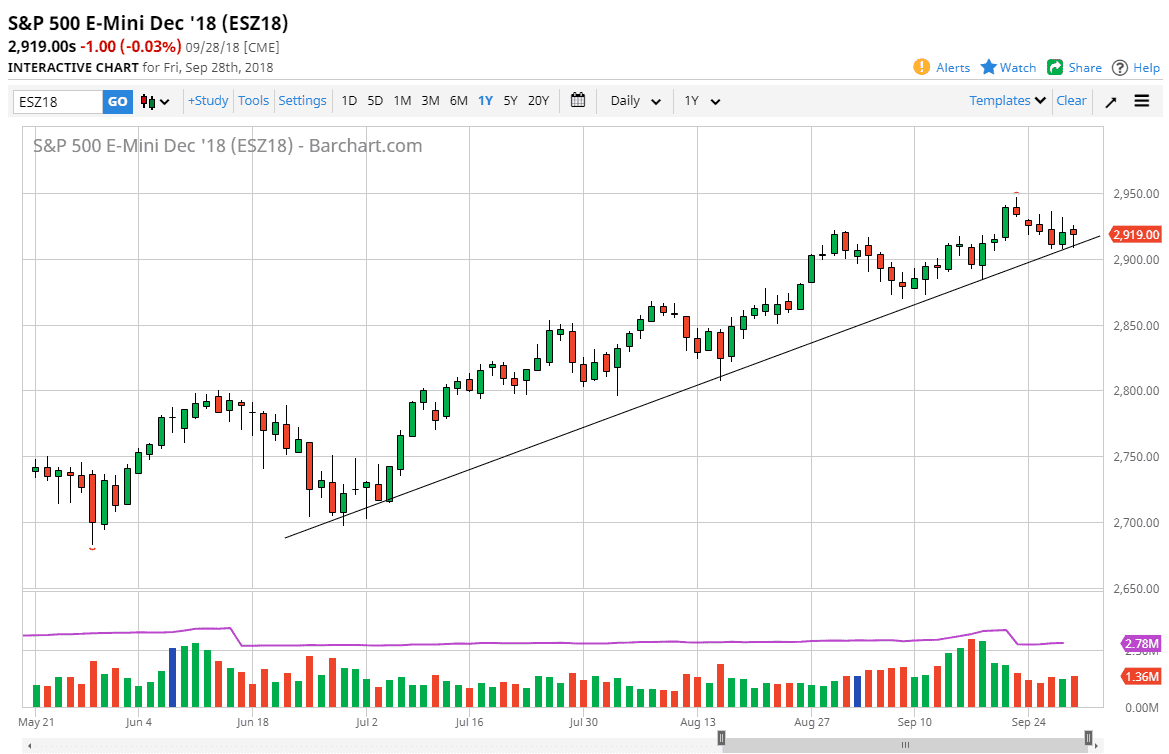

S&P 500

The S&P 500 pulled back initially to kick off the session on Friday but turned around of form a bit of a hammer. What I find interesting is that it sits right at the uptrend line, and an area that’s been supportive over the last couple of candles. While the two previous candles have been converted hammers, we have not broken above the top of them yet so that it isn’t typically uses a signal quite yet. However, I think that the hammer is a very good sign. It also tells us that if we were to break down below the 2900 level, that would be a very negative sign indeed. This would add more credence to the break down. However, we are still very much in and uptrend and it looks as if we are ready to continue going higher. One thing that does concern me about the uptrend though, we have a relatively light volume.

NASDAQ 100

The NASDAQ 100 also initially fell during the day but turned around of form a bit of a hammer as well. It looks as if we are going to continue to try to break above the 7700 level, an area that was the most recent high. Looking at the charts, you can see that there is a clear uptrend line that has been focusing the markets attention to the upside, as the NASDAQ 100 has been a bit of a leader as of late. I think at this point the market is probably trying to get to the 8000 handle, and the 7500 level underneath should be massively supportive based upon previous action, and of course the uptrend line. Ultimately, I have no interest in shorting in this environment but I do recognize that we are close to the highs.