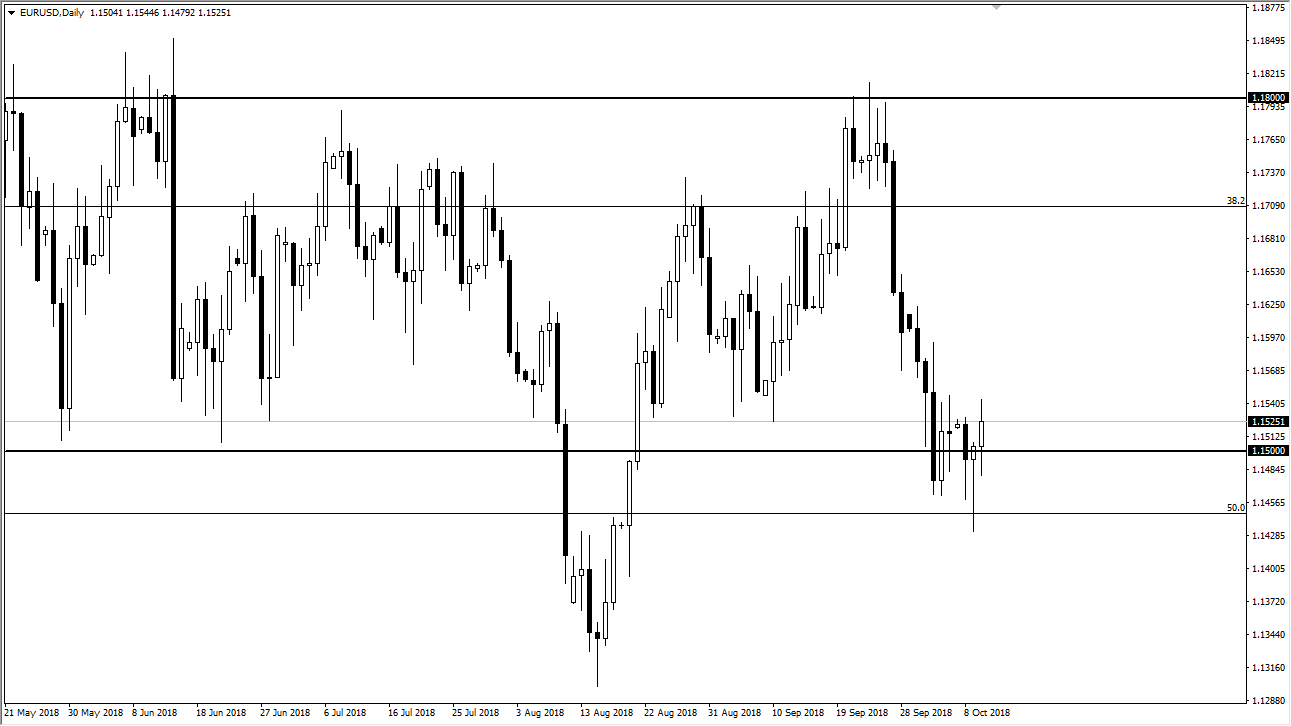

EUR/USD

The Euro rallied significantly during the trading session on Wednesday, breaking above the hammer from the previous session, which of course is a very bullish sign, and I think that we are trying to find some type of bottom in an area that had been very reliable as the bottom of the overall consolidation lately. At this point, I believe that the hammer that formed during the day on Tuesday is probably going to continue to offer significant support, and I think that we could go as high as 1.18 over the longer-term. We have a lot of sideways action ahead of us in the short term though I expect, as there are a lot of concerns around the world involving trade, treasury yields, and many other issues. I am a buyer of short-term dips on short-term charts at this point. It’s not can be easy, but I think we turn around.

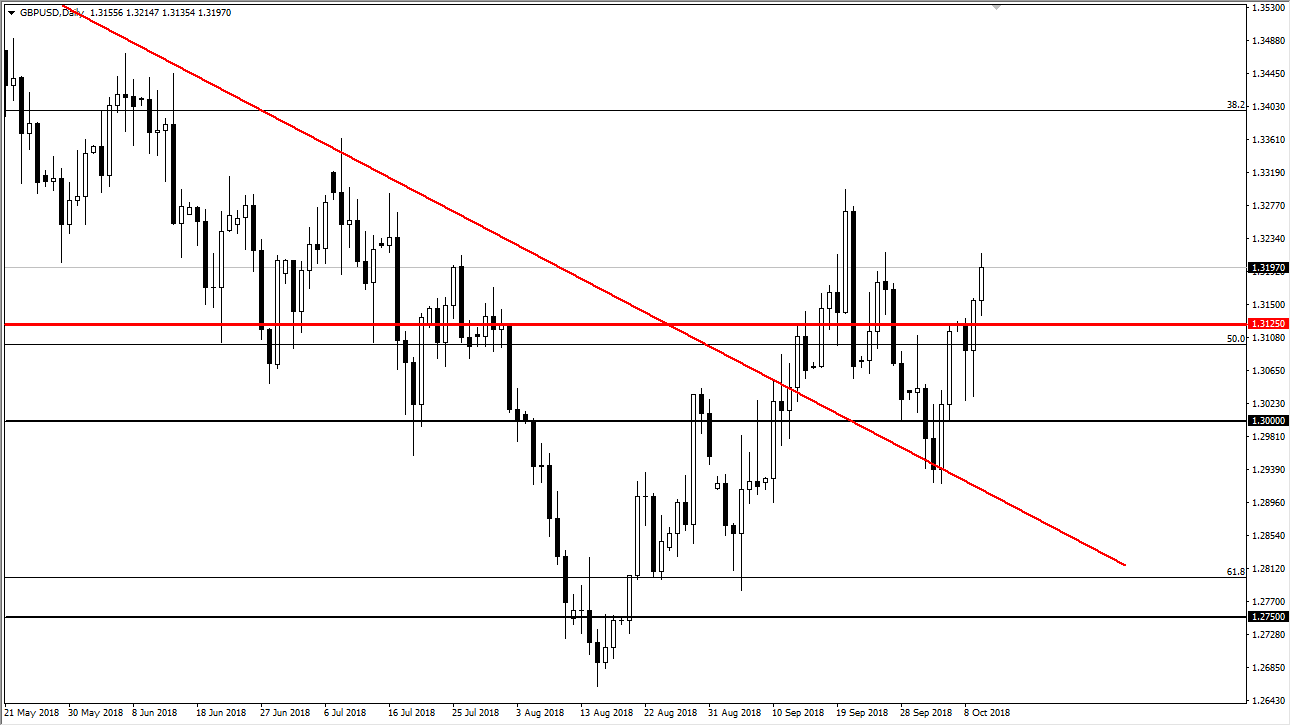

GBP/USD

The British pound initially dipped lower during the day on Wednesday but found enough support at the previous resistance barrier in the form of the 1.3125 level to turn around and rally. The market pierced the 1.32 handle, and I think we will continue to grind higher. Short-term pullbacks should continue to offer buying opportunities, but I would not look at them for a longer-term move quite yet, unless of course you can have a larger stop loss. Overall, I believe that the market does have buyers, but we may be in for a rough few days as there has been so much in the way of volatility and concern. Overall, I think that the market continues to look a bit choppy with an overall bullish attitude.