XTB’s Free Analysis & In-depth Guide - Webinar & Videos Included

Brexit talk has come back to the forefront of traders minds in recent weeks as UK politicians return from their summer recess and the pressure to reach an agreement with the EU for a new trade deal ramps up even further. To underline how important this could be for the markets, one major global investment bank - Bank of America Merrill Lynch - recently noted that getting cable (GBPUSD) right would be the best G10 FX trade for the rest of the year!

Brexit talk to drive the pound in the near-term

Example: Market reaction to soft Brexit rhetoric

In late August 2018 the GBPUSD rallied around 180 pips in less than 24 hours following comments from Chief EU Brexit negotiator Barnier in which he stated the the EU wants to make a Brexit deal. (Source: xStation)

GBPUSD spiked higher by 150 pips in less than 20 minutes after reports that Germany would be willing to drop key Brexit demands saw the pound surge higher. (Source: xStation) (5th September)

Example: Market reaction to hard Brexit rhetoric

Just a couple of days later Barnier said that he "strongly opposed" UK PM May's proposals on future trade while advising European carmakers that they will have to use fewer British-made parts after Brexit. These comments were made over the weekend when the markets were closed but caused a 50 pip gap lower on the open before price fell a further 90 pips in the next 36 hours. (Source: xStation)

These two examples are intended to show that not just the ultimate agreement reached between the UK and EU will drive markets and that expectations ahead of this will also have an impact. From a trading perspective this means that there will be several opportunities to trade off Brexit-related news before a deal is even reached. For instance if we look back to June 2016, there was a clear move higher ahead of the referendum as the markets began to discount a victory for remain. The thrust and counter-thrust of the upcoming negotiations will also likely drive the pound and cause several moves in the coming months.

Learn how to Trade Hard/Soft Brexit with XTB’s Free Brexit Package

3 FX Pairs to trade in countdown to Brexit

GBPUSD

The most widely traded GBP cross is an obvious place to start. BofAML have predicted that under a no-deal outcome the GBPUSD would fall to 1.10, rise to 1.35 with a deal similar to the current May proposal (Chequers) and rally to 1.50 if somehow the UK decides against exiting. According to a poll by research bodies NatCen and The UK in a Changing Europe (released on September 5th) Britons would now vote 59-41 to remain. Given that there isn’t yet a known single event such as a vote on what kind of deal, if any, will be reached it seems plausible that there may not be as sharp a move this time around even if there is a no-deal outcome. Along these lines the markets will likely begin to price in the chances of a hard Brexit in response to the latest developments and there’s a good chance of several twists and turns along the way.

The chart above shows areas highlighted where banks have predicted the market to go in the event of a Hard/Soft Brexit. (Source: xStation)

GBPJPY

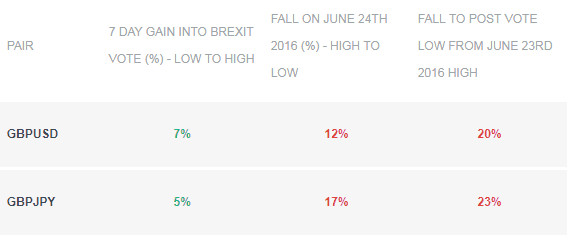

Due to the GBPUSD being the most widely traded pound pair it attracts the Lion’s share of coverage, but the GBPJPY cross is often even more sensitive to events like these. This is because the Japanese Yen is often viewed as a safe-haven asset and therefore investors flock to it in times of uncertainty. What this means is if there’s a major negative shock to the UK, like the Brexit vote, then the market is hit with a double-whammy with both the pound plunging and the Yen rallying. Here’s a quick comparison table showing the percentage change in these markets in the 7 days leading up to the Brexit vote, the day after and the move to the resulting lows.

Note that the GBPJPY suffered greater losses than GBPUSD in percentage terms following the outcome of the Brexit vote. Therefore a no-deal Brexit could see larger declines for the GBPJPY than GBPUSD. (Source: xStation)

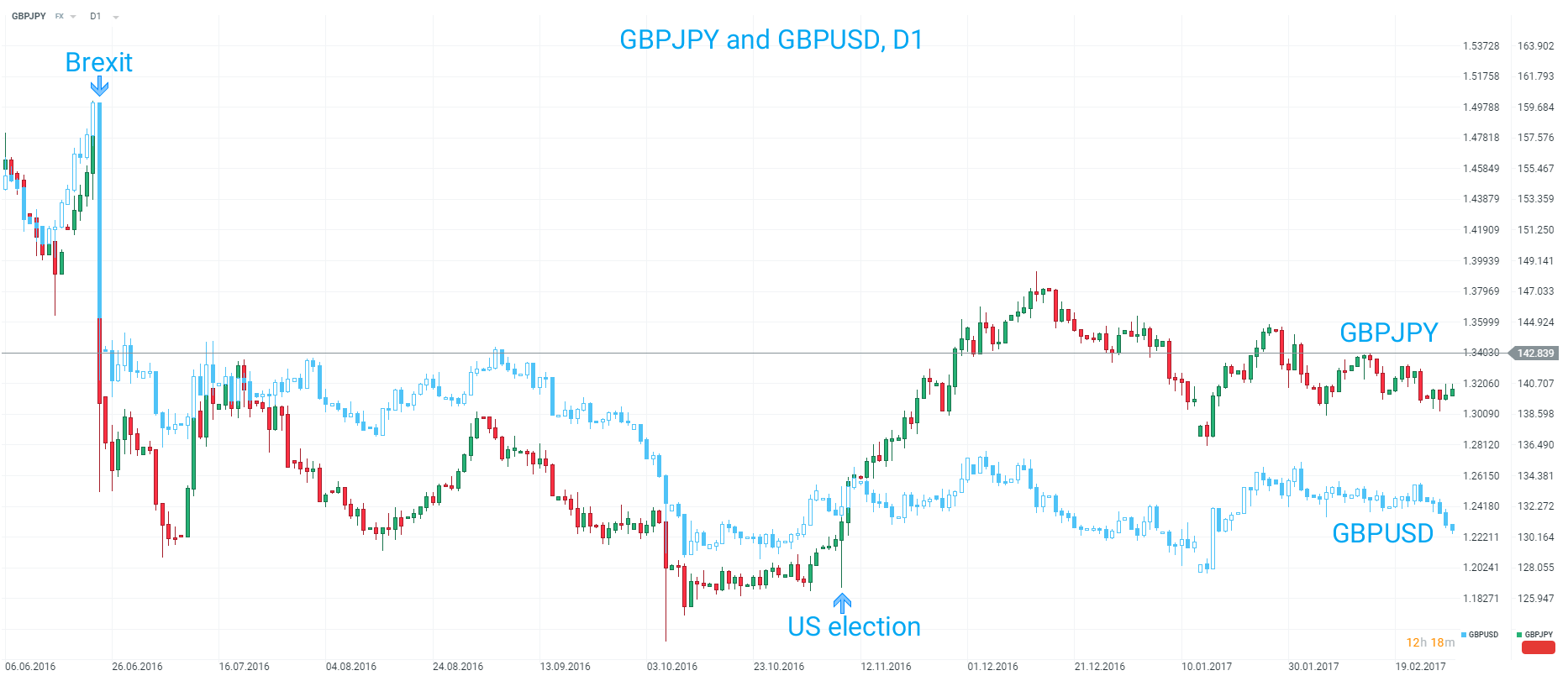

GBPJPY fell further than GBPUSD on the day after the Brexit vote and continued to underperform for the next few months until the US election which impacted the JPY side of the cross due to a marked improvement in risk sentiment. (Source: xStation)

EURGBP

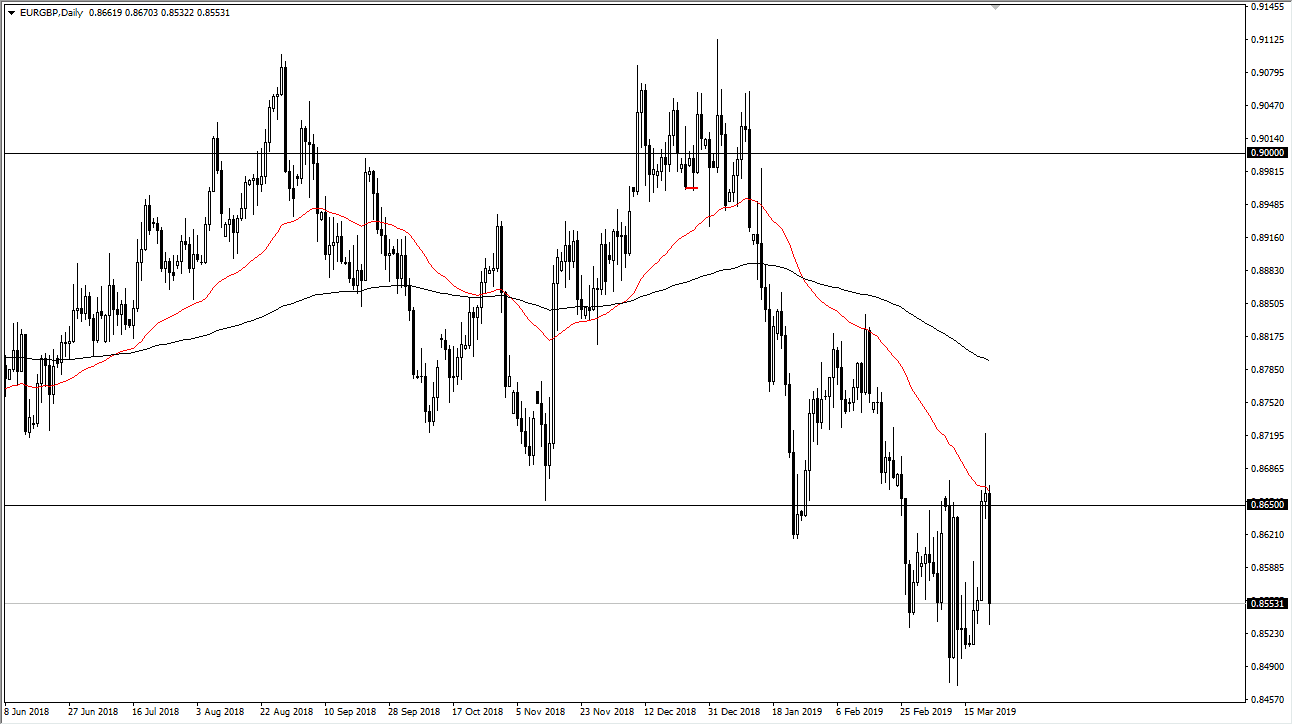

So far this report has focused on just the GBP and the Brexit impact but what about the Euro? Going back to the referendum there was an immediate drop lower for the single currency but it recovered far more quickly than the pound and as such appears to be less sensitive to Brexit developments. This can be seen in the rally witnessed in the EURGBP following the vote, with price jumping in excess of 20% in the next 16 weeks. This pair trades closer to its post Brexit extreme than the GBPUSD and GBPJPY and as such could be seen to offer more potential for GBP gains in the event of a positive outcome for sterling.

Note that GBP gains are represented by lower prices on the EURGBP pair.

The EURGBP saw a comparable move to the GBPUSD and GBPJPY following the Brexit vote, but it remains closer to its post-referendum extreme and as such may be seen to represent greater potential for GBP gains (lower EURGBP price) should a positive outcome for the pound be reached. (Source: xStation)

Want further analysis? Downloads XTB’s Free Brexit Trading Package, which includes an in-depth guide, video strategies and a free webinar with live market analysis on 11th October.