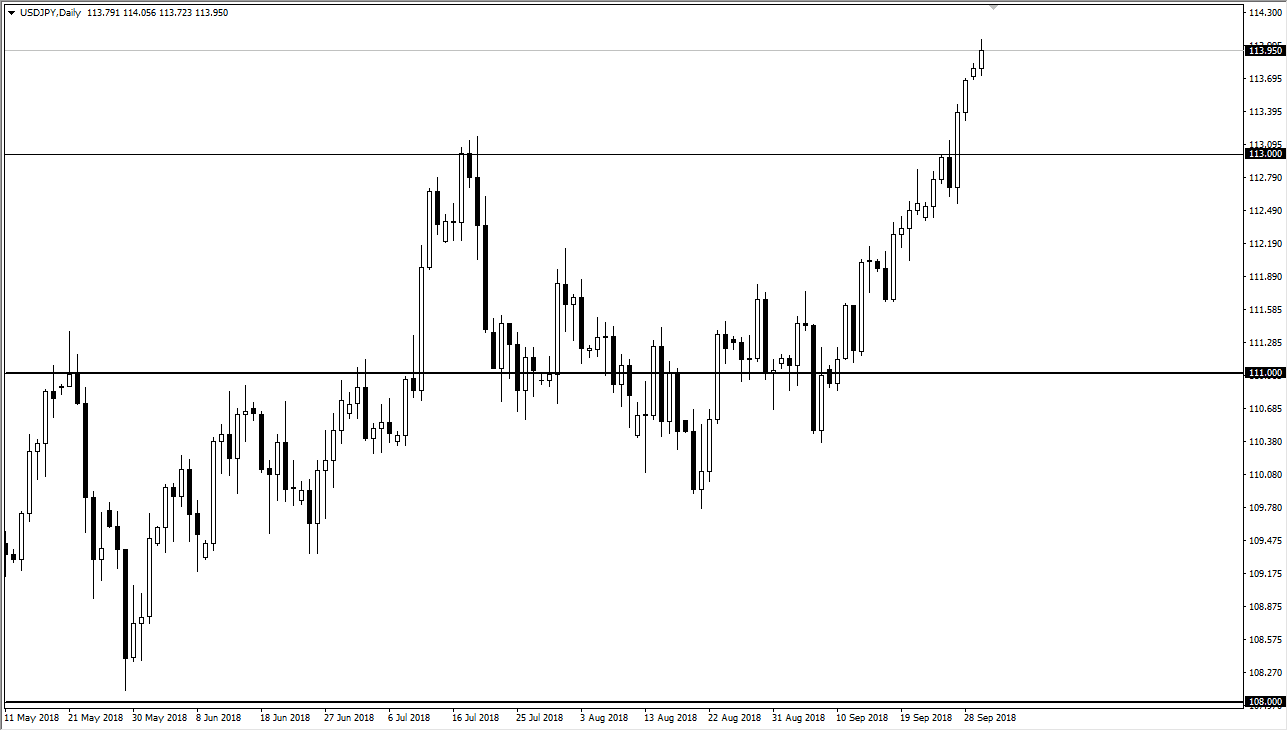

USD/JPY

The US dollar has rallied yet again during the day on Monday, as we continue to see the Japanese yen get sold off against the greenback. The pair is focusing on the differential of interest rate policies between the United States and Japan. Ultimately, this is a market that should continue to go higher, but we have gotten a bit parabolic and of course expensive. I think that a pullback from here makes quite a bit of sense, and I think that we will see it rather soon. I believe that the ¥113 level should be supportive, and I would be very interested in buying on a pull back to that area. I believe that the ¥114.50 level above is massive in its resistance, so therefore it takes quite a bit of momentum to finally break above there. I think that the market will eventually break out, and eventually clear the ¥115 level. That would be a move to ¥120 just waiting to happen, but obviously we have a fight above to make that a reality.

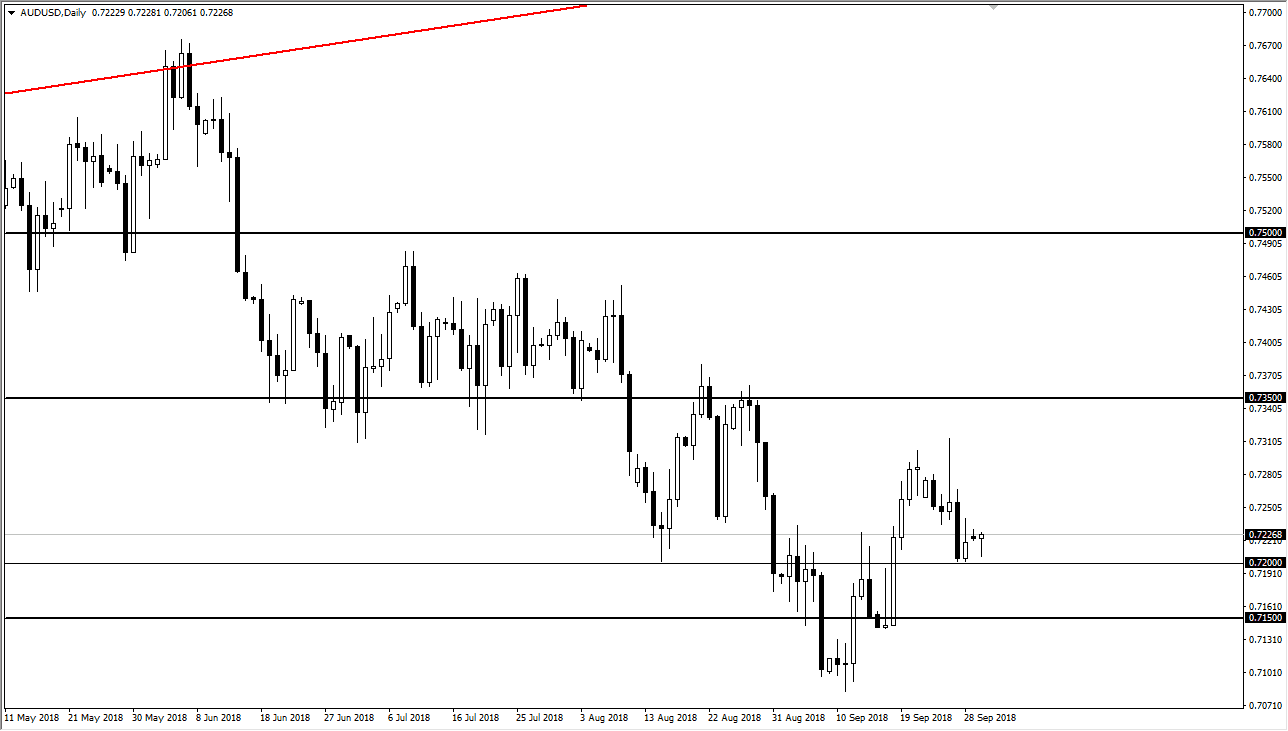

AUD/USD

The Australian dollar initially fell during Monday but found enough support at the 0.72 level to turn around of form a bit of a hammer. Because of this, I think we are trying to rally a bit and good news coming out of the North American trade relations of course will help a bit, as it has people looking to buy a riskier assets. However, this is a pair that is highly sensitive to the situation between the United States and China, so even though it is starting to show signs of support and potential buying, I think that the upside is most certainly limited at this point. The 0.7350 above would be a very difficult barrier to crack.