USD/CHF

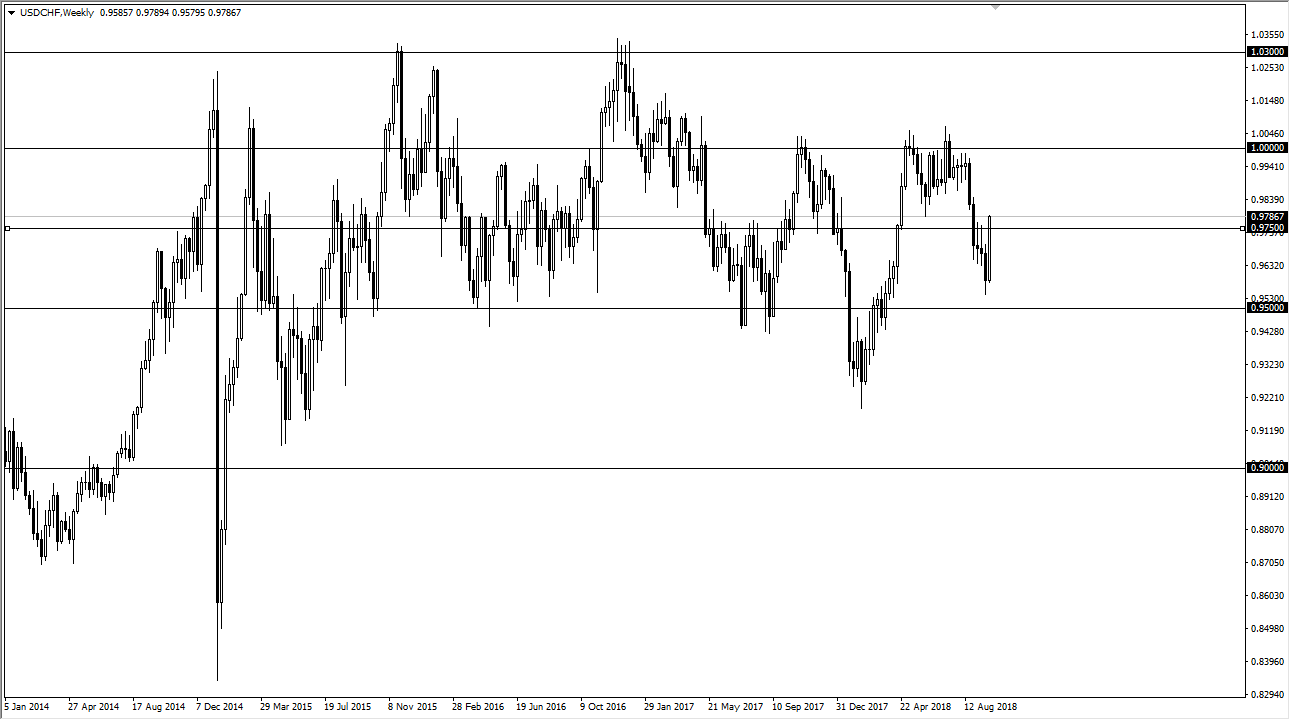

The US dollar has been rather bullish against most currencies but has been especially bullish against the Swiss franc. Looking at this chart, you can see that we ended the month of September with a massive bullish candle, breaking the back of a couple of shooting stars on the weekly chart. That doesn’t happen every day, and it shows real wherewithal on the rally. I believe that we are going to continue to see a choppy and somewhat symmetrical market as we have for a couple of years now, with the 0.95 level underneath being supported, followed by the 0.9750 level that was just broken. I anticipate that shorter-term traders are going to try to push this market back to parity, which quite frankly it’s been comfortable at more than once.

I don’t necessarily think that the US dollar is going to swallow the Swiss franc whole, but it does have the advantage of not being attached to the European Union, which quite frankly looks to be a bit messy right now. Unfortunately for the Swiss, 85% of their exports go into the European Union, which is not necessarily the best place to be selling your goods right now. If your biggest client is struggling, you are most certainly going to have trouble selling. If we were to turn around and break down below the 0.95 level, that would be a very negative turn of events, but quite frankly I don’t see that happening. I think it’s more likely that we break above parity of anything like that happens. Overall, I expect to trade between the 0.9750 and 1.00004 a majority of the month.