WTI Crude Oil

The WTI Crude Oil market had a very negative session on Wednesday, which of course makes quite a bit of sense considering that the inventory number was horrible. Expected to come in at 1 million, it broke 6 million. We sliced into the $70 level, an area that is of course very important and previously had been very resistant. It is because of this that I think we may get a bit of support here, but we also could drift a bit lower, perhaps towards the uptrend line which is a little closer to the $67.50 level. If that’s the case, then we could find even more value. I suspect your best trade in this market is to simply sit on the sidelines and wait to see what the next daily candle brings. One thing is for sure, the candle stick from Wednesday looks very bad.

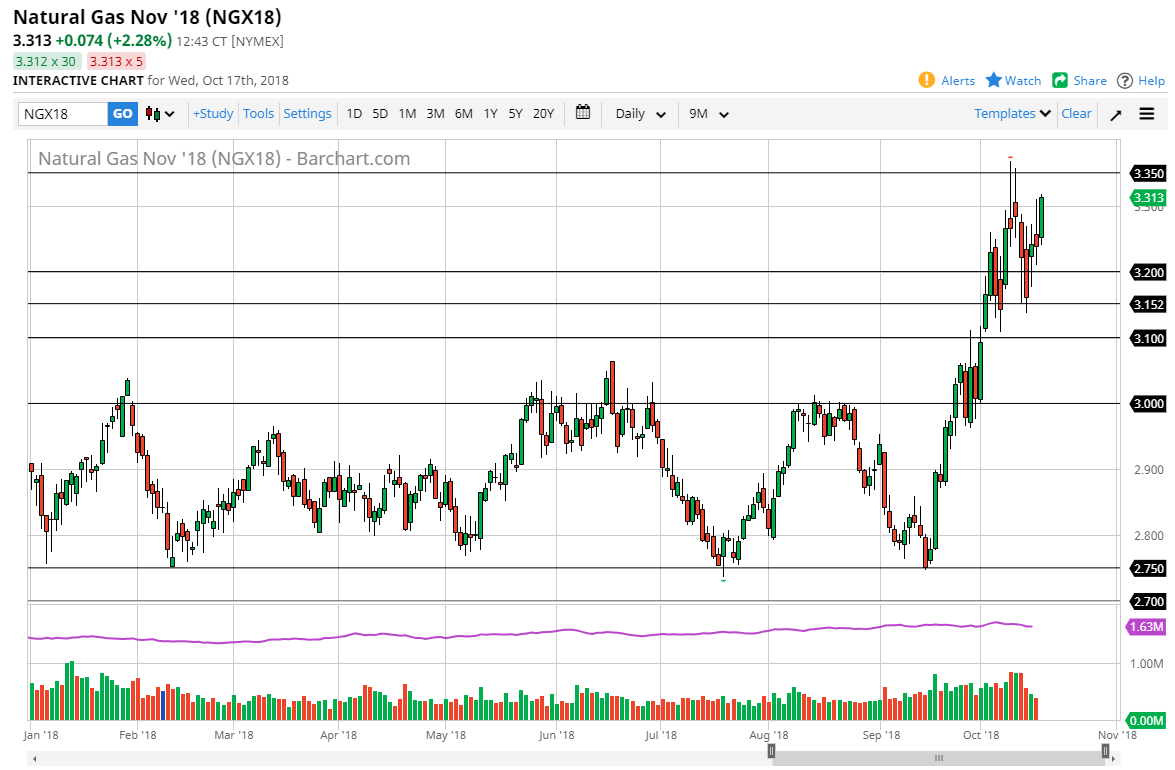

Natural Gas

Natural gas markets ripped higher as WTI fell, as they typically have a bit of an inverse correlation. Beyond that, we have the seasonality effect in natural gas, as Americans will demand more for heating. With that being the case, it’s likely that we will reach towards the $3.35 level eventually, but that’s also an area where we should see a lot of resistance. Pullbacks will occur, and this pullback should be buying opportunities. We have been very choppy for a minute here, but that makes sense because we are simply trying to digest the massive gains. I think at this point your best bet is to simply look for some type of pullback so that we can take advantage of value at this point. We could try to find a shorting opportunity on short-term charts, but quite frankly that’s a bit dangerous when you are trading the November contract.