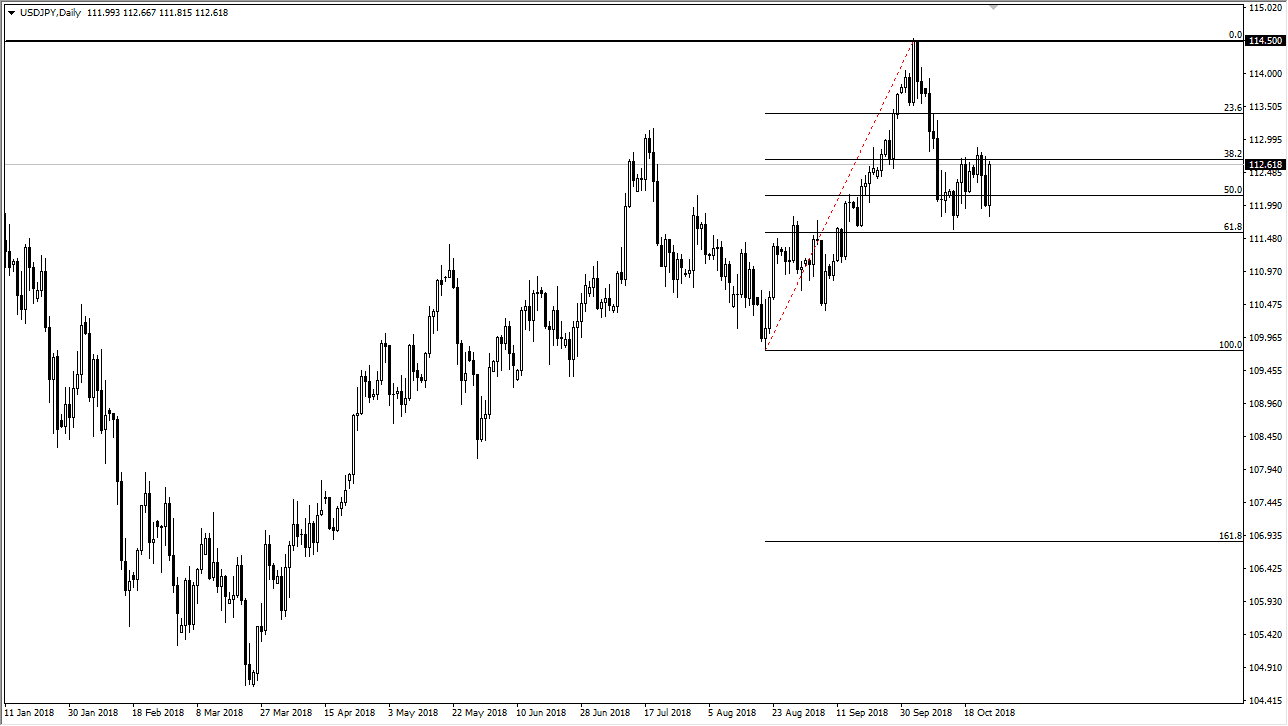

USD/JPY

The US dollar initially tried to fall during the session on Thursday but turned around and reached towards the upside again. It looks as if we are consolidating in general, but I think if we can break above the highs from earlier this week, then the US dollar should continue to go much higher. The 61.8% Fibonacci retracement level underneath continues to offer support, and a bounce from that level of course is a very bullish sign. I think at this point it’s likely that this market could go to the ¥114.50 level above which is the major resistance level. If we break above there, then the ¥115 level would be the next level. At this point, I think that there is still plenty of upward pressure, but as long as there is uncertainty in the risk asset markets, this pair will struggle a bit.

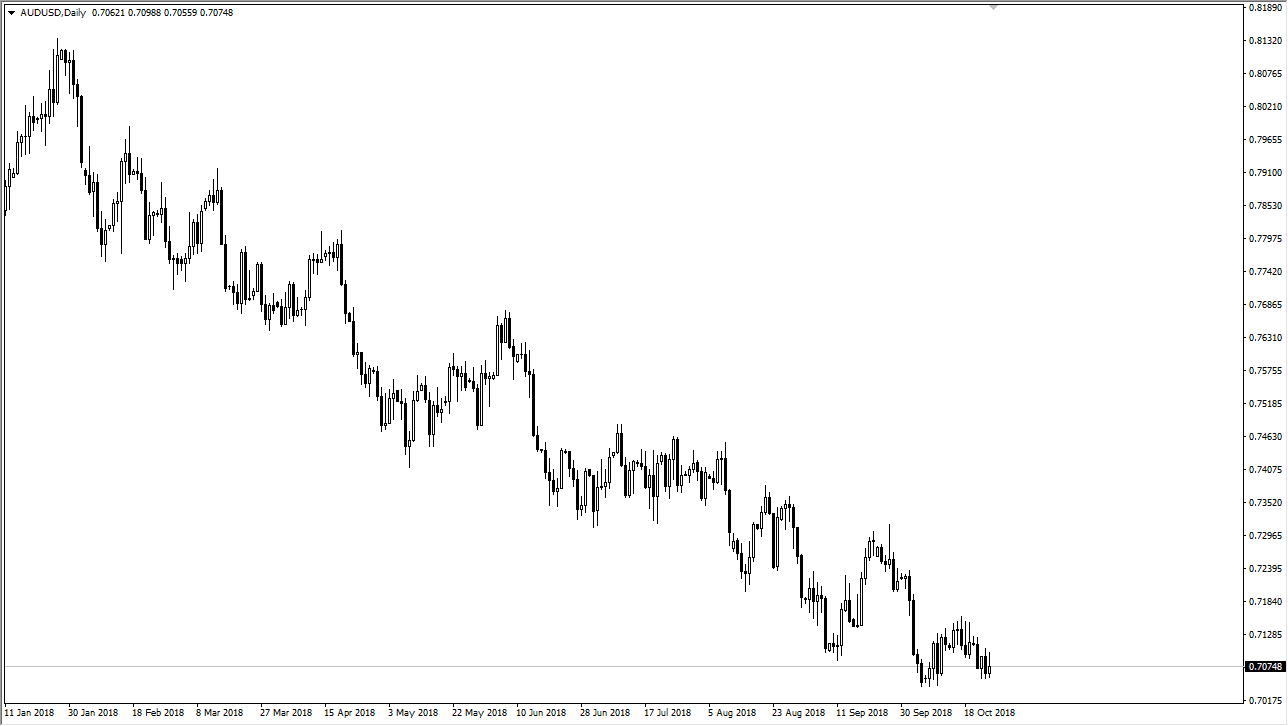

AUD/USD

The Australian dollar try to rally during the trading session but as you can see it rolled over yet again. The market simply cannot get ahead of itself, and even on a day where we had a ton of risk appetite out there, the Australian dollar continued to sell off. The 0.71 level above has offered a lot of resistance, just as the 0.7050 level has offered support. A break down below there could send the market to the 0.70 level after that. This is a downtrend, through and through. However, I think the biggest question is going to be whether or not the United States and China can get back on firm footing when it comes to trade relations. Until then, I think the Australian dollar still has plenty of downward pressure on it longer term. A break down below the 0.70 level opens the door to the 0.68 handle.