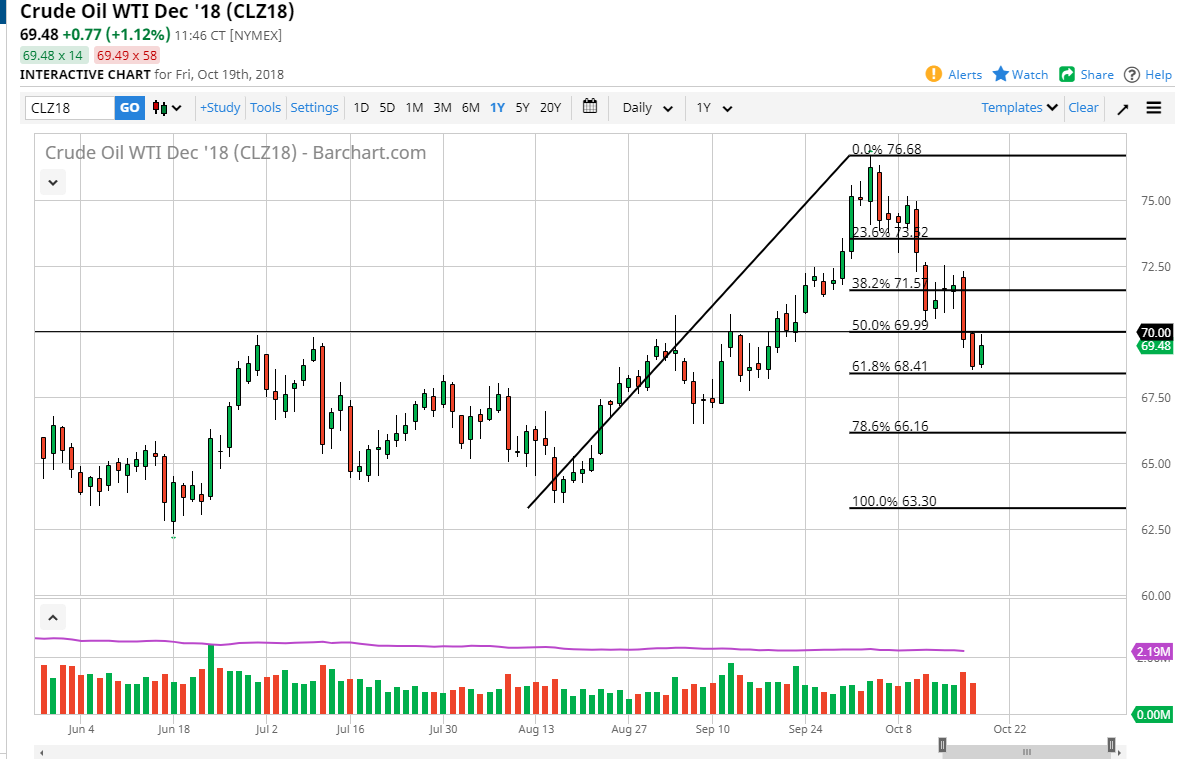

WTI Crude Oil

The WTI Crude Oil market has rallied significantly during the trading session on Friday, testing the $70 level as the 61.8% Fibonacci retracement level has offered enough support. If we can break above the $70 level, then I think the market could probably continue to try to reach towards the $72.50 level after that. It’s a very difficult candle to overcome, but the 61.8% Fibonacci retracement level is called the “golden ratio” for a reason. There’s a lot of noise out there, but I think if we can break above the $70 level it would add much more confidence to the buying opportunity. Otherwise, if we break down below the 61.8% Fibonacci retracement level, then we could unwind the entire move. I think that the tensions between the United States and Saudi Arabia as well as the Iranian sanctions will continue to put upward pressure over the longer-term.

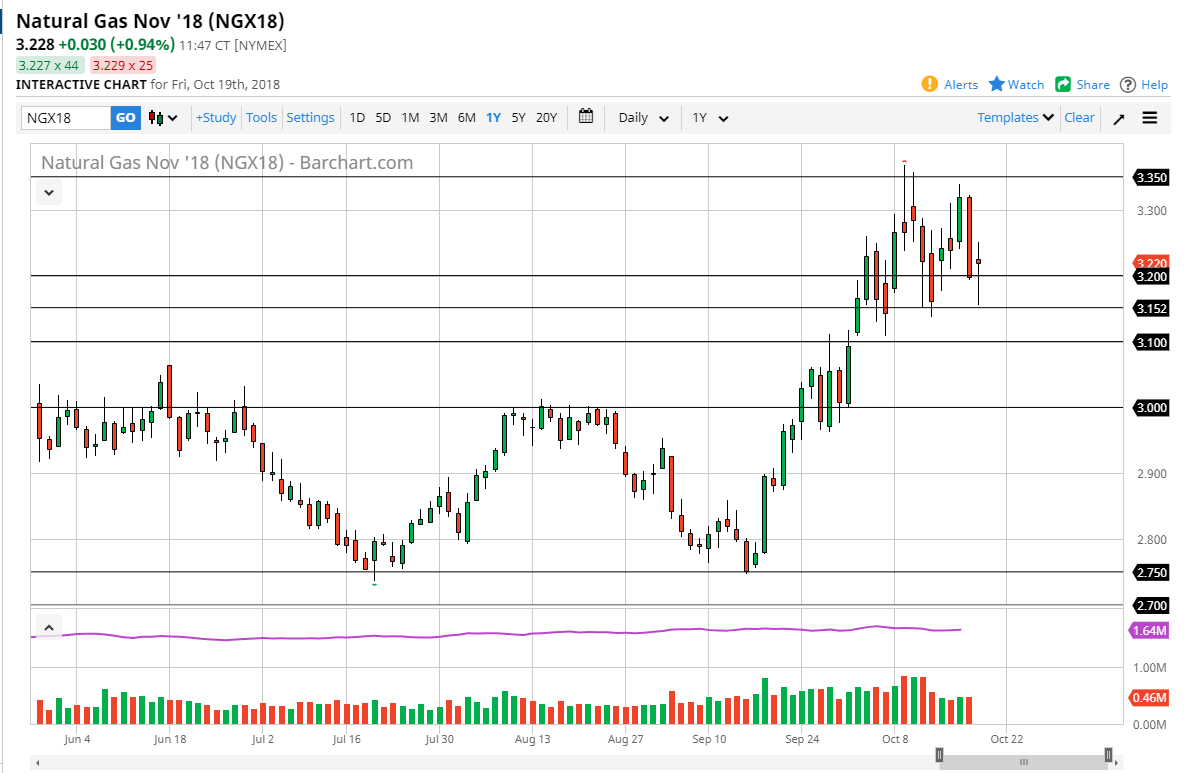

Natural Gas

Natural gas markets were very noisy during the day on Friday, reaching down to the $3.15 level before bouncing again. We ended up forming a bit of a hammer, but we are obviously in massive consolidation right now. The weekly chart is a bit scary looking though, because we had formed a shooting star followed by a relatively neutral candle, so it’s likely that we will continue to be very erratic. I like buying dips though, because it is the typically bullish season for the market, so I think that the dips will continue to attract the seasonality traders. I think there is a bit of a “floor” at the $3.00 level underneath. I would be surprised if we break down below there anytime soon. The $3.10 level is massive support as well. I like buying dips, but I’m also quick to get out.