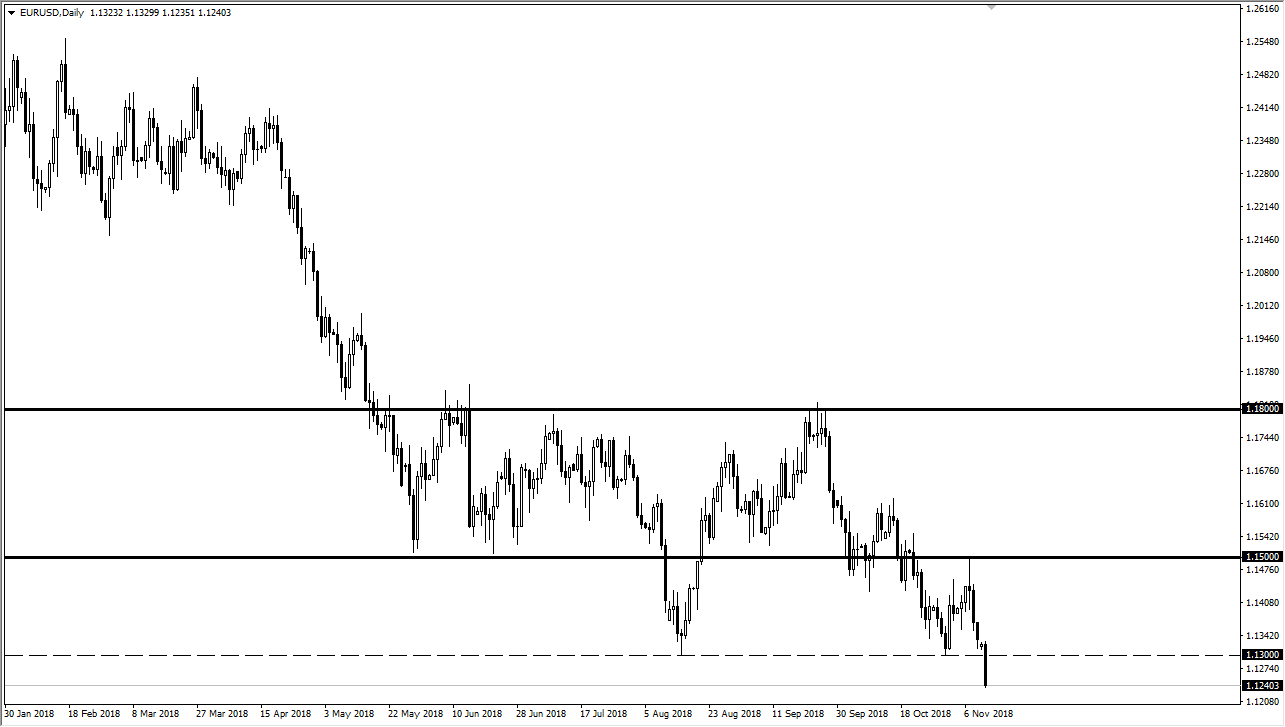

EUR/USD

The Euro fell almost immediately on Monday to kick off the week, as we reached below the 1.13 level based upon fears coming out of both Italy and less than desirable economic figures coming out of the European Union in general. Mary that with the idea of the Federal Reserve raising interest rates, and it makes a lot of sense that we continue to struggle. The 1.13 level was important, and now that we have broken below there it’s likely that we will continue to go towards lower levels, namely the 1.12 handle, followed by the 1.11 level after that which is a major support level on longer-term weekly charts. Rallies at this point are to be sold at the first signs of exhaustion. Now that we have broken below the 1.13 handle, it’s very unlikely that we will get a bullish opportunity in the short term.

GBP/USD

The British pound also broke down during the trading session on Monday, reaching to the 1.28 handle before bouncing slightly. However, the likely move is still lower though, as we gapped lower and we are most certainly seeing a lot of selling pressure every time we try to rally. The 1.27 level underneath is massive support, and I think that it will continue to offer buying pressure. If we break down below that level, then the market goes much lower, perhaps for a measure to move down to the 1.22 handle. Rallies are to be sold at the first signs of trouble, as the downtrend line continues to give us an idea to pressure buyers. I think at this point, it’s only a matter time before some negative headline comes across to spook people out of the British pound yet again. The US dollar has the benefit of interest rate hikes coming as well.