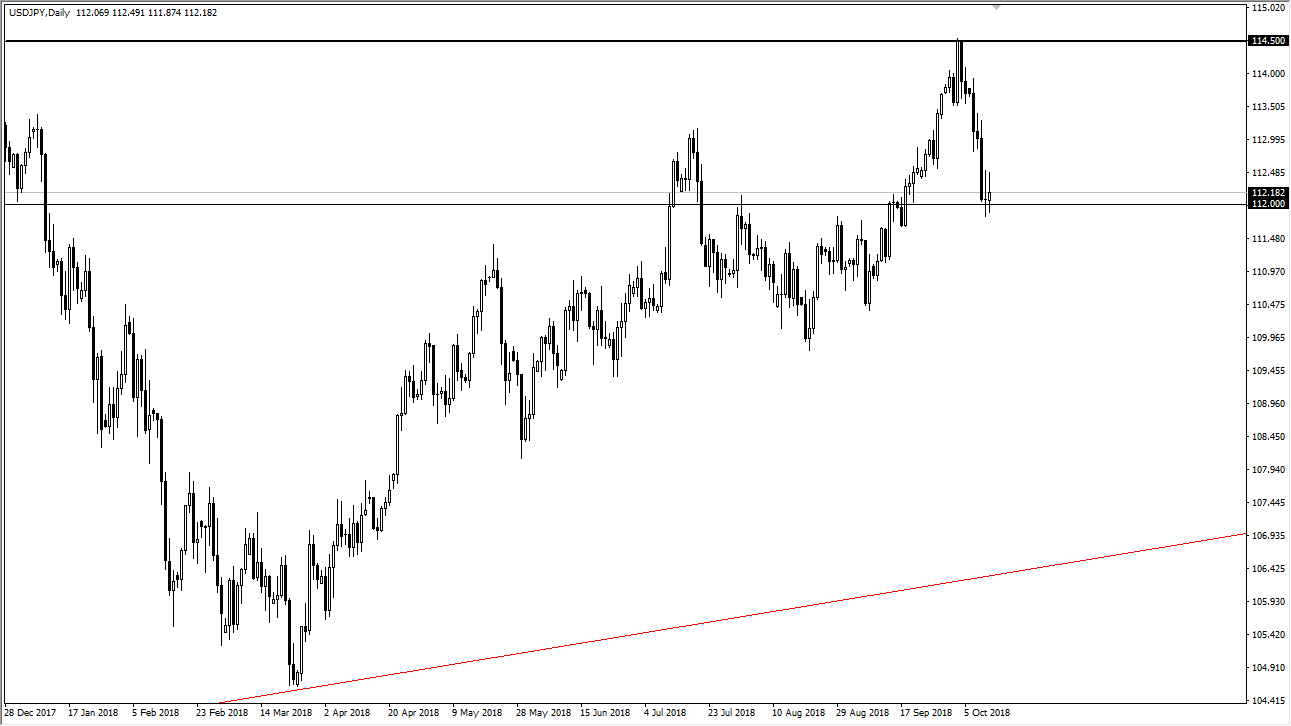

USD/JPY

The US dollar has gone back and forth during the day on Friday just as we did on Thursday, showing signs of support at the ¥112 level. If we can break above the highs from the Thursday session, that would be a very bullish sign and it should send this market to the upside. Otherwise, we could break down below that candle stick, and that would be a market moving events that could send this pair down to the ¥111 level. Certainly at this point, we are a bit oversold, but I think that we need to see at the very least some stability, if not an impulsive candle. At this point, we have had a nice pull back, so it’ll be interesting to see where we go from here. Pay attention to the stock markets in the United States, as it could be a sign of risk appetite. Overall, I believe that the market continues to respect the ¥114.50 level as massive resistance.

AUD/USD

The Australian dollar rallied slightly to kick off the day on Friday, but then turned around to form a slightly negative candle. At this point, I think that the market may roll over a little bit but it wouldn’t surprise me at all to see a short-term rally that offers a nice selling opportunity. I believe that the 0.72 level as an excellent area that we can start selling from. I don’t have any interest in buying the Australian dollar, at least not until the Sino-American trade relations start to get a little bit better. If that’s the case, then the Australian dollar will be one of the main beneficiaries of that positive news. Until then, I continue to sell rallies on signs of failure and weakness.