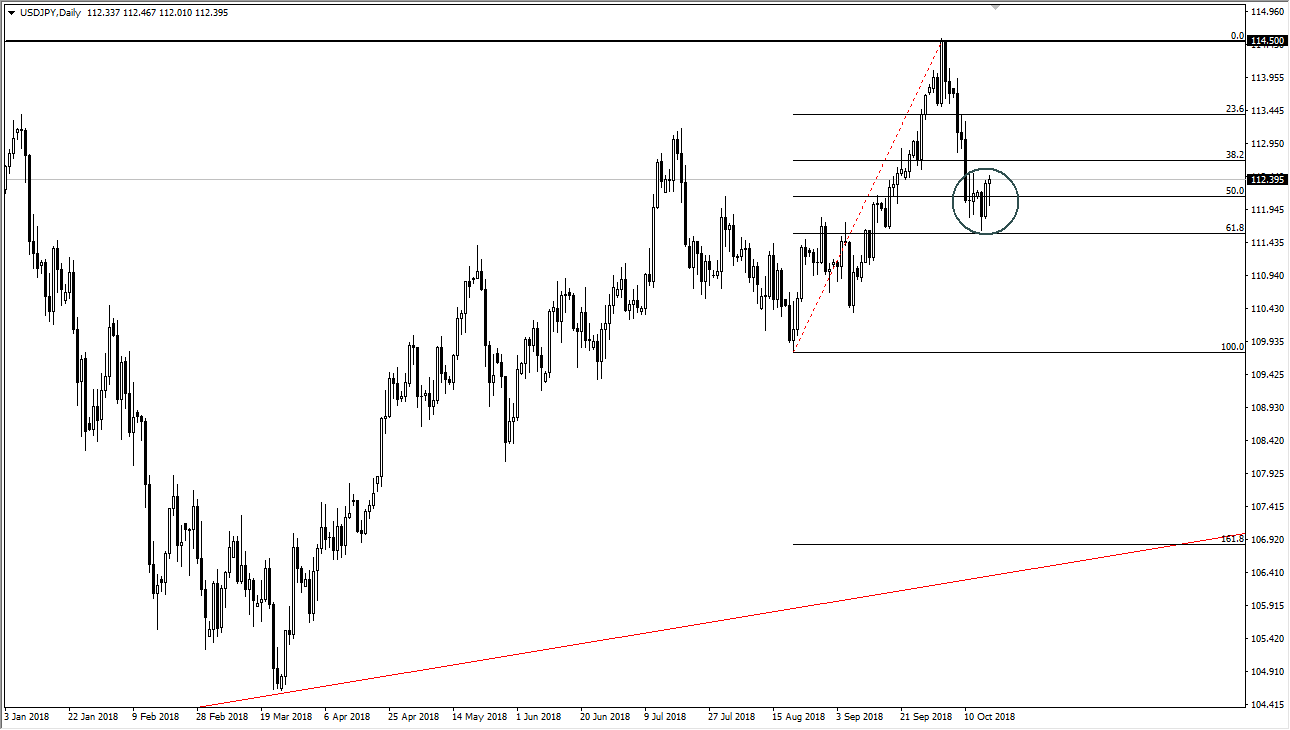

USD/JPY

The US dollar initially fell against the Japanese yen during trading on Wednesday but found the ¥112 level to be supportive enough to turn things around. Towards the end of the day, we are forming a hammer, and the FOMC Meeting Minutes seem to only confirm what we already know about the Federal Reserve, and what they are getting ready to do. With higher interest rates in the United States, it makes sense that we will continue to see this pair rally as money is attracted to the bond market. We have also found plenty of support at the 61.8% Fibonacci retracement level, so of course it makes sense that technical traders are also interested in this area. At this point, I think we are more than likely going to try to break out above, perhaps reaching towards the ¥114.50 level again, although I expect it to take several days.

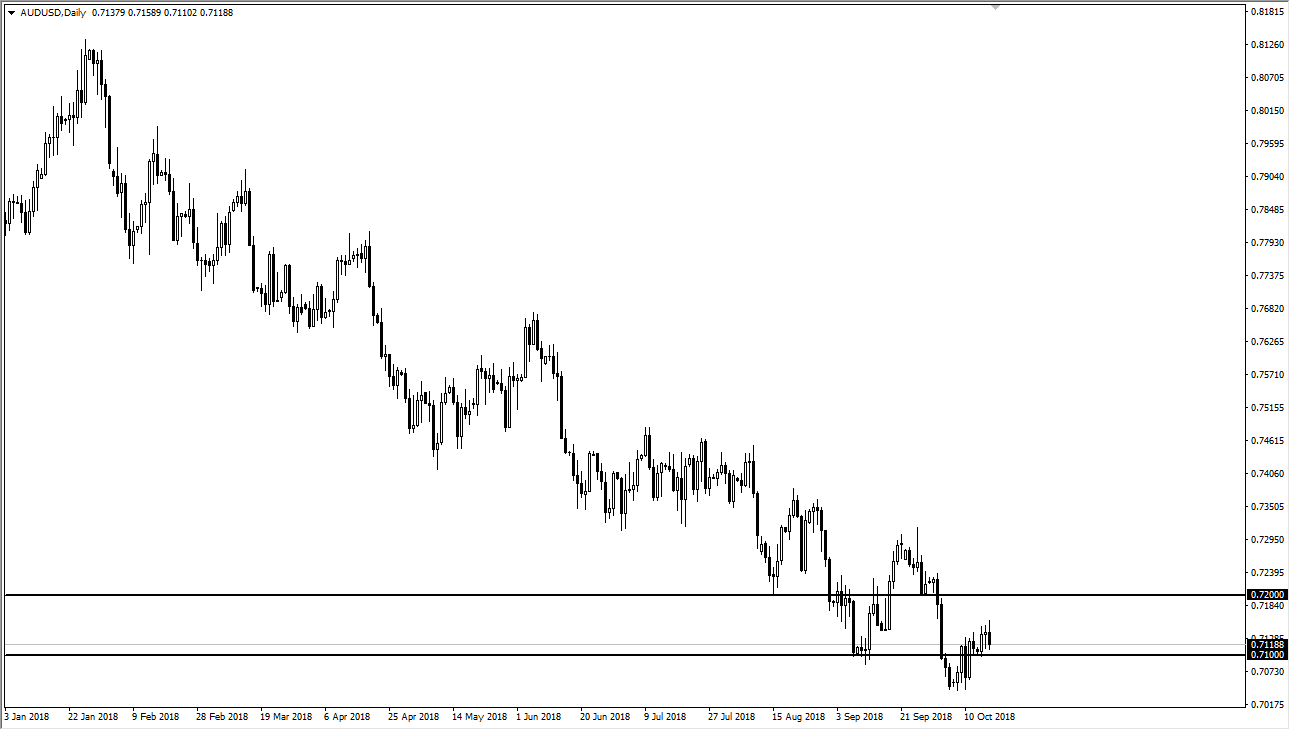

AUD/USD

The Australian dollar has initially tried to rally during the day on Wednesday, but then turned around to fall again. This is a market that is highly sensitive to the Sino-American trade relations, which of course have gotten much worse. We are in a downtrend, there’s no other way to look at this pair. In fact, I think that selling the rallies continues to work out quite nicely in this pair, but I also recognize that the 0.71 level is somewhat supportive. That’s a short-term thing though, and I think that the market then goes down to the 0.70 level after that which of course has much more psychologically significant effects on the market. If we rally from here, I believe that the 0.72 level above will be massively resistive, and I would be surprised to see this market break out from there. I think the only thing that can cause that to happen at this point is probably going to be the US and China coming together with some type of agreement.