Gold prices ended Monday’s session up $9.89 an ounce, supported by safe-haven demand and technical buying. U.S. stocks continued to struggle, with major indexes ending lower. The dollar weakened against major currencies after U.S. retail sales came in lower than expected. An uncertain outlook for global growth and rising tensions between Western powers and Saudi Arabia are also boosting the yellow metal.

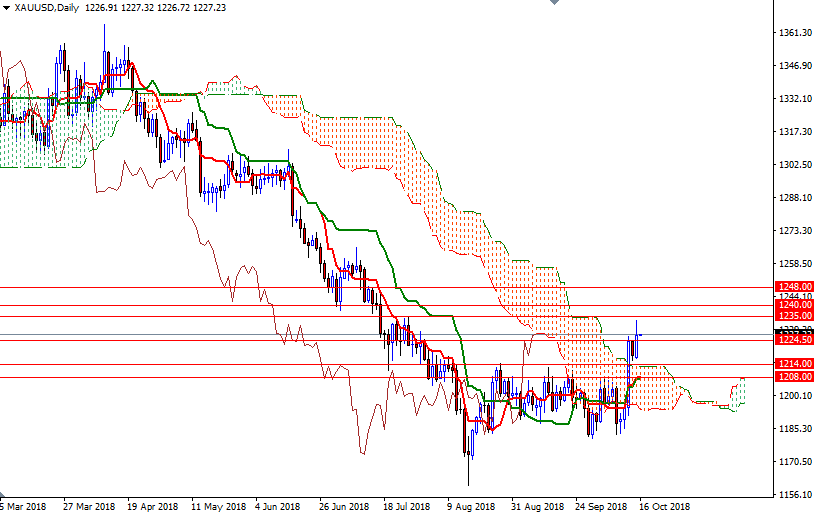

From a chart perspective, the bulls have the near-term technical advantage. XAU/USD is trading above the Ichimoku clouds on the daily and the 4-hourly charts; plus, the Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line) are positively aligned. However, beware that a couple of technical barriers, such as the 200-week moving average and the 38.2% retracement of the bearish run from 1365.10 to 1160.05, cluster in the 1240/35 zone. A break through there indicates that 1245.50 and 1252/48 will be the next targets.

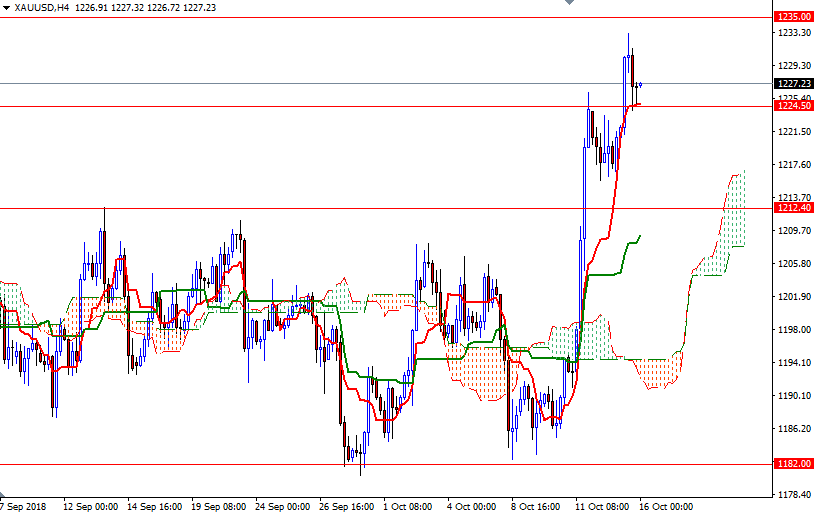

To the downside, the initial support stands at 1224.50, which happens to be the bottom of the cloud on the M30 chart. The bears have to push prices below there to test 1219.50 and 1216. If prices get back below 1216, then the market will be targeting 1214-1212.40. Closing below 1212.40 on a daily basis could foreshadow a move down to 1208/5.