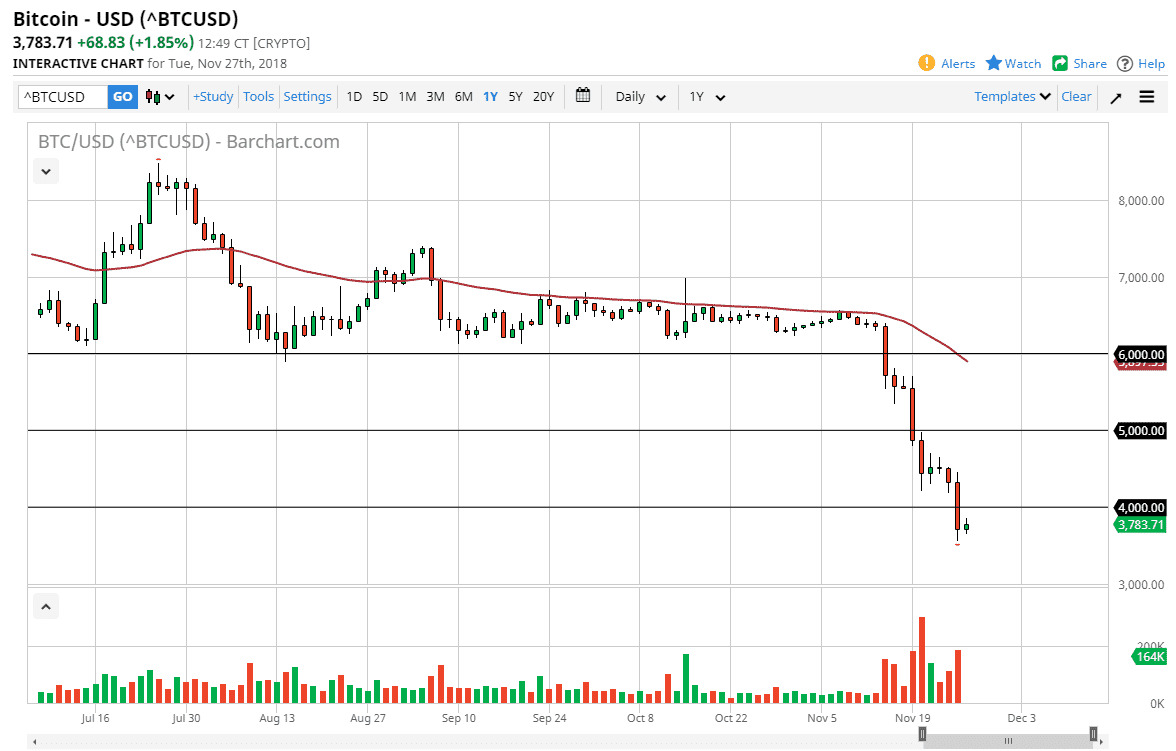

Bitcoin did very little on Tuesday as we continue to hang below the $4000 level. Selling isn’t done, and I think that the massive red candle that we ended up forming for the Monday session tells you just how negative this market truly is. Volume has picked up as we sell off, so although it’s been very large compared to recent trading, I don’t think that we have formed a flush or capitulation as although volume is picking up, it’s not critical. Ultimately, I think that this shows that every time this market rallies you should be a seller, but then again that’s been the case for a good year now anyway.

Looking at the 50 day EMA, we are now below the $6000 level with that indicator and it is most certainly turning to the downside. This is a technically negative sign, and now I think that the $4000 level could offer resistance, and that of course at $4500, followed by the $5000 level. The rallies will be opportunities for people to get rid of bitcoin at a higher price, and I think they will take advantage of it.

We still don’t have adoption of bitcoin, and I think we are a long time away from having it. Every day, I get emails about how bitcoin is the future of money, but the reality is money cannot be this volatile. Think of it this way: you have been accepting bitcoin as a business for two years. Where’s your cost basis? How do you price things? You simply can’t because the value of it is all over the place. It does not function as money, and I don’t know if it ever will. Beyond that, most places simply don’t use it. We are a long time from seeing bitcoin having a practical use.