EUR/USD

The Euro rallied during the trading session on Thursday but struggled just above the 1.15 level. It looks as if the market is still trying to buy this area as support, and with the jobs number coming out today it’s very likely that we will see volatility. It’ll be interesting to see how we react during the session but I have found that most Nonfarm Payroll trading sessions are quite often a wash. The market quite often will jump around in both directions, essentially settling on going nowhere. We already know that the Federal Reserve is going to raise interest rates several times, so that should not be a huge surprise. However, I still believe that if we can break above the top of the range for the Wednesday candle, we will turn around and bounce towards 1.18 level.

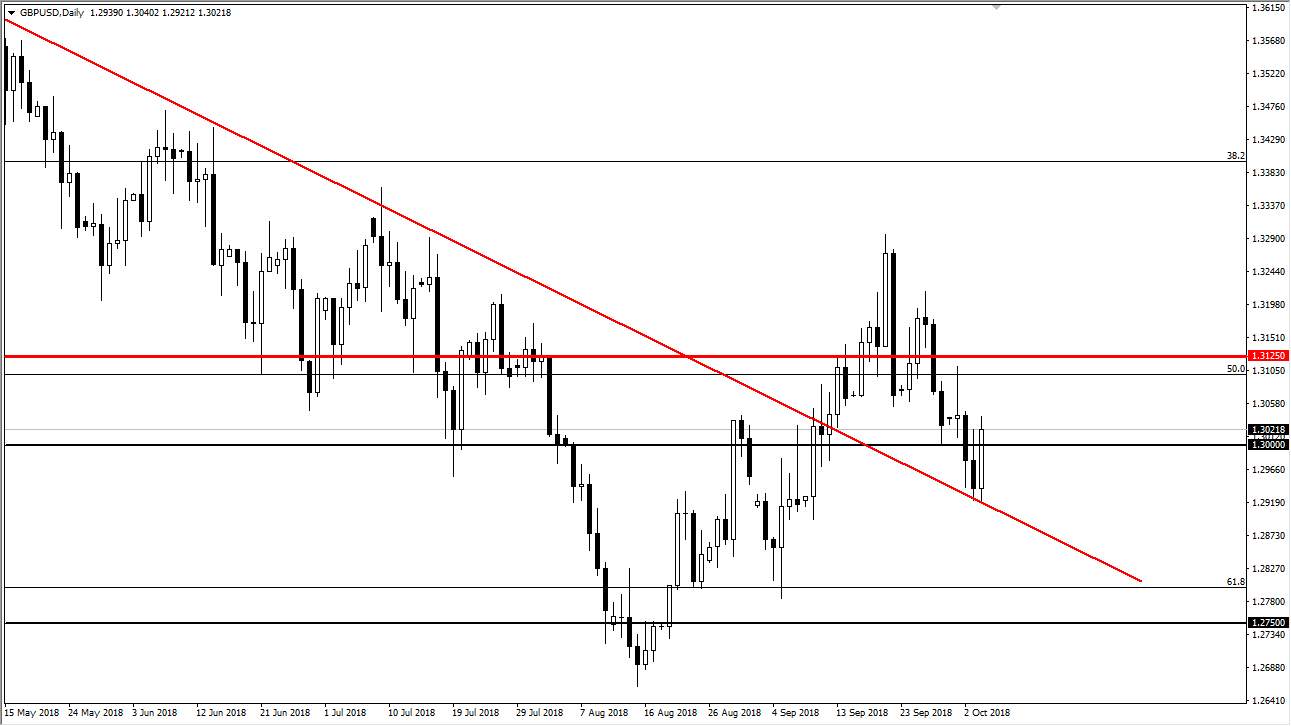

GBP/USD

The British pound rallied significantly during the trading session on Thursday, breaking above the top of the shooting star like candle from the previous day, showing signs of life at the previous downtrend line. It looks as if we are going to try to go higher, but with the jobs number coming out today, I would be a bit hesitant about jumping in straightaway. I’d like to see a little bit of a pullback before I start buying, but I have no interest whatsoever in shorting this market, because it looks as if we are trying to build a bit of a base. That makes for difficult trading, but the reality is that trend changes almost always look like this. I believe that if we can break above the 1.3125 level, the market continues to rise longer term.