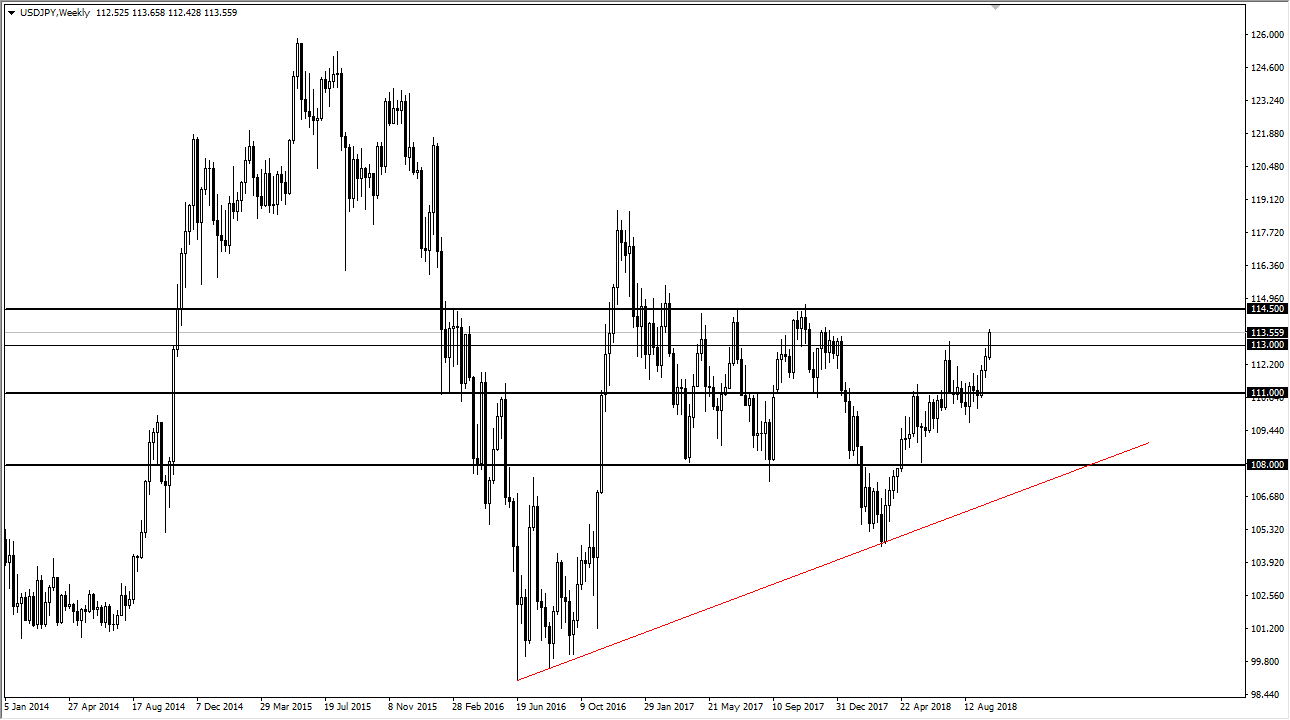

USD/JPY

The US dollar rallied during the bulk of the month on September, and even managed to break the ¥113 level. This is a market that has shown the lot of bullish pressure over the last several weeks, and I think it’s only a matter of time before we go looking towards the ¥114.50 level. That’s an area that should be important, and I think if we can break above there we could then see a significant fight in that area, with the ¥115 level showing a lot of selling pressure. If we can break above that level, it frees the USD/JPY pair to go all the way to the ¥120 level. Overall, the market should continue to be bullish based upon the overall interest rate differential between the economies, and it’s likely that the US dollar will continue to be favored over the Japanese yen.

If we do pull back, I think there’s plenty of support underneath at the ¥113 level, and of course the ¥111 level that we have seen previously. I don’t have any interest in shorting this market, I think it’s only a matter time before we break out, so look at pullbacks as value in a market that has clearly made up its mind. Based upon the longer-term charts, I believe that we could go as high as ¥120, but it will be this month, that’s a story for next spring in my estimation.

If we did break down below the ¥110 level, that would be a huge turn of events, and would obviously show a complete capitulation by the buyers. I don’t think that happens, I give it about a 5% chance this month if that.