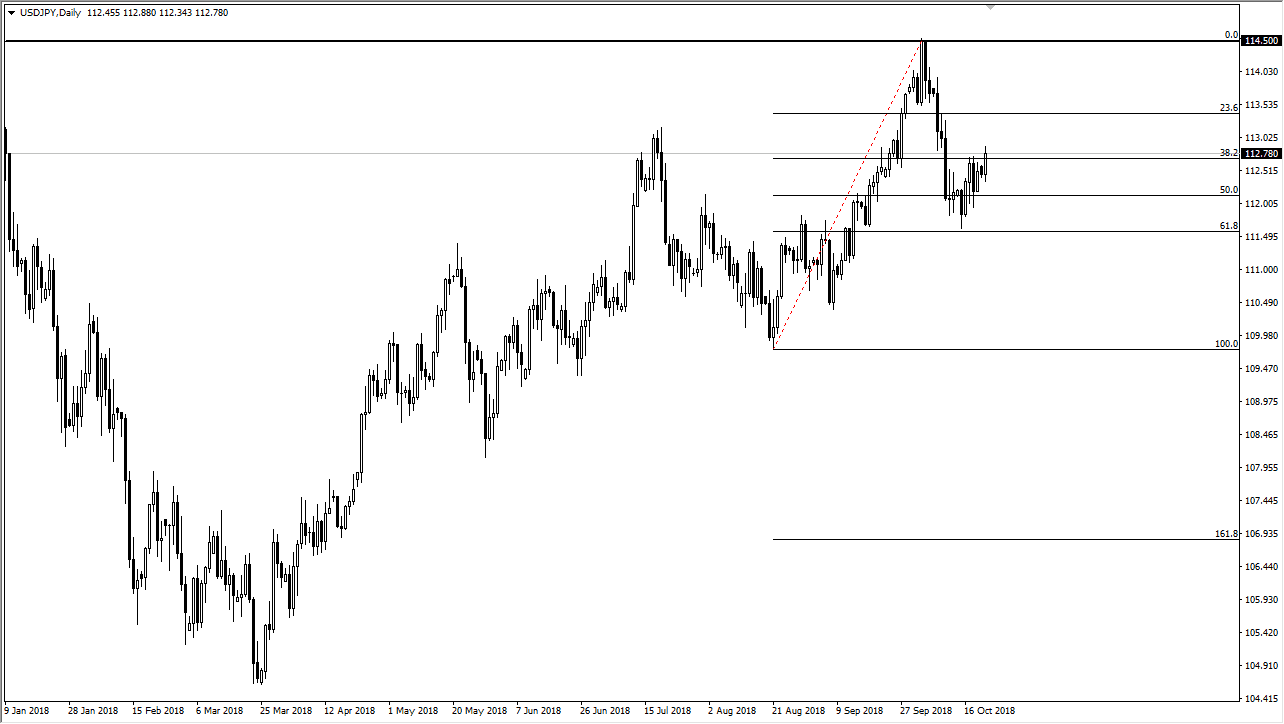

USD/JPY

The US dollar has rallied against the Japanese yen, breaking above the highs from the last couple of days. We obviously have a lot of resistance above, and of course the markets are ready to quite go anywhere yet but it does look like we are trying to grind higher more than anything else. After bouncing from the 61.8% Fibonacci retracement level, for me it makes sense that we would rally from here and continue to go higher. The ¥114.50 level above is significant resistance I think it is only a matter time before we test that level again. It makes sense that we pull back after yet another attempt upon that crucial level, but I do think eventually we break above there based upon interest rate differential. Beyond that, if we can get a little bit of a “risk on” rally, then that could move this market higher as well. A break down below the ¥111.50 level would be very negative indeed.

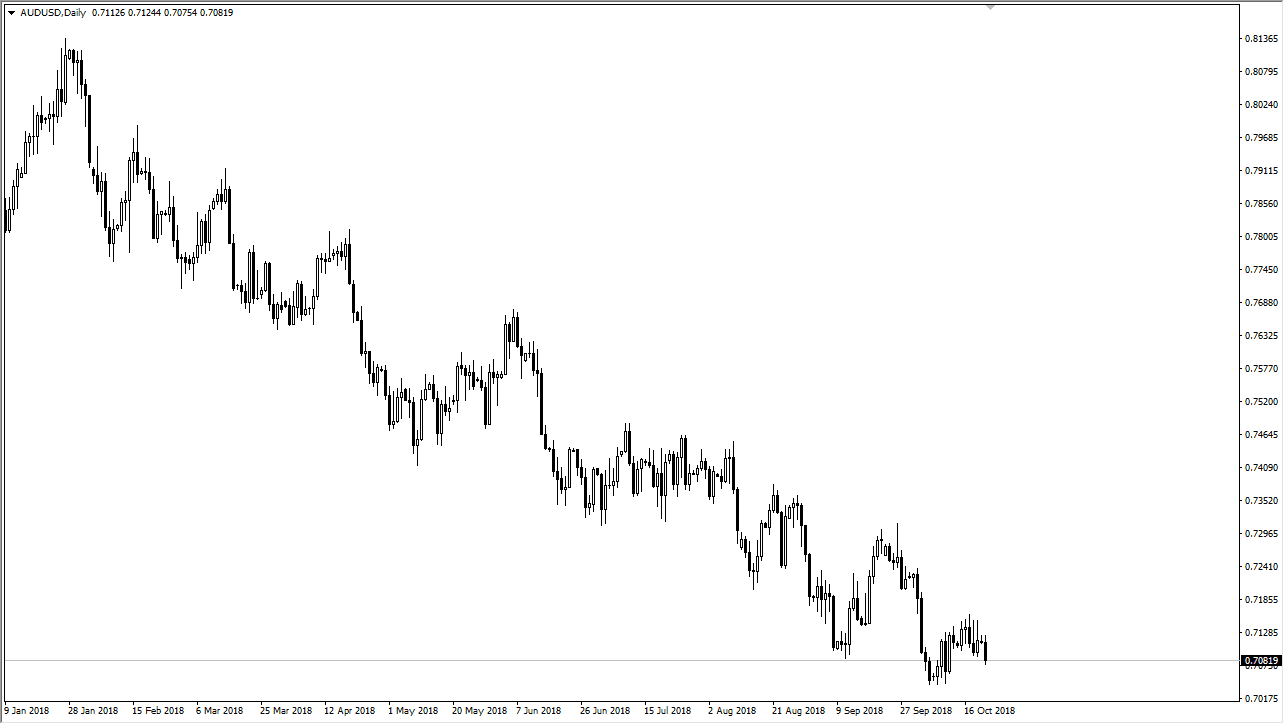

AUD/USD

The Australian dollar has rolled over a little bit during the trading session on Monday, as we continue to focus on the Sino-American trade spat. That of course weighs upon the value of the Aussie dollar as it is so highly leveraged to the Chinese economy. With that being the case, the markets continue to struggle to find gains, and I think we are more than likely going to go looking towards the lows again at the 0.7050 level. A break down below there opens the door to the 0.70 level, and then possibly even as low as the 0.68 level. The alternate scenario is that we break above the 0.7150 level and then go looking towards the 0.70 level where I see a lot of supply.