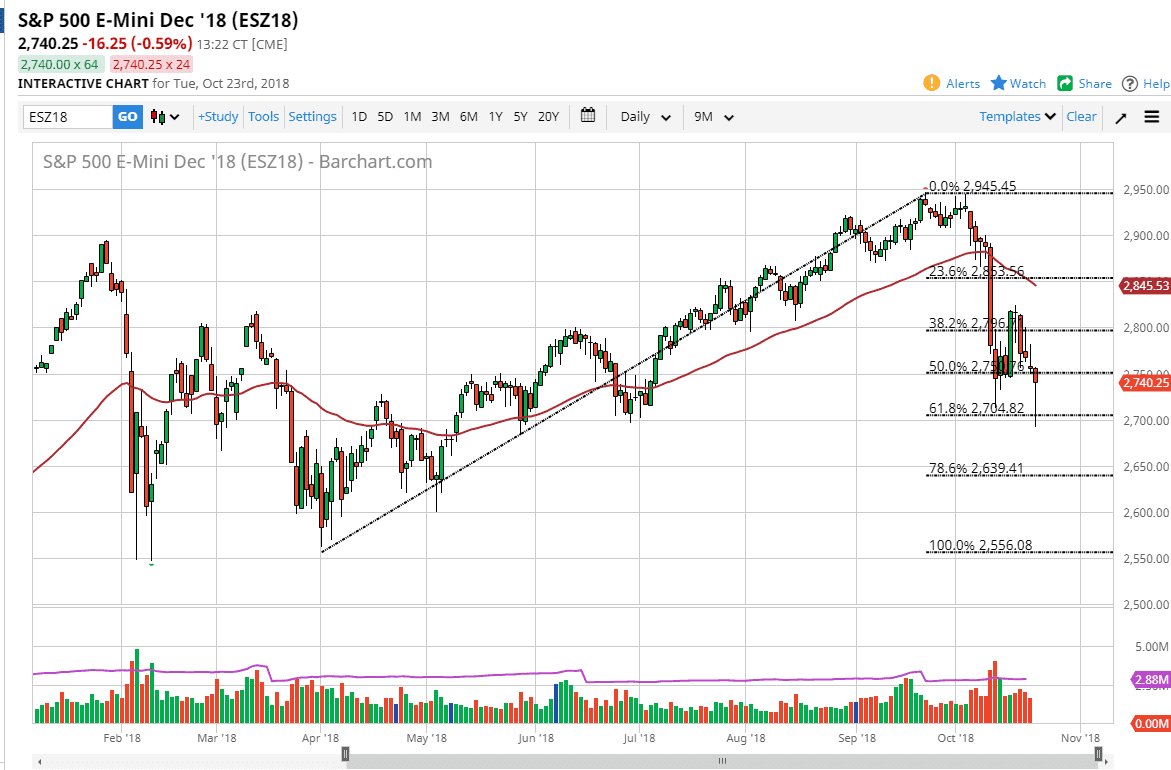

S&P 500

The S&P 500 broke down rather significantly during the trading session on Tuesday, slicing through the 61.8% Fibonacci retracement level but late in the day started to see a lot of buyers jump back into the market. I think a lot of the market participants came in to pick up value, and I have to admit that the return back to almost unchanged was rather impressive. However, we are still in an area that has done a lot of technical damage, so it’s not until we clear the 2800 level that I feel comfortable buying. I think this just simply shows that we are not ready to break down. If we break down below the lows of the Tuesday session, that of course would be a very negative turn of events. Perhaps it is the hope of a meeting between Donald Trump and the Chinese leader Xi, but buyers decided to pick up the stock market late in the day.

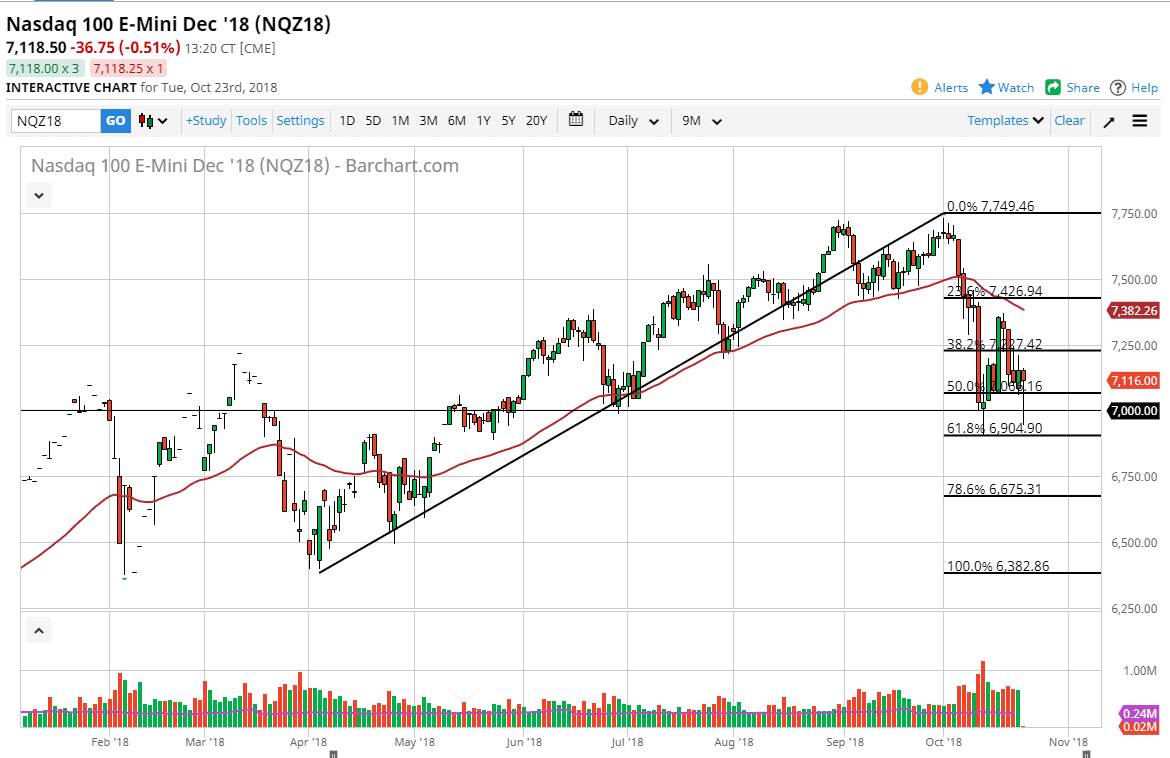

NASDAQ 100

The NASDAQ 100 recovered even more than the S&P 500 it at the time of writing, as the 7000 level continues offer support and we didn’t make a fresh low. Because of this, I think that the NASDAQ 100 could end up leading the way. Pay attention to this market if you are going to trade the S&P 500, or any other indices for that matter. At this point, it’s not until we break down below the 6900 level that I become overly concerned about the NASDAQ 100, but I also recognize that we will probably see a lot of volatility and a lot of chop back and forth. This is going to be a very difficult market to trade in what I think will be very tight range bound action.