EUR/USD

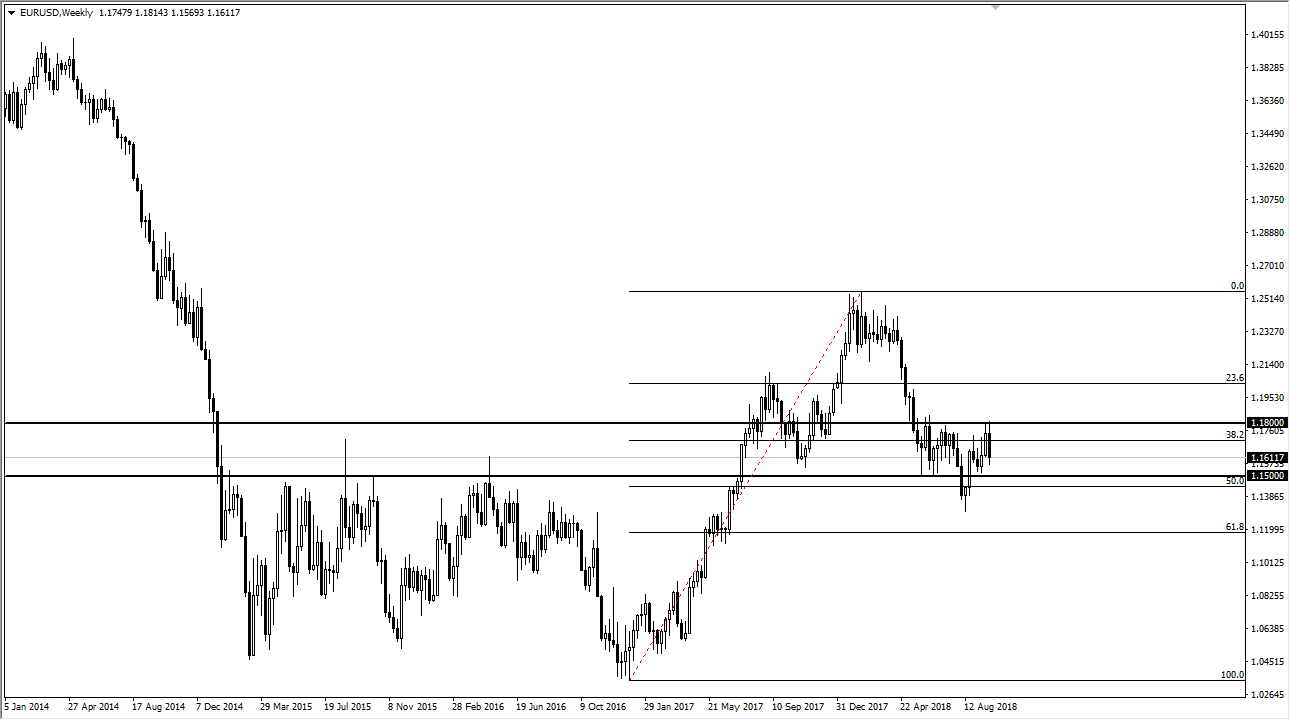

The Euro has had a rather volatile month, as we continue to chop around overall in September. Rolling into October, I don’t see anything on this chart that tells me we are about to see anything easier to deal with. I believe that the 1.15 level continues offer a lot of support, just as the 1.18 level above offers a lot of resistance. The latest concerns and the European Union is the Italian budget, and quite frankly the murmurings of many other countries around the continent that are unhappy with the union. I think that the 1.15 level begins a massive amount of support though, as seen based upon the 50% Fibonacci retracement level and of course the previous resistance just below that big figure.

With this in mind, I believe that the month of October will be a lot of sideways back and forth trading between these 300 pips, but ultimately we could see a break out. If we can get a daily close above the 1.18 level, that almost certainly would send this market looking towards 1.20 level after that. At this point though, we know that the Federal Reserve is going to be continuing its tightening policy, while the European Central Bank still looks to be on the sidelines at least in the short term. I think confusion reigns yet again, and quite frankly the EUR/USD pair will probably be one of my least favorite places to trade, unless of course there are short-term opportunities near the outer ranges of the consolidation, which of course is always a good trading opportunity. The beauty of this is that we have two very clear and concise levels to pay attention to for the next month.