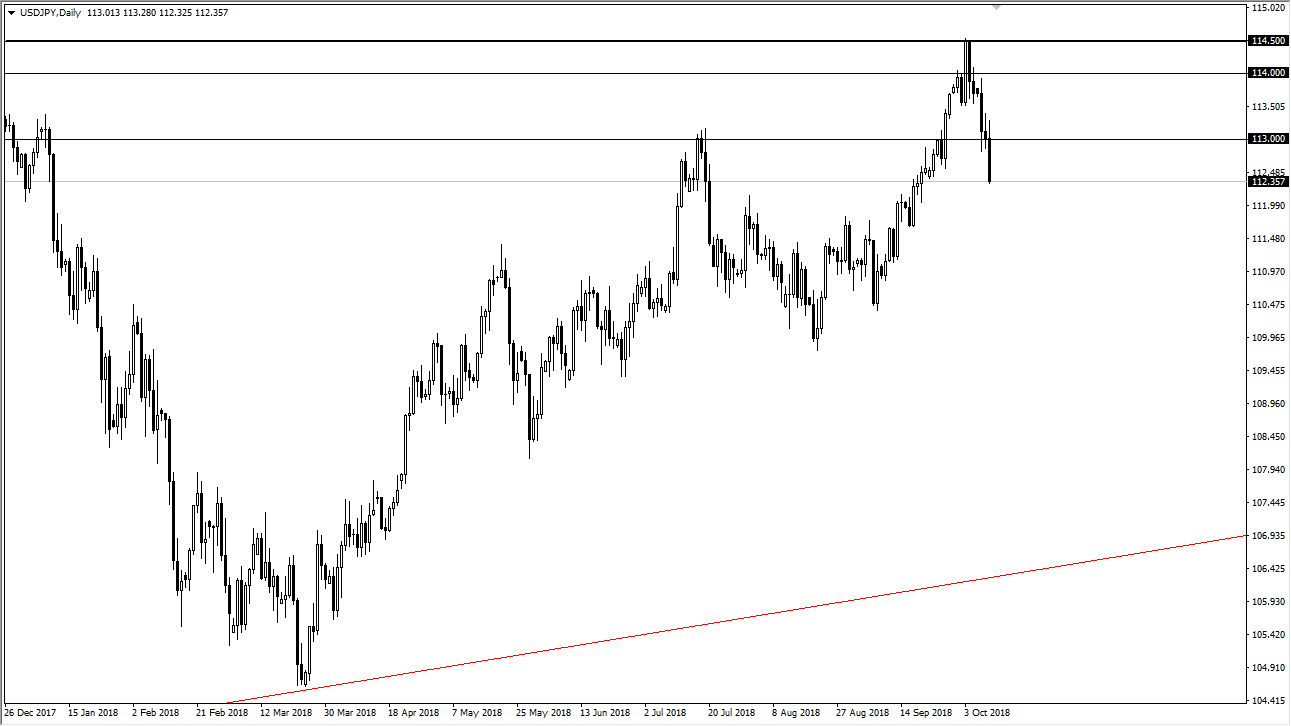

USD/JPY

The US dollar has initially tried to rally during the trading session on Wednesday but sold off rather brutally as the markets freaked out. The stock markets in America got absolutely hammered with the NASDAQ 100 losing almost 5%, showing just how afraid the market suddenly had become. The Japanese yen of course is the ultimate “safety currency”, and I think we could see some follow-through at this point. Overall, I think there is plenty of support underneath but we may need to break down a little further in order to find a buying opportunity. I think the ¥112 level would be an area where buyers may be interested in going long, and as we had been a bit over brought, it makes sense that a pullback would happen anyway. I believe that the ¥114.50 level will continue to be massive resistance.

AUD/USD

The Australian dollar broke down significantly during the trading session on Wednesday, breaking down below the 0.71 level, but not only that ended up closing at the very bottom of the range. It looks as if the market is ready to continue going lower, which makes a lot of sense as there are concerns about the trade war, and of course risk appetite in general. If that’s the case, the Australian dollar will get hammered. With treasury yields rising in the United States, it makes sense that the US dollar will strengthen against riskier assets such as the Aussie dollar. We have been in a downtrend for some time anyway, so although I thought we might be able to get a bit of a rally from here, we have just about wiped out the gains from the previous session, which of course is a very negative sign.