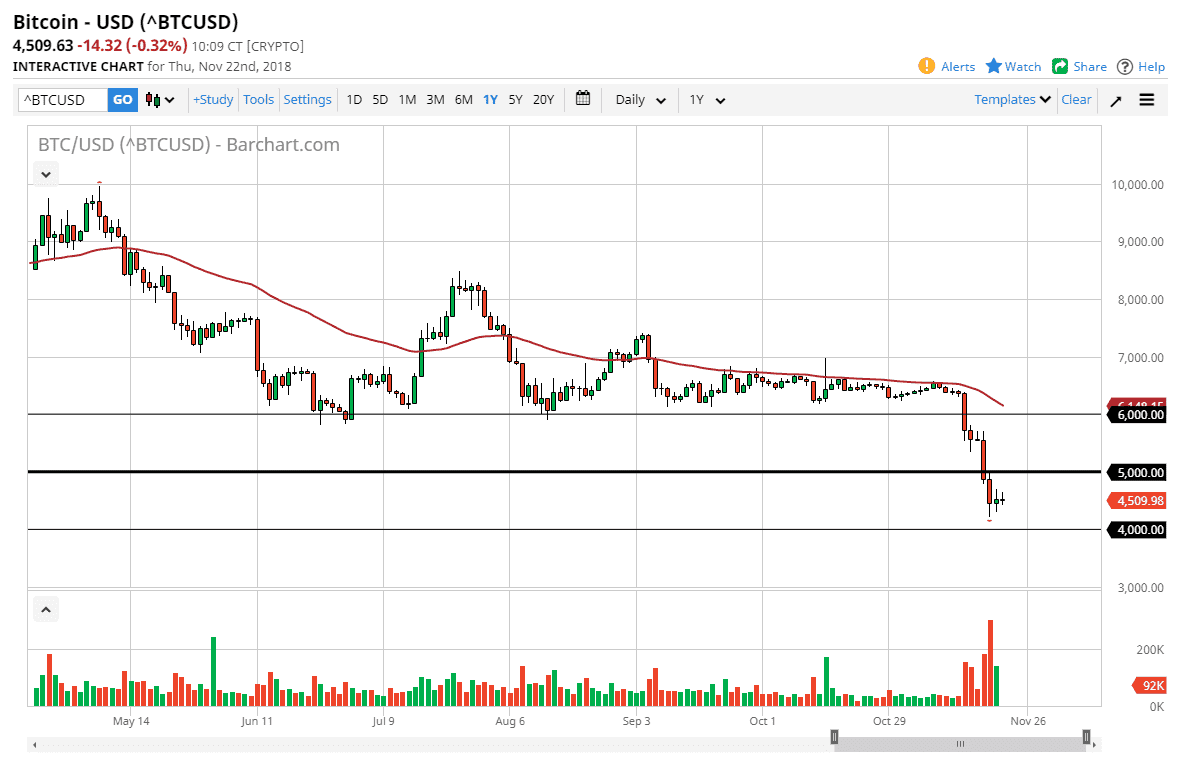

BTC/USD

Bitcoin did almost nothing during the trading session on Thursday, not much of a surprise considering that the market is probably a bit exhausted from breaking through massive support, and of course the Thanksgiving Day holiday was going on in the United States. Regardless, it’s obvious that breaking through the $5000 level is a significant turn of events, and I believe it’s only a matter of time before we go crashing through 4000 as well. This doesn’t mean that we have to do it immediately, and I would not be surprised at all to see a bit of a bounce as value hunters come into the marketplace.

However, I would advise you not to listen to people out there suggesting that “bankers are crashing this market so they can pick up coins cheaply later”, which is great advice for those looking to lose money. I’ve been hearing this story since somewhere around $17,000 earlier this year, and you can see just how well that’s worked out for anybody hanging on. This is a market that is changing before your very eyes, and even if we do become bullish again, the market will never look like it did last year. This is because if the institutions are in fact going to get involved in this market, they can’t be bothered with something that swings 10% every day. Bitcoin has become something much closer to a currency in that sense. In a somewhat ironic twist, Bitcoin is starting to trade more like gold than anything else.

There are a lot of concerns about adoption as well. This was a speculative bubble that serve no purpose. Unlike housing which was in a similar speculative bubble a few years ago, and some would even say right now, there is no use to this asset outside of speculation. I understand that there are a lot of people that talk about this being the future of money, but the reality is that central banks will produce their own digital currencies, and 98% of the population will be using them. That’s the future of digital currency. I continue to sell rallies.