Gold prices ended the week up $9.54 at $1226.35 an ounce, recoding a second consecutive weekly gain. The recent volatility in global stock markets and heightened geopolitical tensions continued to provide some demand for safe-haven gold. However, expectations for further interest rate hikes in the United States capped gains. Minutes from the Federal Reserve’s September meeting showed policy makers “generally anticipated that further gradual increases in the target range for the federal funds rate would most likely be consistent with a sustained economic expansion, strong labor market conditions, and inflation near 2 percent over the medium term.” Comments from Dallas Federal Reserve President Robert Kaplan on Friday reinforced the view that the Federal Reserve will deliver another quarter-point increase at its final meeting of the year in December, but after that no rate move is anticipated until June 2019.

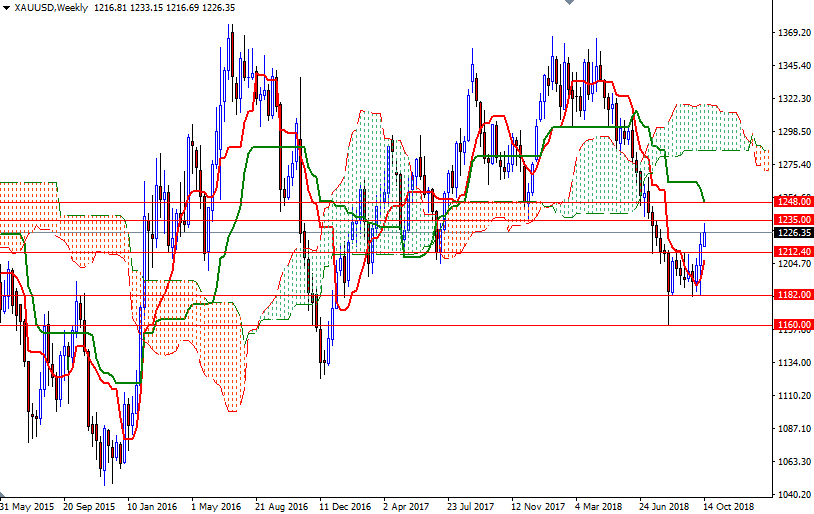

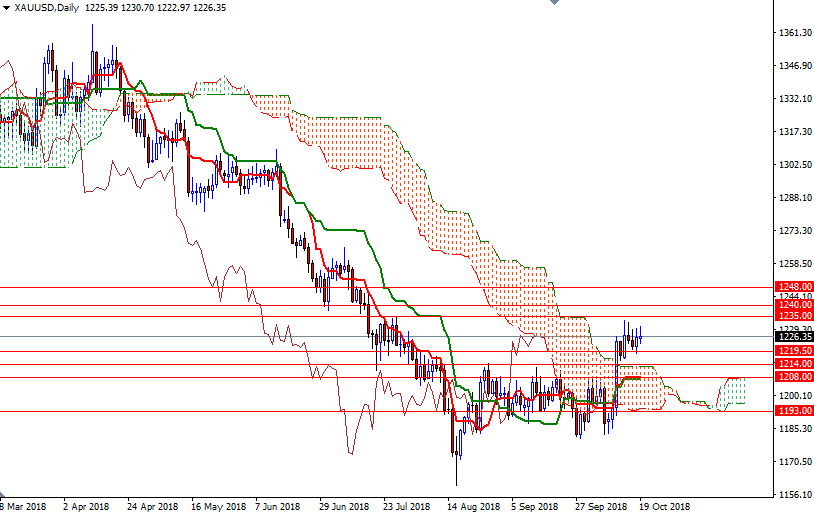

The bulls have the near-term technical advantage, with the market trading above the Ichimoku clouds on the daily and the 4-hourly charts. The Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line) are positively aligned. On the other hand, keep in mind that XAU/USD is still below the weekly cloud; plus, the daily cloud is sitting right on top of the Chikou-span (closing price plotted 26 periods behind, brown line). If XAU/USD successfully breaks through the 1240/35 area, then the market will be targeting 1245.50 and 1252/48. A daily close above 1252 paves the way for a test of 1260.

To the downside, the initial support stands in 1220.50-1219.50, and that is followed by 1214-1212.40, where the top of the daily cloud resides. A break below 1212.40 could foreshadow a move down to 1208/5. The daily Tenkan-sen and the Kijun-sen also sit in this area so the bears have to push prices below there to challenge 1202 or possibly 1198/6. If XAU/USD dives below 1196, the market will be aiming for 1193/1, the bottom of the daily cloud.