S&P 500

The S&P 500 got crushed during trading on Wednesday, as the bloodbath in global stocks continues. That being the case, we have broken below the bottom of the hammer from the trading session on Tuesday, which is a very negative turn of events. I think what we are looking at here is the beginning of a serious sell off again, and I think we will probably go looking towards the 2550 level over the longer-term. My experience has been once you break down below the 61.8% Fibonacci retracement level, quite often you see a wipeout back to the 100% Fibonacci retracement level, hence my target. I have no interest in buying the S&P 500 right now, as we have broken through a major support level on longer-term charts as well. It certainly looks as if we are nowhere near done selling.

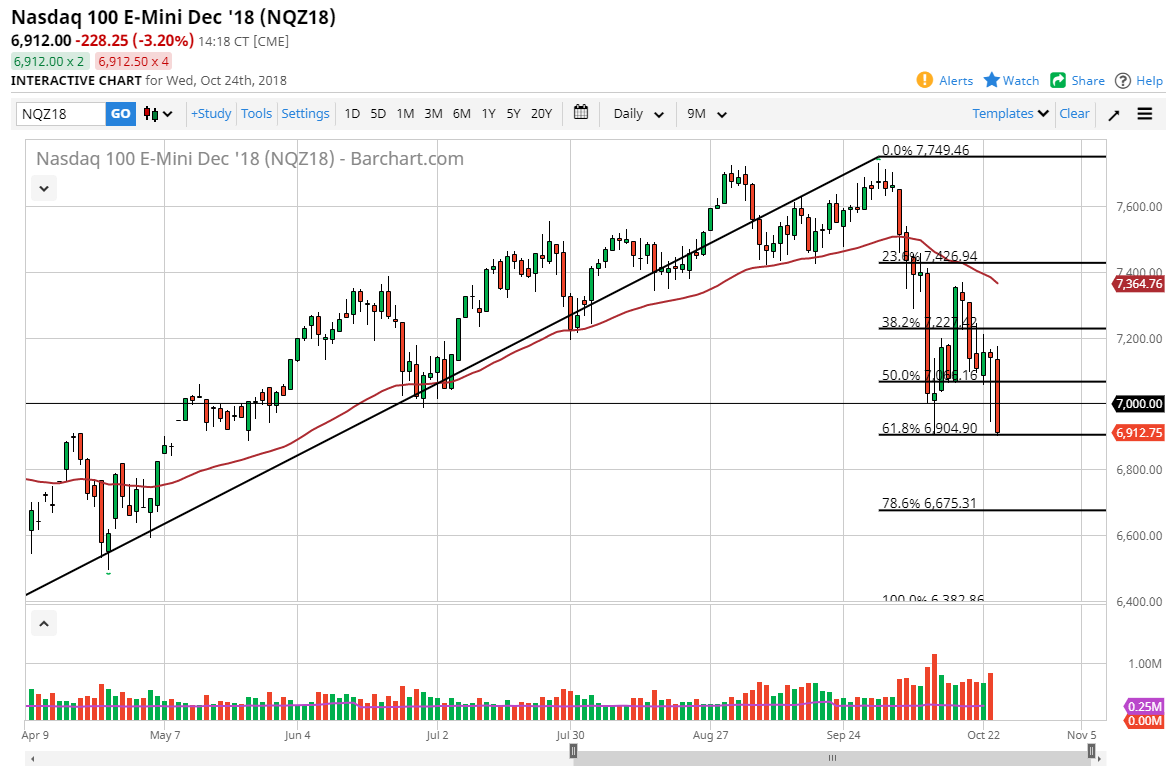

NASDAQ 100

The NASDAQ 100 got crushed as well, showing signs of massive bearish pressure, slicing through the 61.8% Fibonacci retracement level, and slicing through the 6900 level. At this point, I think that we continue to sell off on rallies, and the first signs of exhaustion get dumped immediately without people asking about it. Overall, I think that the market probably continues to go towards the 6400 level, but obviously the 6500 level will be psychologically important. I look for opportunities to short every time we show signs of strength but having said that I will do so in small positions because I recognize just how volatile things are right now. I believe at this point it’s likely that the market will continue to grind lower, and if you are patient enough you should have plenty of opportunities to sell as technically we look very weak.