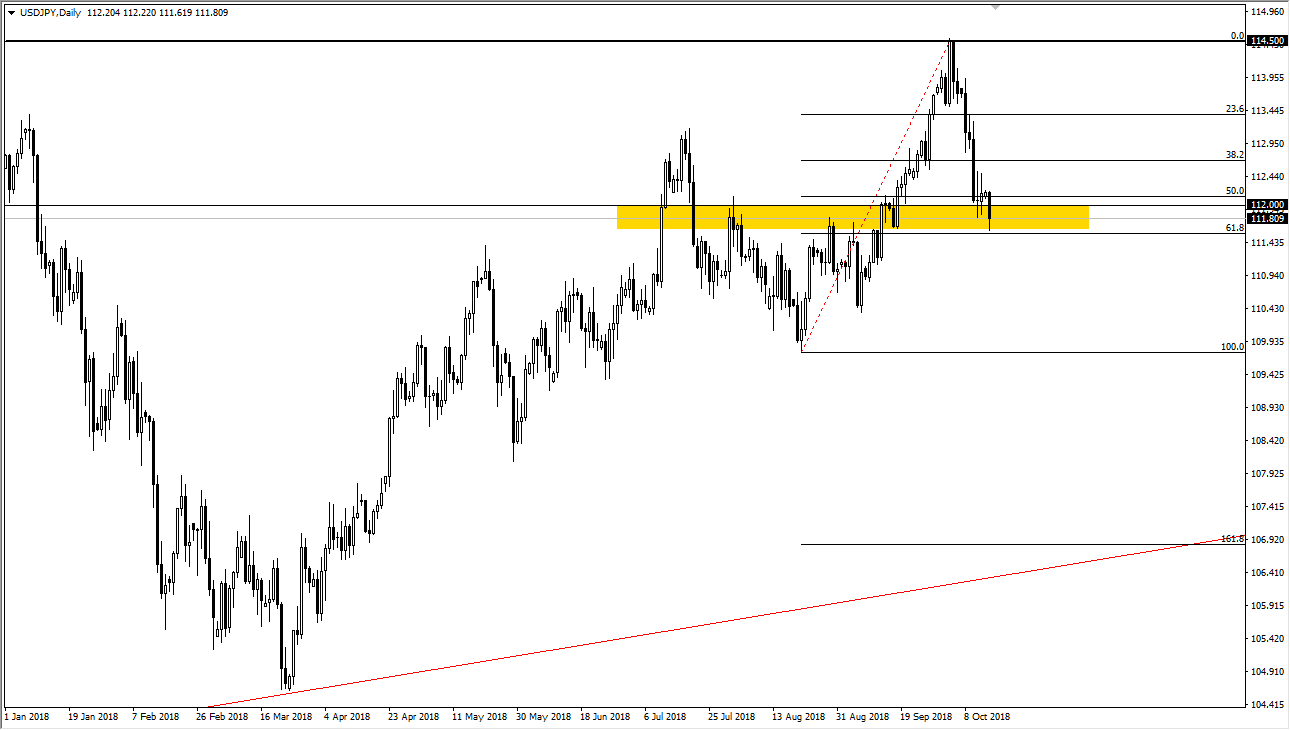

USD/JPY

The US dollar initially fell against the Japanese yen during trading on Monday, testing the ¥111.50 level, which is also the scene of the 61.8% Fibonacci retracement level from the most recent rally. I think at this point, we are starting to see buyers pick up the pair based upon value, but keep in mind that this pair is highly sensitive to risk appetite overall. Because of this, pay attention to stock markets and see if they can get a bit of a bounce. If we do, that should help this pair as well because I believe at that point traders will start focusing on interest rate differential more than anything else. However, if we see a major “risk off” event, then we may see this pair sold off as money starts flooding to the relative safety of Japan to pay off any carry trade situation funds may find themselves in.

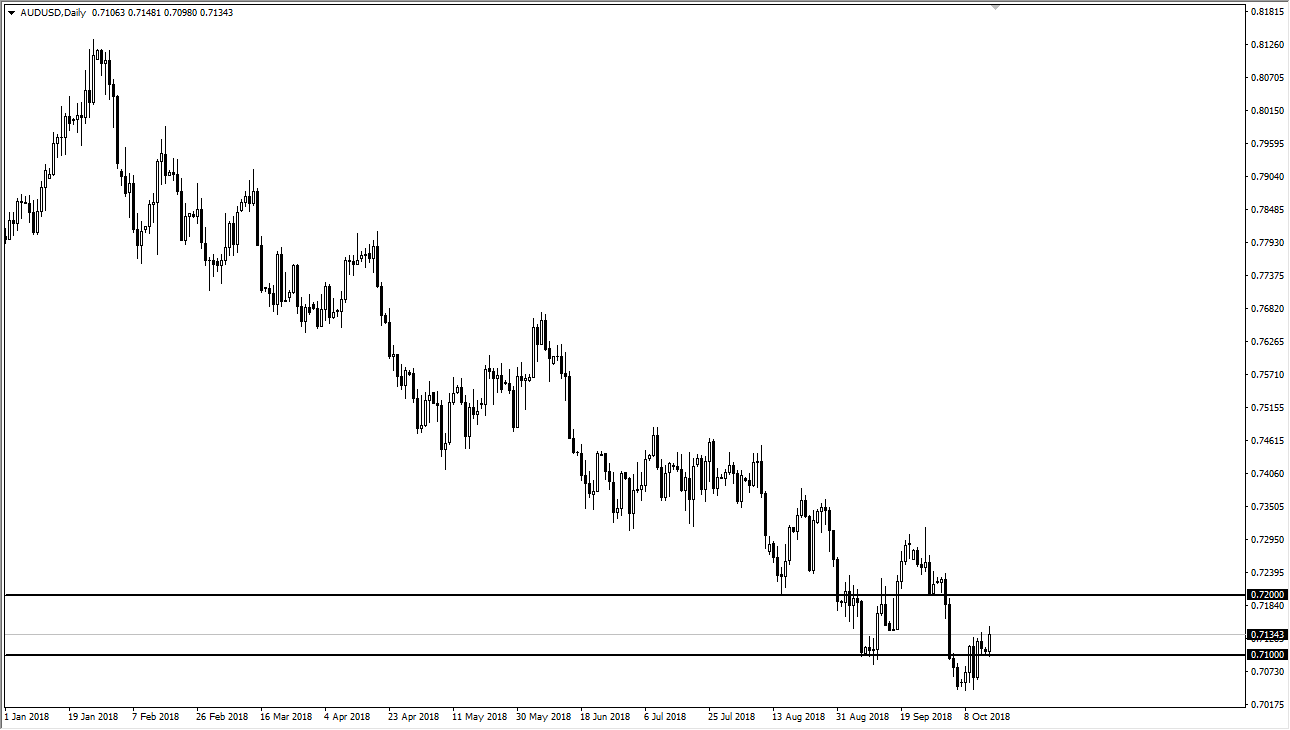

AUD/USD

The Australian dollar did rally a bit during the day on Monday, falling right along with gold. The 0.7150 level above is a minor resistance, and I think at this point it’s likely that we will continue to see a bit of selling pressure up there. When you pay attention to the AUD/USD pair, it’s hard not to notice that we are in a down trending channel, but we are nowhere near the resistance point yet. It is because of this that I am much more willing to sell this pair closer to the 0.72 handle but would recognize that a move below the 0.71 handle would show a resumption of bearish pressure. I think if you wait you get a better opportunity to short from higher levels. Keep in mind, this pair is going to continue to suffer as the trade war heats up between America and China.