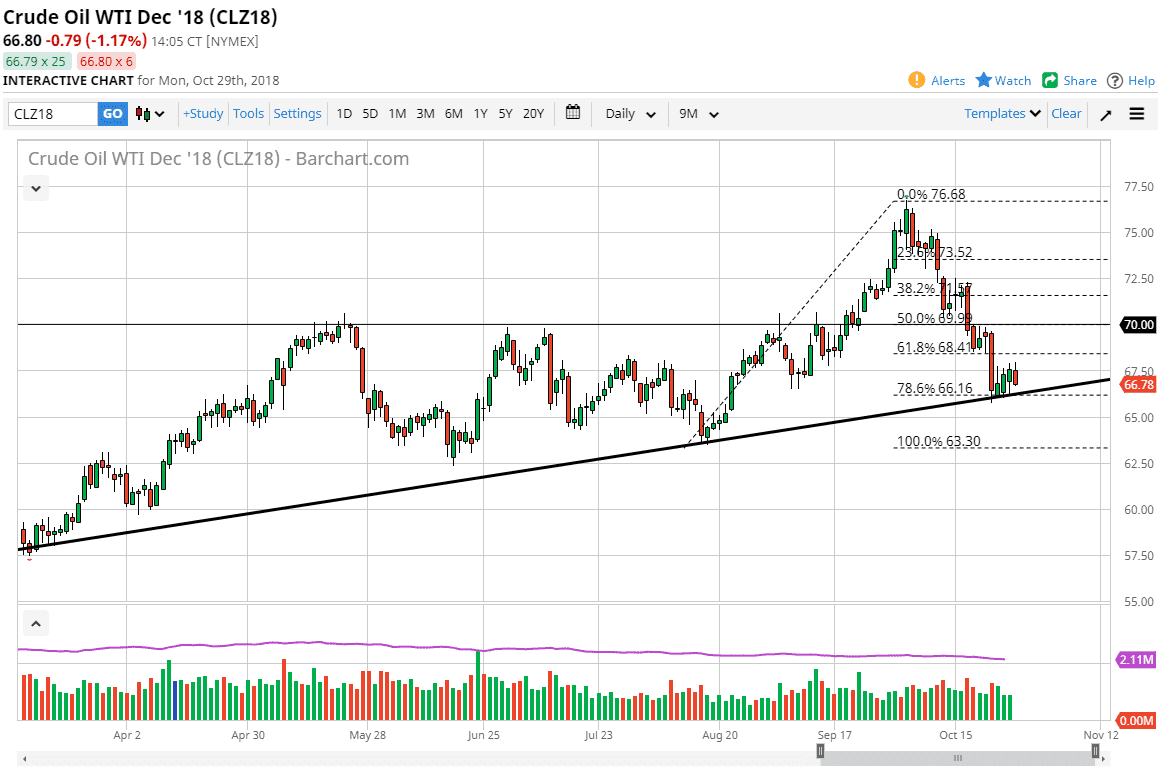

WTI Crude Oil

The WTI Crude Oil market initially tried to rally on Monday, but the sellers came back in and sent this market back into consolidation. There is still a lot of support underneath at the trend line, so I think it’s only a matter of time before buyers jump in. If we do break down below the uptrend line, that would be very negative, and if we manage to break down below the $65 level after that, that would be extraordinarily bearish. The alternate scenario is of course a bounce and if we can break above the highs from both Friday and Monday, then we could go higher, perhaps reaching towards the $70 handle. The markets have been sold off quite drastically, so the question now is whether or not we can continue the uptrend, or can we find some type of value hunting in this area?

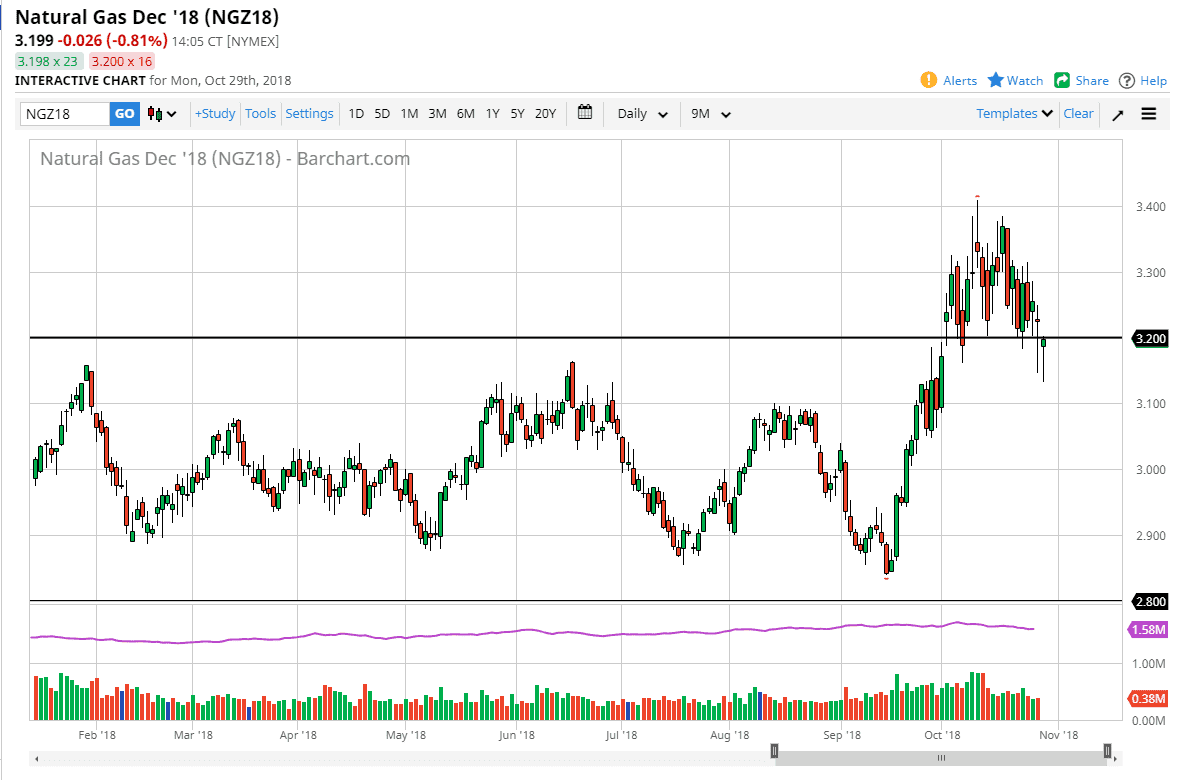

Natural Gas

Natural gas markets gapped lower to kick off the week, breaking below the $3.20 level, and then reaching down towards the $3.15 level before turning around and form a hammer. Ultimately, if we can break higher and reach towards the gap, then eventually we could break towards the $3.40 level above as we would reenter consolidation. However, I think what we are starting to see is that the markets are trying to break down, perhaps giving back due to a lot of concern when it comes to a warmer than expected winter in the United States. Pain attention to the weekly inventory number will be crucial as well, and I think that volatility is probably the one thing we can count on. However, this has been a significant break down over the last several sessions. Expect choppy conditions and look to sell on signs of exhaustion.