Gold prices settled at $1191.47 an ounce on Friday, falling 0.63% on the week and 0.77% over the month. The strong greenback has been a major bearish element for the precious metal in recent weeks. Recent U.S. economic data have been broadly positive. Expectations that the Federal Reserve will deliver a fourth interest-rate increase this year may prevent any significant recovery until December. Another negative for the gold market was the keener risk appetite which continued to support buying interest in equities.

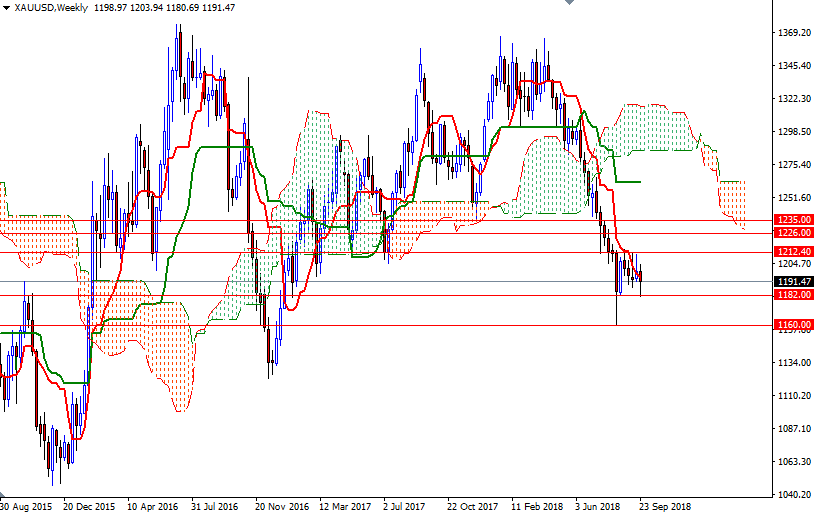

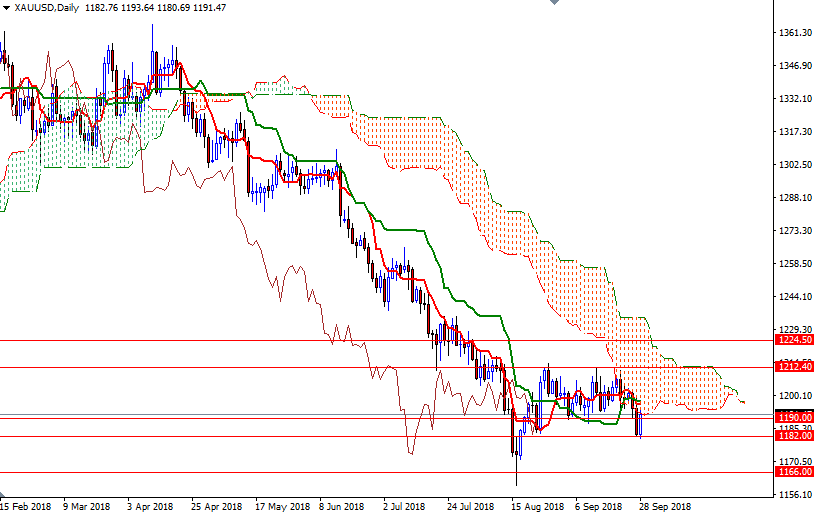

Friday was the last trading day of the month and of the quarter, and it prompted some short-covering, though the bears have gained downside momentum recently. The technical posture for gold remains bearish, with the market trading below the weekly Ichimoku cloud. The Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) are negatively aligned.

To the downside, we have a strategic support in the 1182-1180.50 zone, and the bears have to confidently drag prices below there to increase technical selling pressure. If that is the case, look for further downside with 1173/2 and 1166 as targets. Below there, the 1160 level stands out as a solid support. A break down below 1160 implies that XAU/USD is on its way to 1250/45. Further weakness below 1245 could trigger a drop to 1237. However, if the aforementioned support in 1182-1180.50 remains intact, XAU/USD may grind higher towards the 1204/2 area occupied by the 4-hourly Ichimoku cloud. Closing above 1204 on a daily basis could offer enough inspiration for bulls to send prices higher to 1214-1212.40, which is the next solid technical resistance on the charts. The bulls have to pass through this strong barrier to challenge 1226-1224.50. A successful break above 1226 would open the door for a move to 1235.