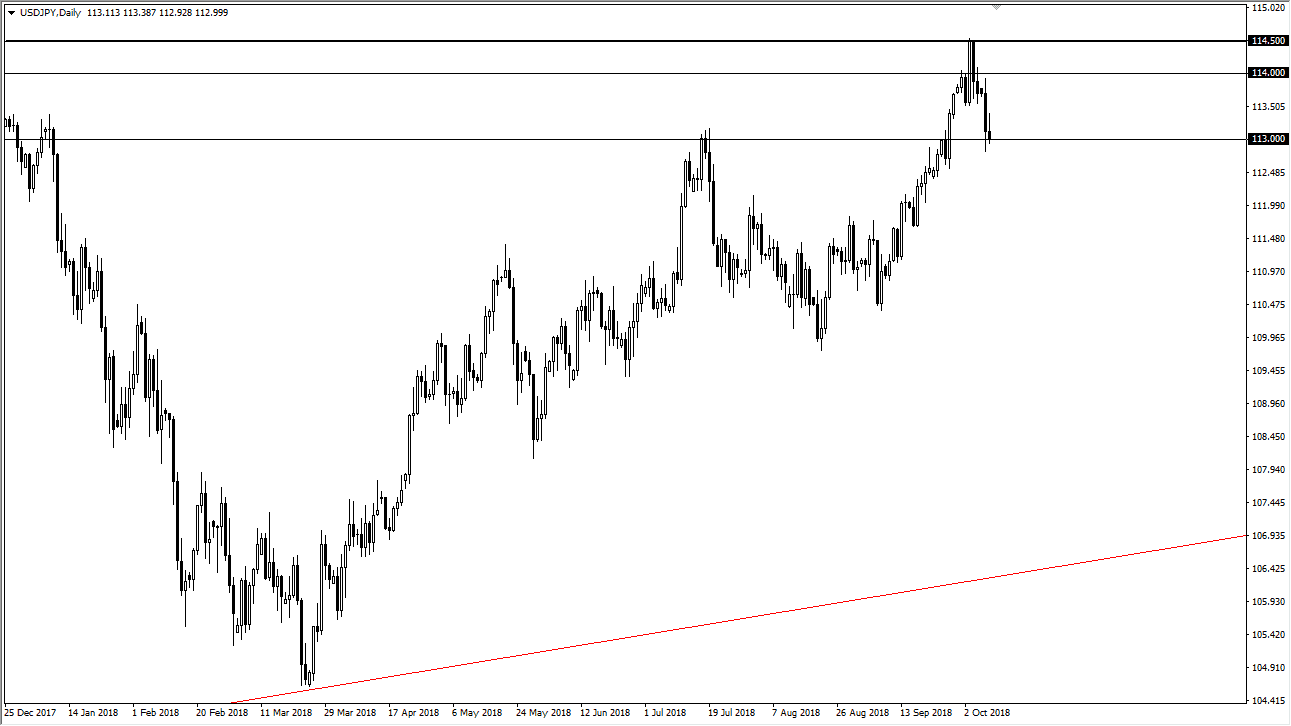

USD/JPY

The US dollar tried to rally during the trading session on Tuesday, but turned around of form a inverted hammer. We are sitting at the ¥113 level, an area that I would expect to see a lot of support. If we can break above the top of the candle for the Tuesday session, that would be a very bullish sign but I think we will struggle to break out to the upside for a longer-term move as we had gotten a bit overextended. If we break down below the ¥112.50 level, then I think we probably go down to the ¥112 level. Remember that this pair is highly sensitive to risk appetite and trading of riskier assets, so pay attention to the stock markets and see how they behave as they could give us a bit of a heads up. For what it’s worth, interest rates in the United States futures markets did drop a bit, so that of course works against the greenback.

AUD/USD

The Australian dollar turned around and showed signs of strength on Tuesday, slamming into the 0.71 level toward the end of the day in north American trading. This is a very good sign, and I think at this point we will probably break to the upside. However, I would be a bit surprised to break above the 0.72 handle. I think it’s only a matter time before something ugly or noisy happens that since the Australian dollar lower. Any signs of exhaustion is probably an invitation to start shorting again, as we are still very much stuck in a down trending channel. There is still an escalation of trade tensions between the Americans and the Chinese, and that will continue to weigh upon this market.