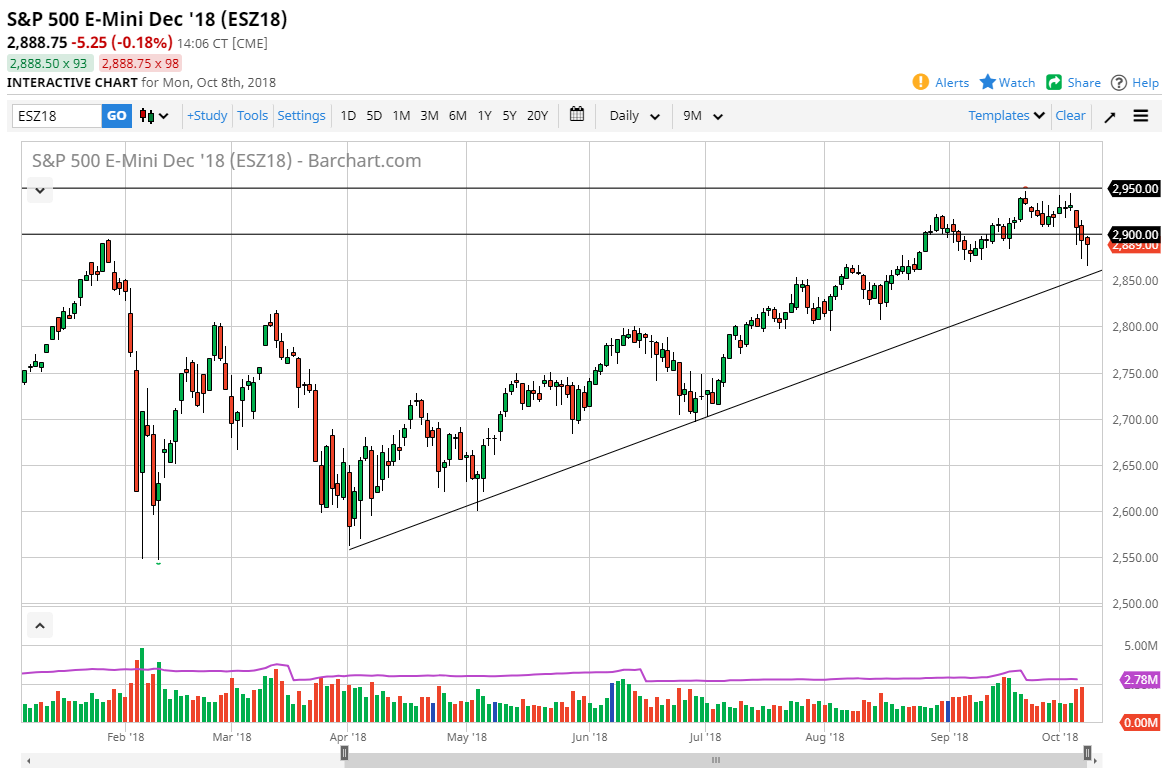

S&P 500

The S&P 500 fell initially during the trading session on Monday as we came back from the weekend. However, we continue to find support underneath and if you can see we have formed a nice-looking hammer for the day. We have formed that hammer just above the massive uptrend line, so it looks as if the S&P 500 is going to continue to find resiliency. At this point, I think it’s not until we break down below the 2850 level that I would be concerned. That doesn’t mean we will get yet another pull back, but it shows if we do get that pullback, buyers are willing to come back. If we can break above the 2900 level, the market should break towards the 2950 level, and then perhaps the 3000 level. Alternately, if we break down below the 2850 level then it’s time for a move down to the 2800 level.

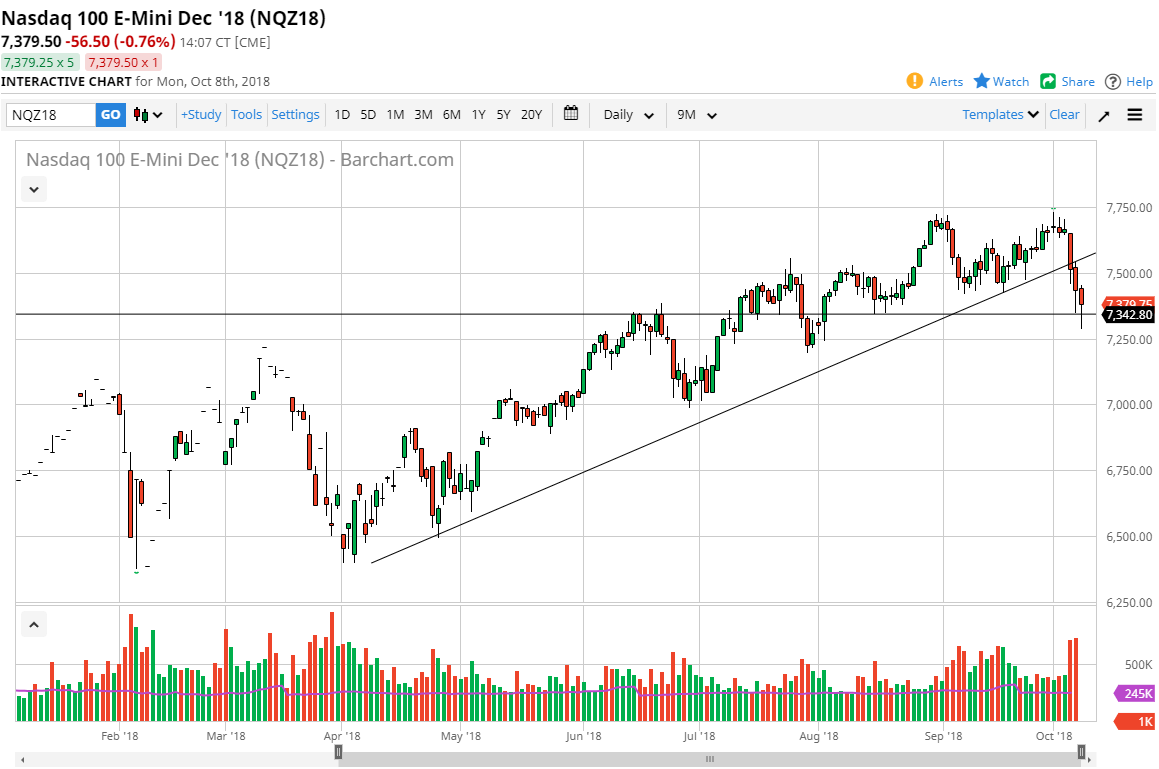

NASDAQ 100

The NASDAQ 100 fell during the day again but has found enough support just above the 7250 level to turn around and form a bit of a hammer. That hammer sits on top of horizontal support, but we have broken through a significant uptrend line. This is mainly due to the fact of how sensitive the NASDAQ 100 is to the situation with trade regarding both the United States and China. I would point out that volume was relatively strong during the day, just as it was on Friday, and both days showed resiliency. Because of this, I like the idea of buying dips going forward. Overall, I believe that the market will probably continue to offer value, and it looks as if we are trying to find significant support.