The Australian dollar has bounced a bit against the Swiss franc and other currencies during the last 30 days. October was reasonably good, but we had been massively oversold to going into the month, so it makes sense that we got a bit of a bounce. Volatility and of course risk aversion has come back into the marketplace, so I think at this point we are looking at the high likelihood of selling pressure above. Remember, the Australian dollar is considered to be a “riskier currency”, while the Swiss franc is certainly a bit of a safe haven in and of itself.

This has been a bit more difficult lately, mainly because the Swiss franc is held hostage by the overall European economic condition. After all, 85% of Switzerland’s exports go into the EU, which makes sense that it would be a bit of a drag on your currency because your best and most important customer is financially strapped, that means they aren’t buying. Beyond that, Switzerland has negative real rates, so that doesn’t help the situation.

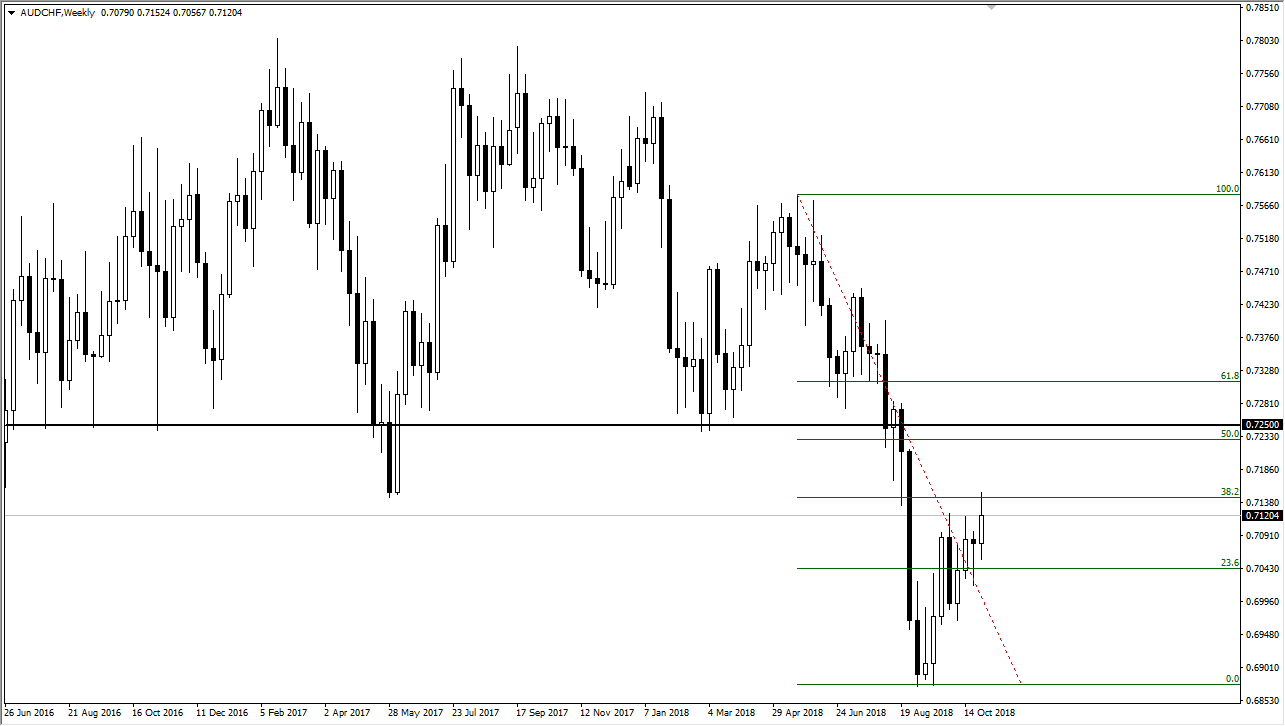

However, this pair does have the dynamic of falling with risk aversion, and we are certainly starting to see more of that. At this point, I think the 0.7250 level will be the ceiling that we test over the first couple of weeks during the month of November. However, we’ve seen a major break down in that area, and I think that selling pressure will overwhelm the buyers. Beyond that, there is the 50% Fibonacci retracement level in that neighborhood as well, so I think it makes sense that we would roll over again. In fact, I’m not comfortable of calling a trend change until we break above the 0.7350 handle. I believe that the beginning of November might be a bit positive, but the sellers are certainly coming soon.