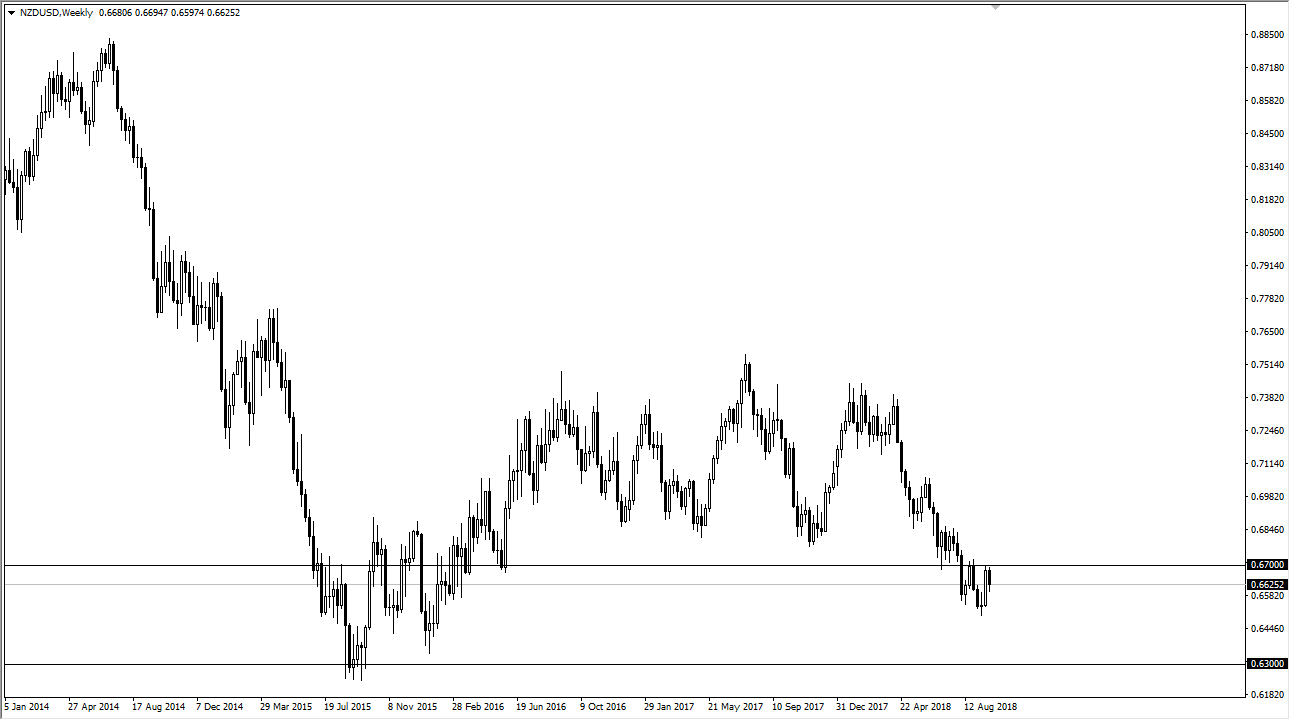

NZD/USD

The New Zealand dollar has been rather choppy during the month of September, as we have seen value hunters jumping in at roughly 0.66 or so. The market has even more support below at the 0.63 level, so I think that it’s only a matter of time before the buyers return, but it certainly looks negative at the moment and I think there is still significant downward momentum.

The New Zealand dollar has been negative for some time, and I think the United States dollar will continue to strengthen as it has been benefiting from a Federal Reserve that is looking to raise interest rates. Overall, I think that it’s only a matter time before the we continue to see selling pressure. The 0.67 level above is resistance, and I think if we break above there we could then reach towards the 0.6850 level. I think that the New Zealand dollar is going to be highly choppy over the next couple of weeks, and October I think certainly favors the downside overall, but the third week of September has certainly shown a lot of buying pressure. Overall, it looks to me as if the crucial question is whether we can break above the 0.67 level or not.

This is a market that has been sold off rather rapidly, and I think a lot of this comes down to the trade tariffs being slapped on China by the United States, as we continue to see the knock on effect to the commodity currencies. Alternately, if we can break above the 0.6850 level, that could be a very bullish sign but I see a lot of noise above and I think it is going to be much easier to sell off than rally.