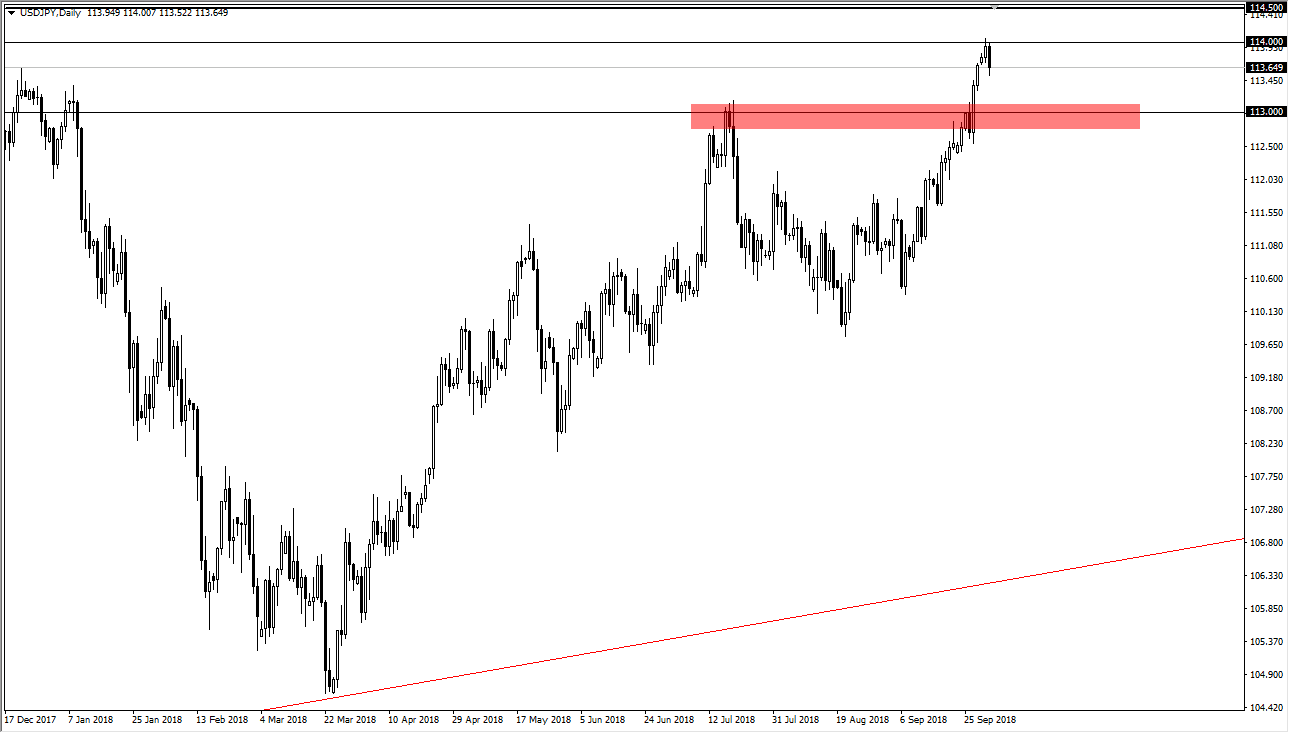

USD/JPY

The US dollar fell during the trading session on Tuesday, as the ¥114 level has been a bit too much. Ultimately, this is a market that is bullish, but ultimately beyond that I believe that it’s time to buy on dips. The ¥113 level should be an area where value hunters will come back in, and I think that the area will be a great launching point for another move towards the ¥114 level. Above there, I think there’s plenty of resistance between the ¥114.50 level and the ¥115 level. If we break down below the ¥113 level, then I think ¥112 ends up being the next launch point. Overall, I believe that the US dollar continues to strengthen due to the interest rate differential between the couple of currencies. I am bullish but give it a chance to pullback to build up the necessary momentum.

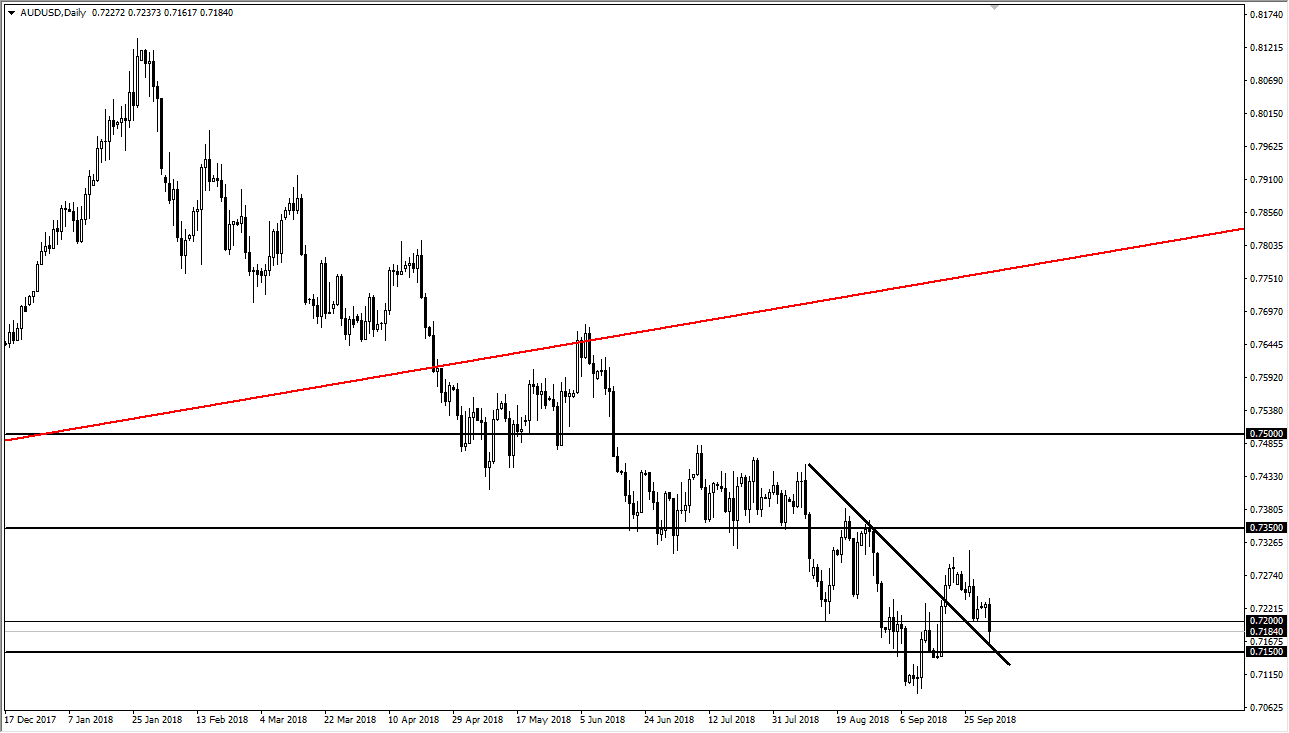

AUD/USD

The Australian dollar broke down below the 0.72 level, showing signs of weakness but we have bounced from the previous downtrend line showing signs of support, and I think that the 0.7150 level underneath should offer support as well. Ultimately, I think that if we can recapture the 0.72 level, the market should continue to go higher. I think we are trying to build the sideways action to change the overall trend, but the Australian dollar will have the weight around its neck of the noise coming out of the Sino-American trade relations. I think that the 0.7350 level above is a target, but it can take quite some momentum to get up there. If we can break above that, then the market would continue to go higher, perhaps reaching towards the 0.75 level.