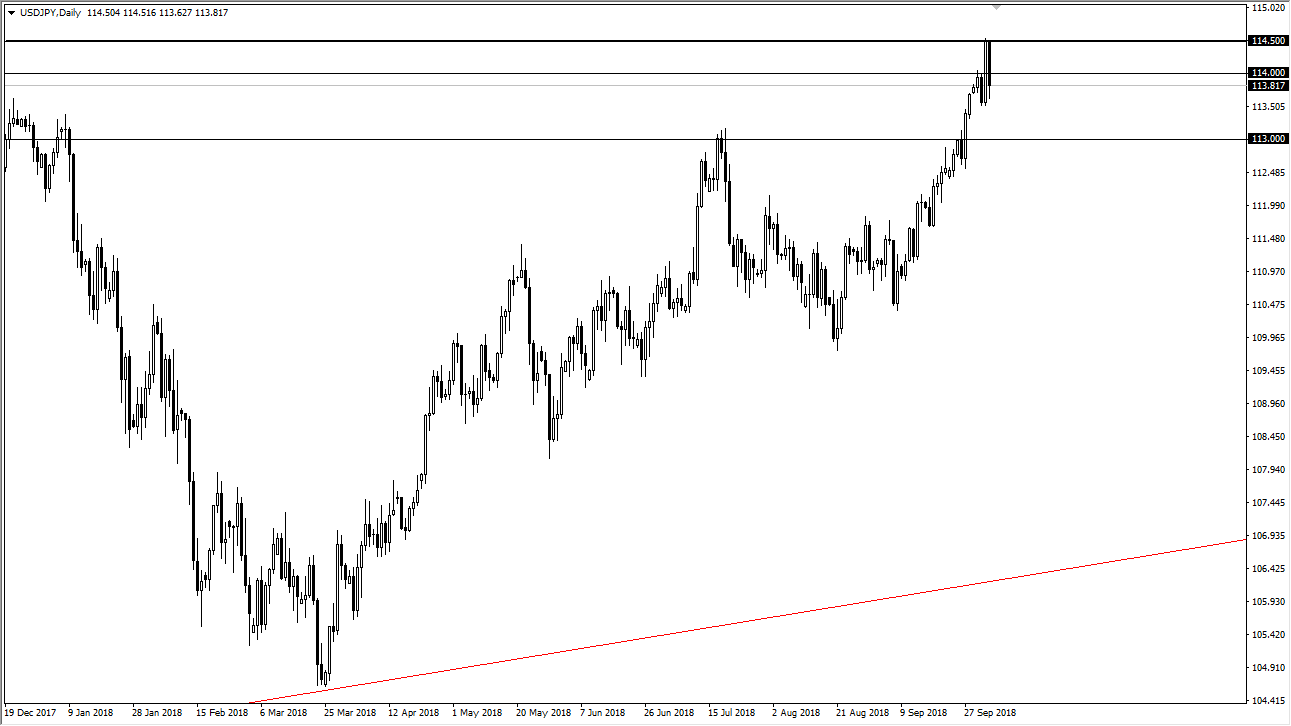

USD/JPY

The US dollar pulled back significantly during the trading session on Friday, as the ¥114.50 level has offered significant resistance. When I look at the candlesticks from both the Wednesday and Thursday sessions, it’s easy to see that there is essentially a shooting star over the last 48 hours. That tells me that we are very likely to see a pullback, but I think there is plenty of support near the ¥113 level. Beyond that, I think the ¥112 level will also offer a certain amount of support. I think if you sit on the sidelines and wait for a pullback, you should be able to find plenty of value in the market. If we break above the ¥114.50 level, there is a significant amount of resistance just waiting to happen and extending to the ¥115 level. I think we need to back up in order to break out above the ¥115 level as we need to build up momentum.

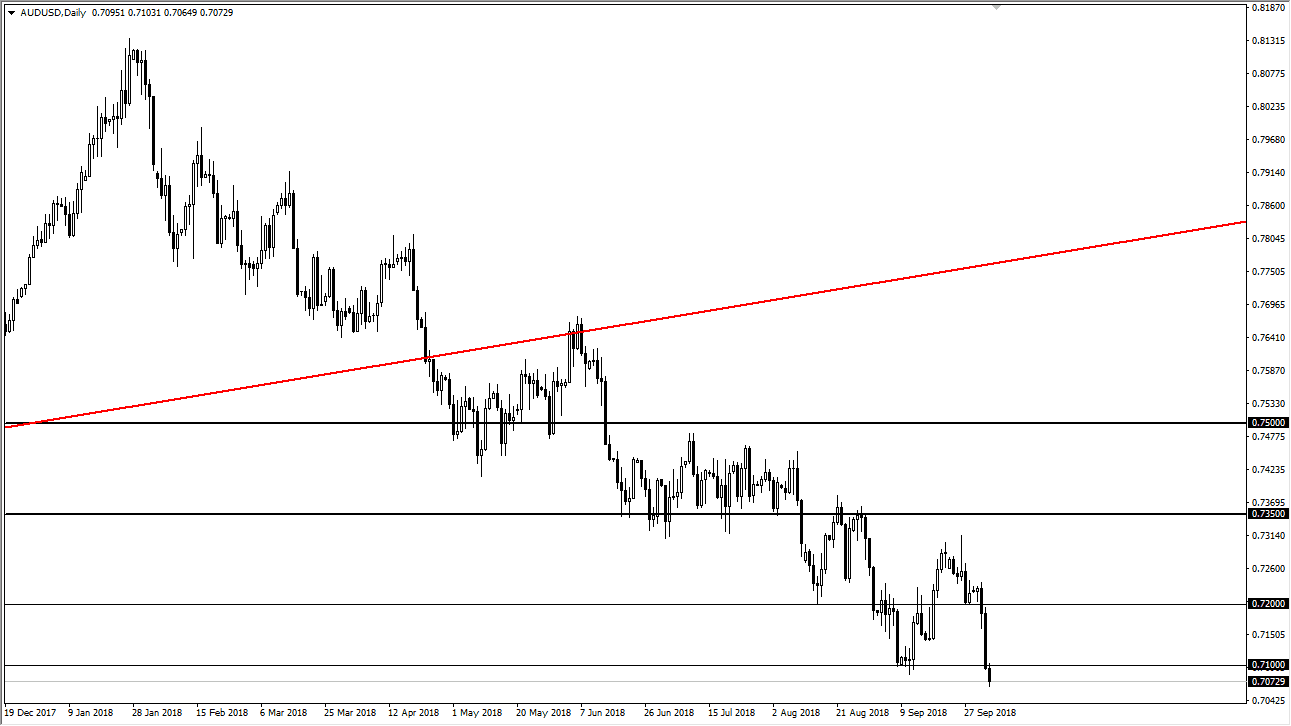

AUD/USD

The Australian dollar has fallen a bit during the trading session on Thursday, as we are below the 0.71 handle. This “fresh low” signifies that we should continue to go lower, and I think at this point rally should be sold. Ultimately, the market looks as if it is ready to go down to the 0.70 level underneath, especially considering that the Australian dollar is highly levered to the Chinese economy. As we still have a trade war brewing, the reality is that the Australian dollar will continue to struggle. With the jobs number coming out today, it’s likely that the pair will be very volatile. I think that rallies at this point should offer selling opportunities though, so I’m looking for some type of exhaustion to start selling yet again.