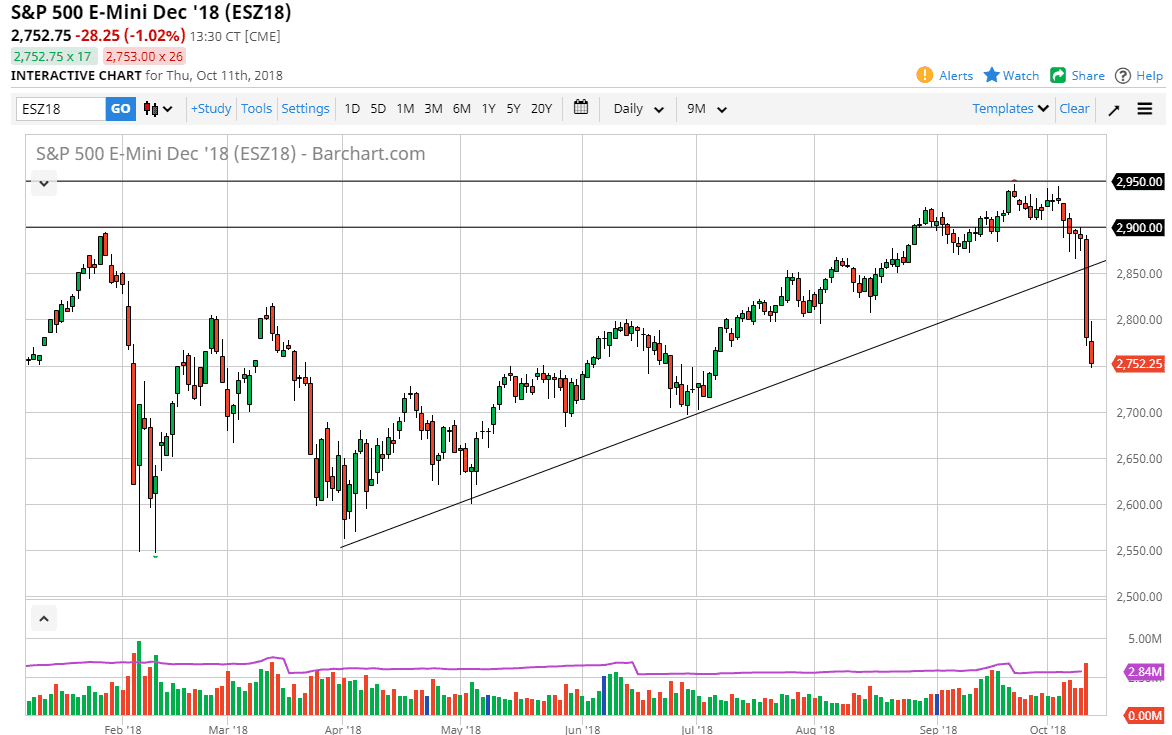

S&P 500

The S&P 500 initially went higher during the day as the Americans stopped on board, but we are clearly starting to break down again. I think at this point, it’s likely that we will continue to see selling, perhaps reaching down towards the 2700 level. That’s an area that I find a bit crucial, and if we break down below there are things could get rather ugly. I think at this point, it’s a very difficult market to be involved in, because interest rates remain elevated, and then of course geopolitical concerns. After all, we have a trade war going on with the Chinese and the Americans, and that’s not getting any better anytime soon. I think eventually, the market had to react to this, and with this massive negative candle that formed on Wednesday, it’s difficult to imagine people are willing to jump into this market and pick things up. If you are looking to go long, you need at least a significant bullish day. As far as selling is concerned, if we sustain below 2750, 2700 is the next target.

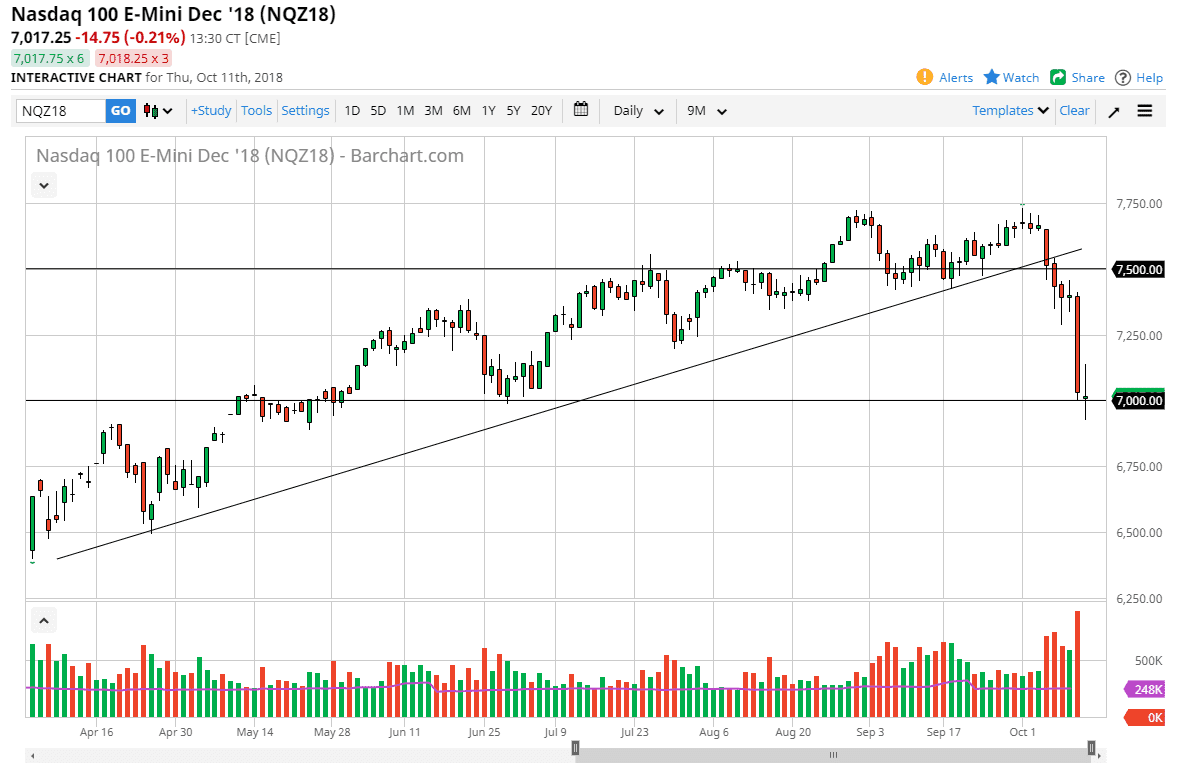

NASDAQ 100

The NASDAQ 100 has gone back and forth during the trading session on Thursday, showing signs of stability near the 7000 handle. This is a nice departure from what we have seen previously, because technology stocks have been getting hammered. If we can break above the top of the range for the day on Thursday, the NASDAQ 100 should continue to go higher, aiming for at least the 7250 level. Otherwise, if we break down below the lows of the day, it’s very likely that we drift down to the 6750 level underneath. Ultimately, I think that it is probably best to leave the NASDAQ 100 alone until we get some type of clarity via a break of the range for the day on Thursday.