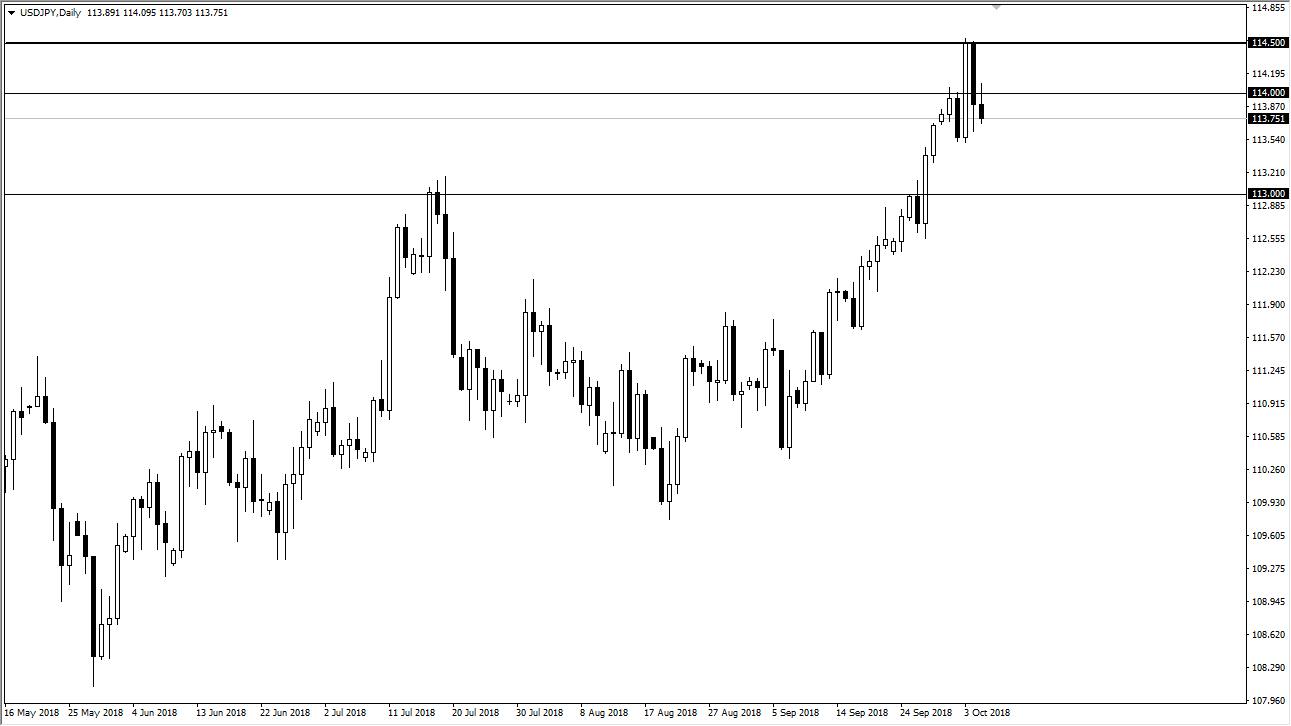

USD/JPY

The US dollar rallied a bit initially during the trading session on Friday, but after the jobs number turn around and fell. Ultimately, the market reached down to the ¥113.50 level, an area that has been supportive. However, the market has formed a shooting star on the weekly chart, so I think at this point we are probably going to continue to see a little bit of softness. That makes sense, because quite frankly this market has gotten ahead of itself. The ¥113 level should be supportive as it was previously resistance, and it’s at that area that I would be looking for some type of buying opportunity. I think the market breaking down below the candle stick that sliced through the ¥113 level could send this market down to the ¥112.50 level. Ultimately, if we clear the ¥114.50 level, then we could probably head towards the ¥115 level.

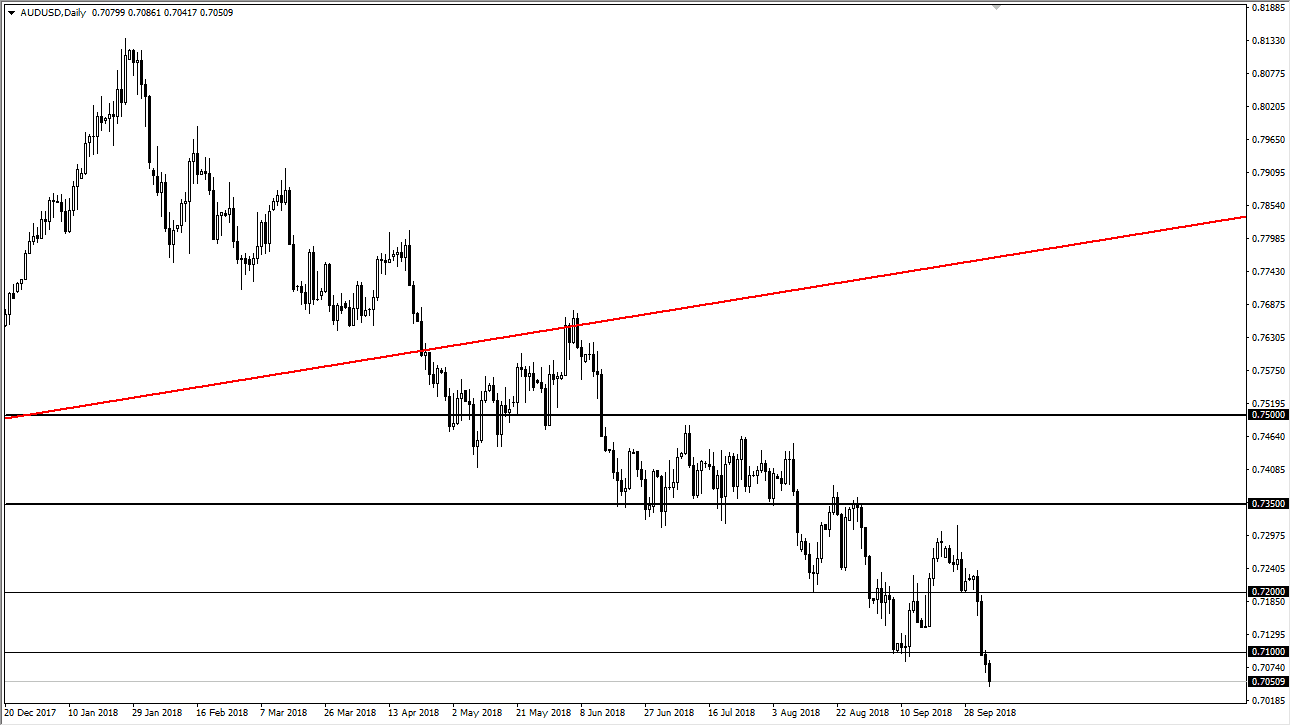

AUD/USD

The Australian dollar has fallen again during the day on Friday, making a fresh, new low as we reached down towards the 0.7050 handle. I think eventually we go to the 0.70 level, but that should cause a little bit of psychological support. I think the market is ready to go much lower though, probably down to the structurally supportive but 0.68 handle. In the environment we find ourselves in, I think the Australian dollar will be handcuffed by the Sino-American trade spat, which continues to get worse, not better. As long as that’s an issue, I don’t think that the Australian dollar will rally for a significant amount of time. Currently, I see the ceiling as the 0.72 handle. I continue to sell the rallies going into this and look to short-term charts to do so.