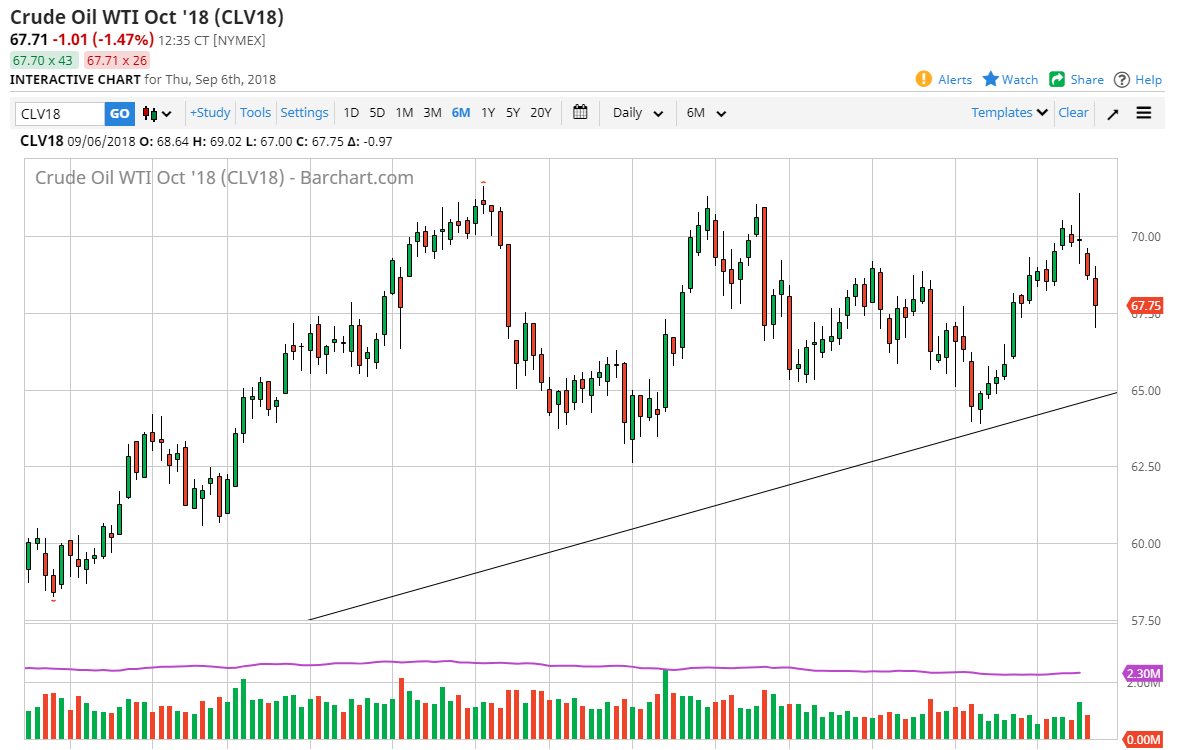

WTI Crude Oil

The WTI Crude Oil market broke down rather significantly during the trading session on Thursday, showing signs of extreme weakness. We broke down below the $67.50 level on disappointing inventory numbers and of course concerns about trade wars driving down demand. At this point, the uptrend line crosses the $65 level, so I think at this point longer-term traders will be down there looking to pick up a bit of value. If we break down below the $65 level, the market could break down even further, but at this point I think we are going to grind to the downside. Clearly, we have a lot of issues and of course a stronger US dollar weighs upon the crude oil markets as well. It currently looks as if the $71 level above is the “ceiling” in the market. With today being the jobs number, expect extreme volatility.

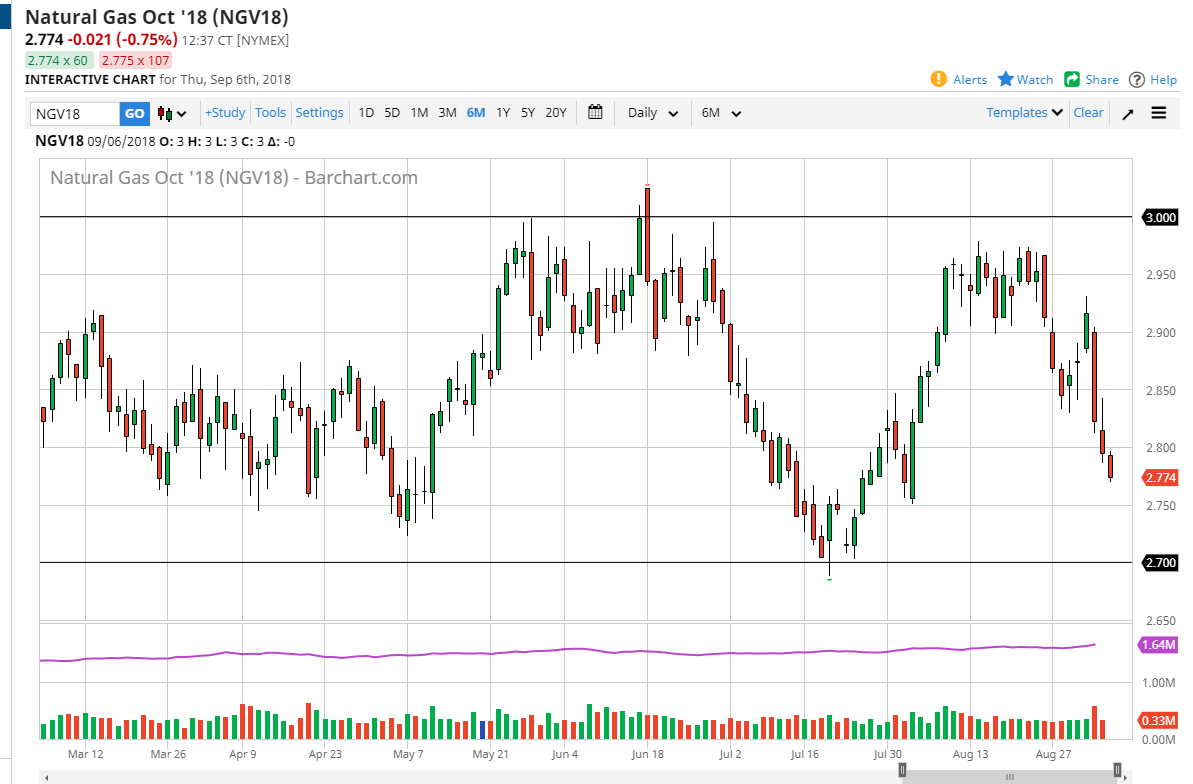

Natural Gas

Natural gas markets have broken down a bit during the trading session on Thursday, reaching down towards the $2.77 level as I record this. The $2.75 level underneath is support, and a break down below there opens the door to the $2.70 level which is the bottom of the overall consolidation. I think that in the short term, small rallies that show signs of exhaustion should be selling opportunities. However, longer-term traders will look at the $2.70 level as an opportunity to pick up value. We are still in the overall consolidation area that I have marked on the chart, and as a result is very likely that the market continues to do the same thing that is done for quite some time.