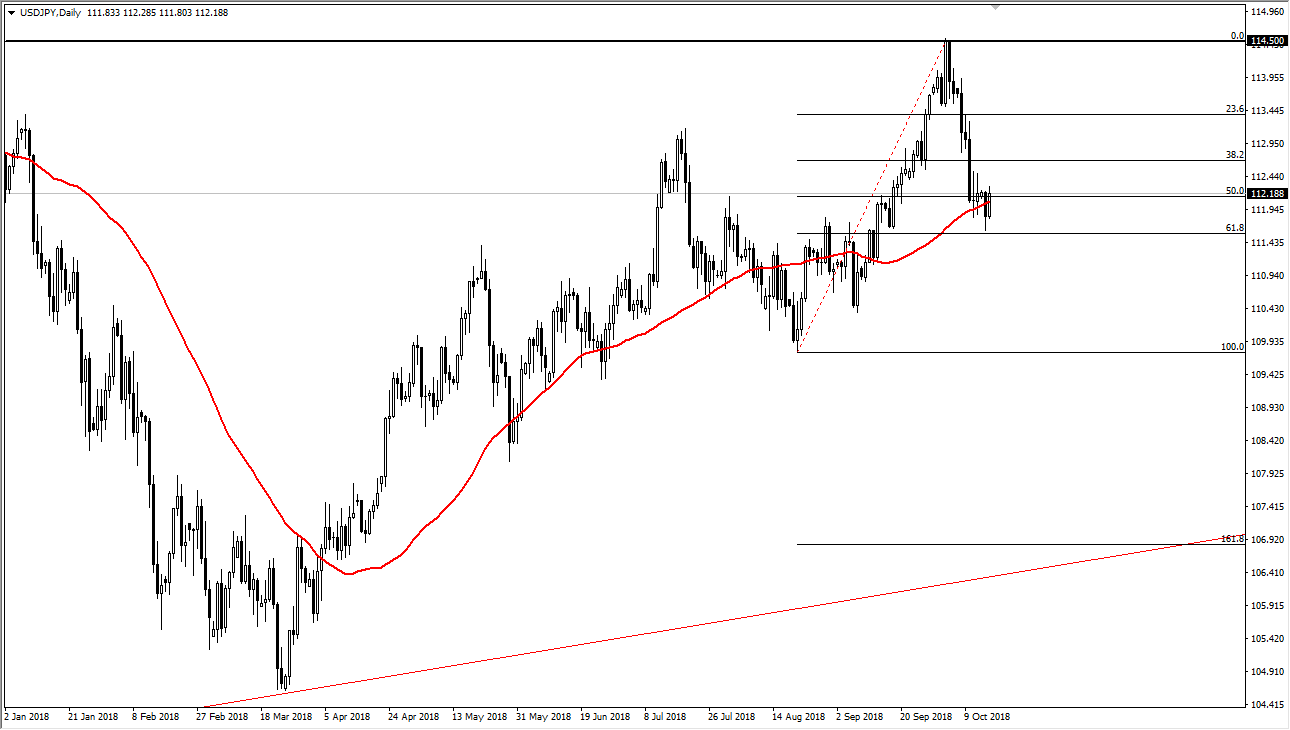

USD/JPY

The US dollar rallied against the Japanese yen during the bulk of the session on Tuesday, breaking back above the 50 day exponential moving average and the ¥112 level again. Because of this, I suspect that we are getting ready to see more bullish pressure for the US dollar against the Japanese yen, as the interest rates in America are climbing and of course we have the FOMC Meeting Minutes coming out today. If it looks even more bullish than we thought, that will drive this pair much higher. We have recently bounced from the 61.8% Fibonacci retracement level, so it is very likely that opportunity for longer-term traders to pick up value and drive towards the ¥114.50 level above which had been so massive in its resistance. If we were to turn on a break below the ¥111.40 level, at that point I think we could unwind to the ¥110 level.

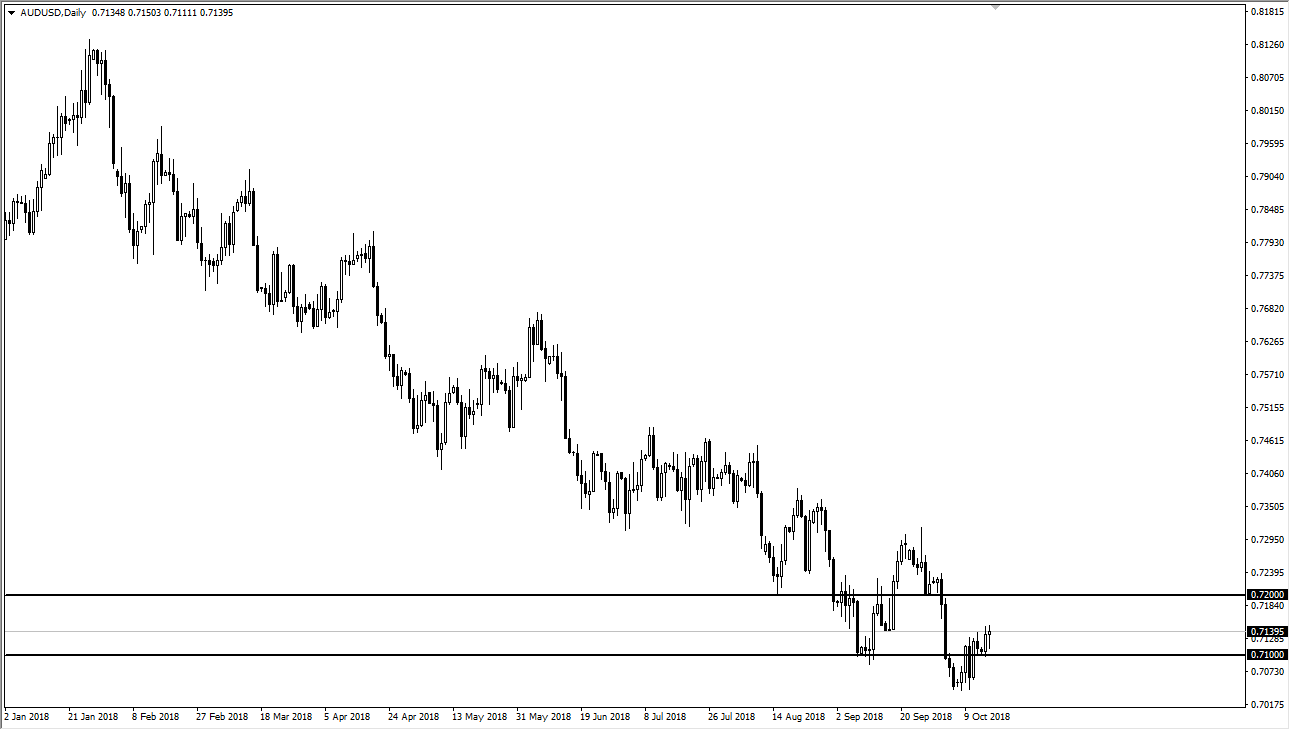

AUD/USD

The Australian dollar has been a bit noisy during the trading session on Tuesday, showing signs of support at the 0.71 level though, and forming a bit of a hammer looking candle. If that’s the case, then I think that the market is ready to bounce towards the 0.72 level. That’s an area where I think there is a significant amount of resistance, and therefore I would be a surprise for the market to break above there. Certainly, we would need to see the Sino-American relations taken a turn for the better for the Australian dollar to be comfortable at higher levels. At this point, I think we will continue to see sellers come in on these rallies as we are still firmly in a downtrend, despite what we are seeing over the last couple of days.