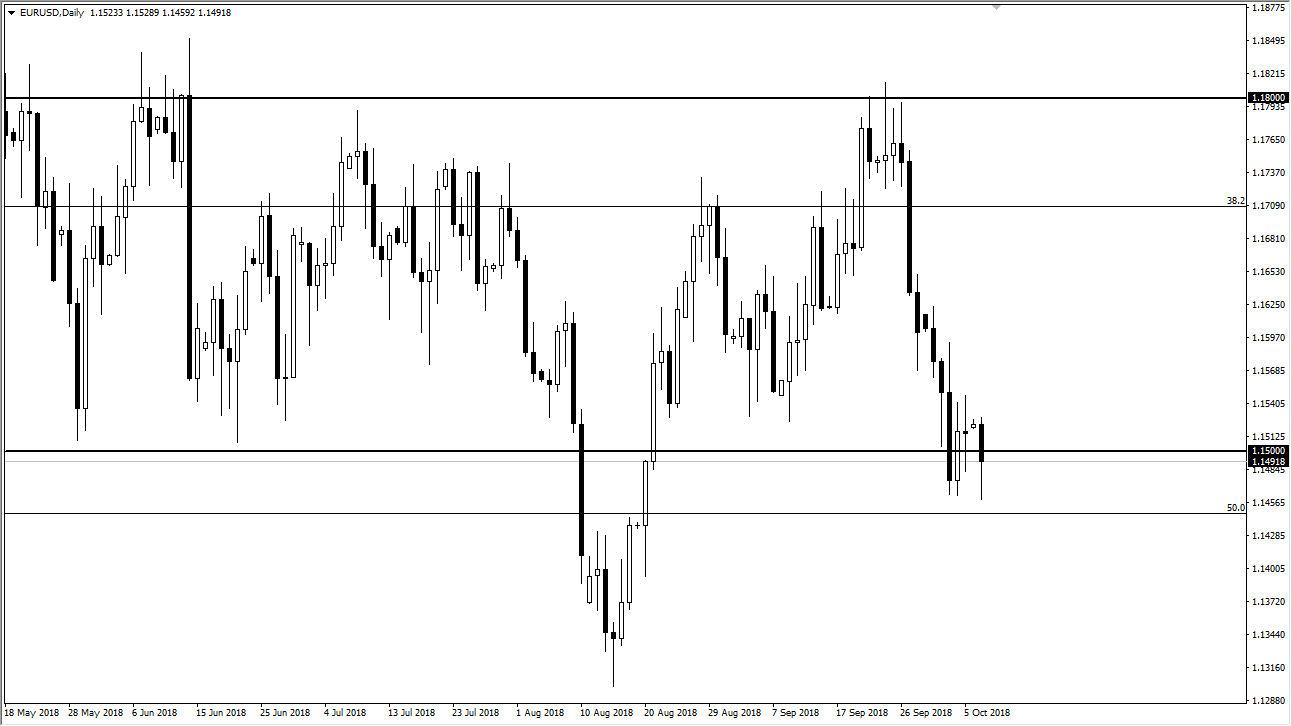

EUR/USD

The Euro fell significantly during the trading session on Monday but found enough support underneath at the 1.1450 level to turn around of form a supportive looking candle. This tells me that the market still has plenty of resiliency, and I think this is an area that makes a lot of sense for buyers to return to, mainly because we are at the 50% Fibonacci retracement level. I do think eventually we rally from here and go looking towards the 1.17 level, and that eventually the 1.18 level. If we do break down below the 1.14 handle, then we probably grind a bit further, but at this point I think that the risk is more to the upside than the downside at this point, so I believe these dips can continue to offer buying opportunities and value in a market that has been beaten down.

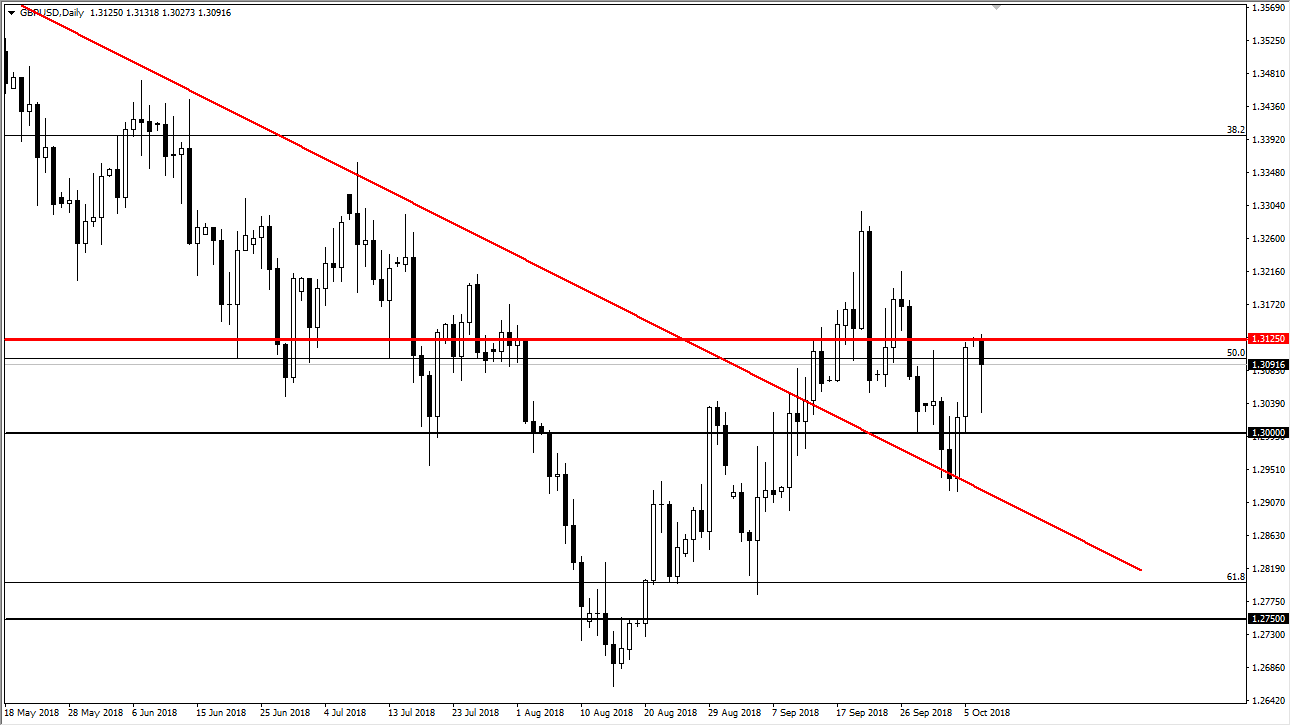

GBP/USD

The British pound also initially fell during the trading session, reaching down towards the 1.3030 level, before turning around to show signs of support. It looks as if we are trying to break out to the upside, and the actions of traders on Monday certainly shows that there are plenty of people who are willing to jump into this market and pick up the British pound as it is “cheap”, so therefore I think that buying the dips continues to be the best way to play this market. If we break down below the 1.30 level, then the market will probably reach towards the previous downtrend line that has of course been very supportive. If we break down below there, then things could change. However, the hammer that formed during the day on Monday for me was very telling, and it suggests that we will eventually break out to the upside. After all, the British pound has been remarkably resilient.