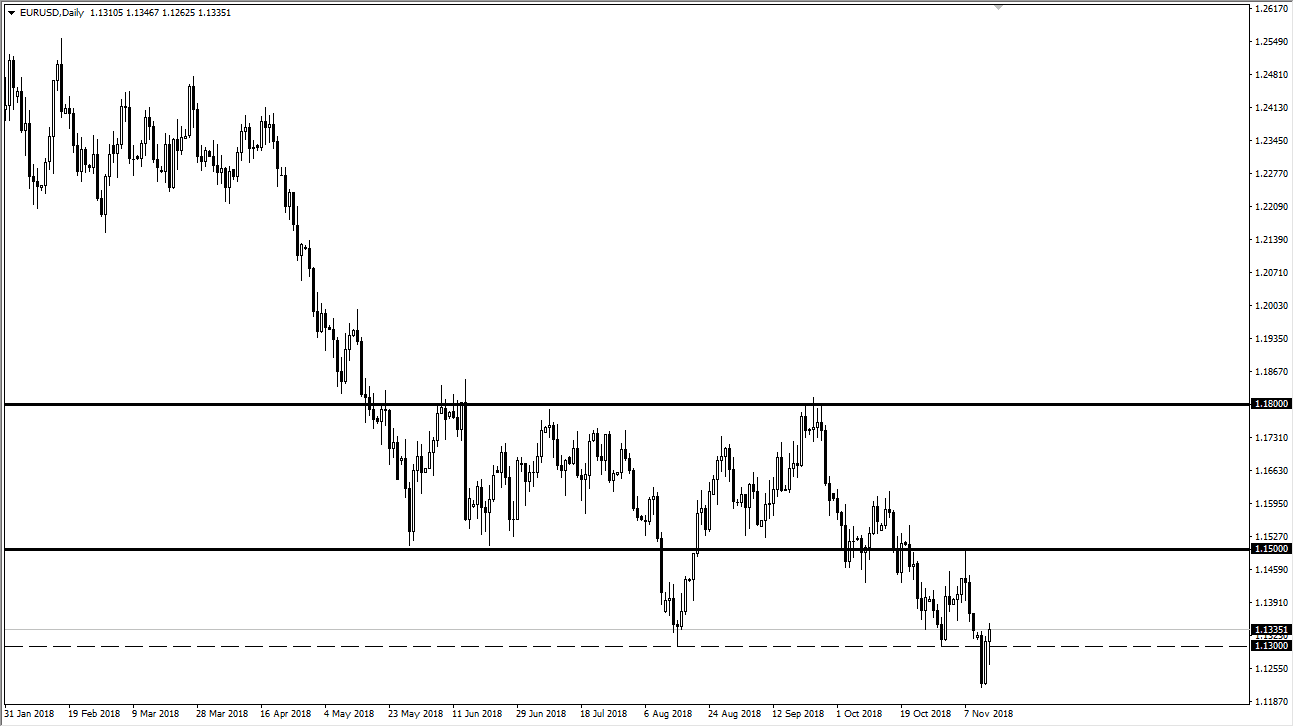

EUR/USD

The Euro initially fell during the trading session on Wednesday but turned around to break above the 1.13 level. Beyond that, we rallied a bit more, as people are talking about potential moves forward and the Brexit. However, there is far too much in the way of negativity out there for me to think that it is going to continue to go much further to the upside. I believe that the 1.15 level will continue to cause a significant amount of resistance, so I’m looking for some type of exhaustive candle to turn around and start shorting. The market could break down at any moment, because the higher interest rates in the United States and of course the uncertainty with the Italian debt situation will continue to weigh upon this pair. If we were to break above the 1.15 handle, then it could be a very bullish sign, but until then I don’t think I trust rallies.

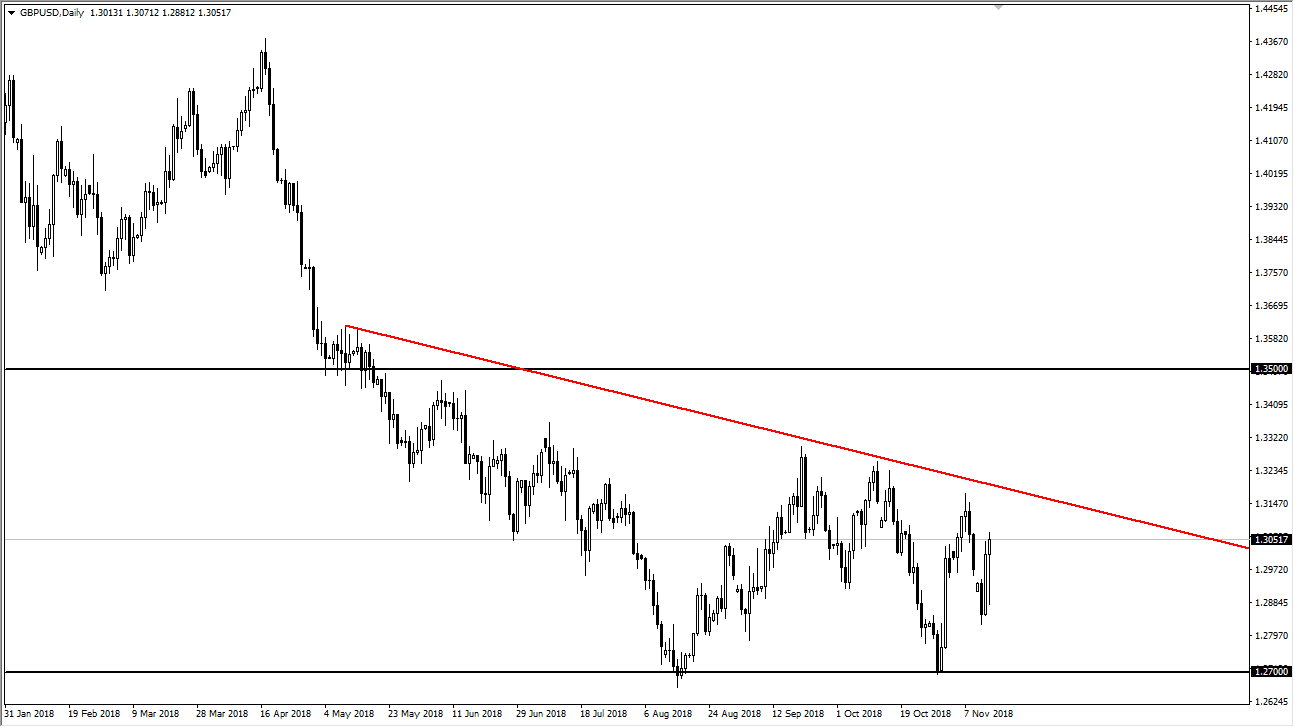

GBP/USD

The British pound of course has been going back and forth based upon Algo trading reading headlines about the Brexit. We are still struggling to get any type of grip, and I think that the downtrend line above will continue to show negative pressure that weighs upon the British pound in general. I think the 1.27 level underneath is massive support, but if we were to break down below there we could then go down to the 1.22 level after that. There is a lot of negativity out there, and there’s no sign that things are going to change in the short term. Longer-term, I do think that the British pound will rally based upon a Brexit deal, but we have so much noise out there I have found that fading rallies tends to be the best way.