Gold prices ended Monday’s session down $3.45 an ounce, pressured by a firmer dollar and keener risk appetite in the world marketplace. The dollar has been supported by expectations the Federal Reserve will continue to raise interest rates. U.S. stock indexes and bond yields jumped at the start of the week on news of a U.S.-Canada trade deal reached on Sunday.

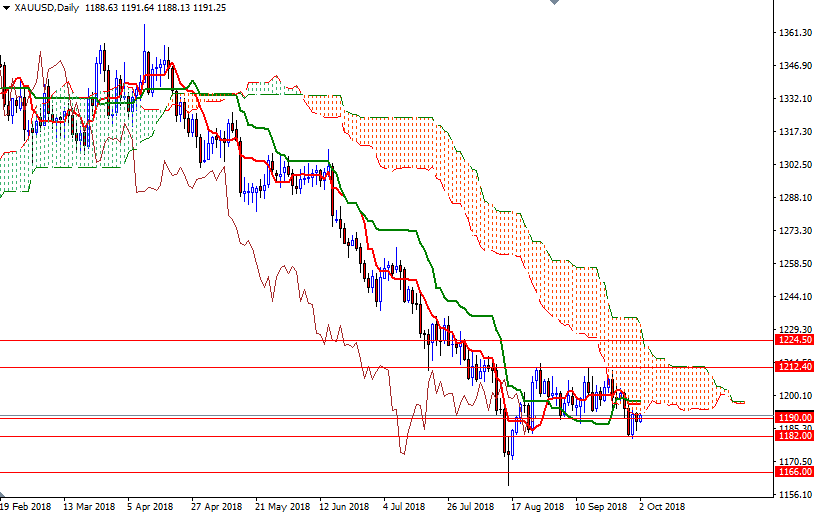

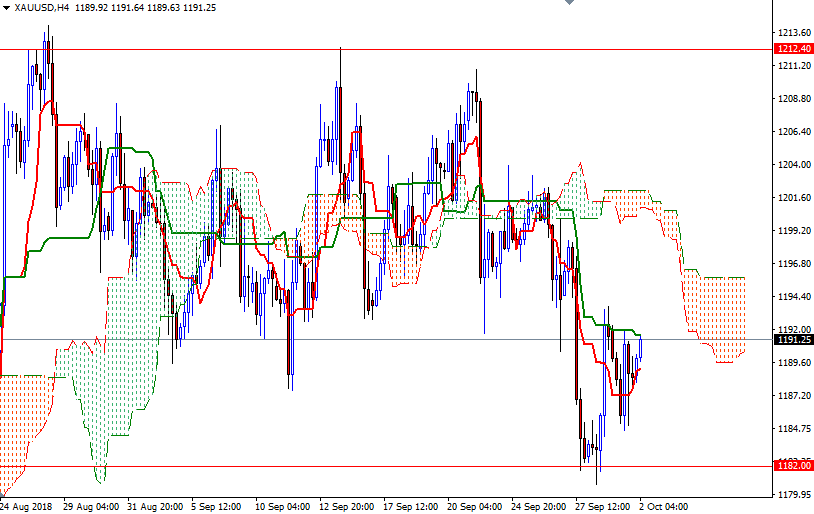

From a chart perspective, the bears have the overall technical advantage. XAU/USD is still below the weekly Ichimoku cloud; plus, the Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) are negatively aligned on both the weekly and the daily charts. However, the market is currently trading above the cloud on the H1 chart, and we are in the process of testing the resistance in the 1193/0 zone.

If this resistance is broken, look for further upside with 1197/6 and 1200 as targets. A break above 1200 suggests an extension to 1204/2. The bulls have to produce a daily close above 1204 to gain momentum for a test of 1214-1212.40. To the downside, the initial support comes in around 1187, the bottom of the hourly cloud, and that is followed by a horizontal support at 1185. If XAU/USD falls below 1185, then the next stop will be 1182/0. Closing below 1180 on a daily basis indicates more downside price pressure is coming. In that case, XAU/USD could test 1173/2 and 1166.