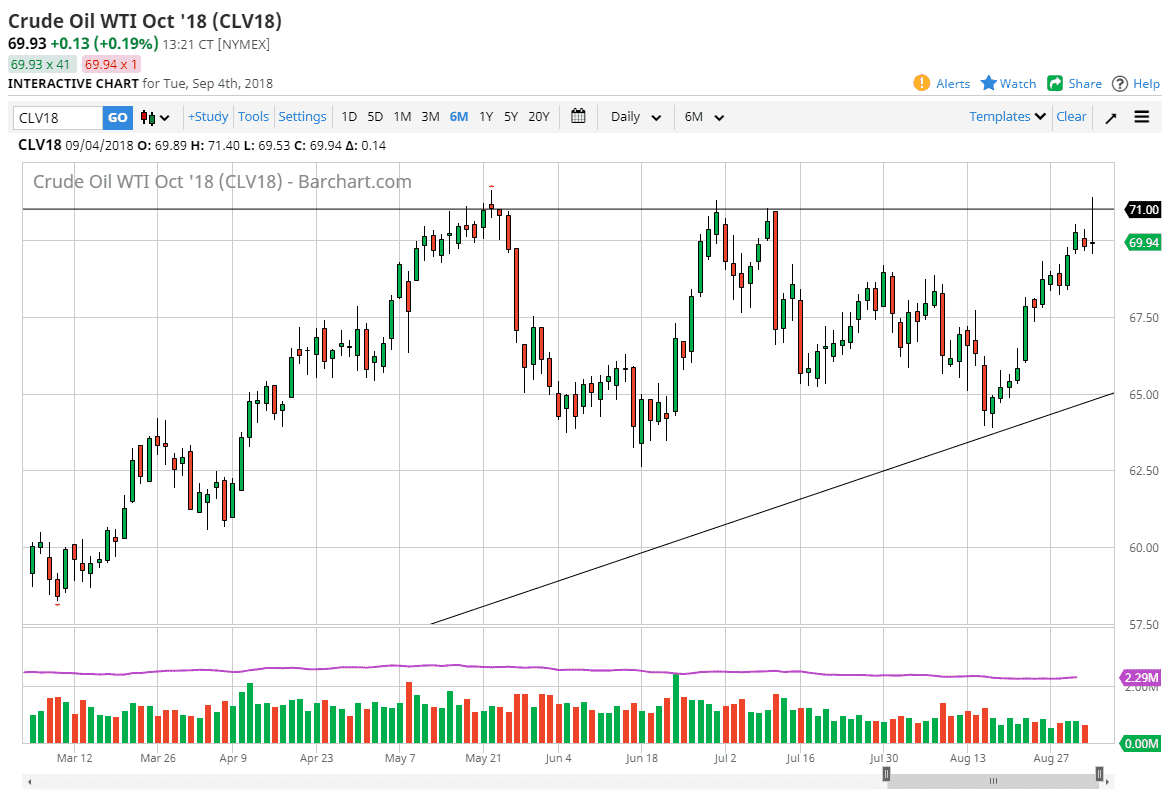

WTI Crude Oil

The WTI Crude Oil market had a very volatile session during trading on Tuesday, initially breaking higher due to threats of a hurricane, but rolling over drastically as the US dollar weighed upon any rally. Because of this, it looks as if the market isn’t quite ready to break out, and a pullback is imminent. A break down below the bottom of the range for the day could send this market looking towards the $68.50 level, and then possibly $67.50. Quite frankly, today was horrible in this market and it shows just how hard it is going to be to break out to the upside for the longer-term move. This could end up being a very ominous sign if we get any type of follow-through to the downside. With that in mind, I would be very cautious about going long of this market until we break well above the shooting star.

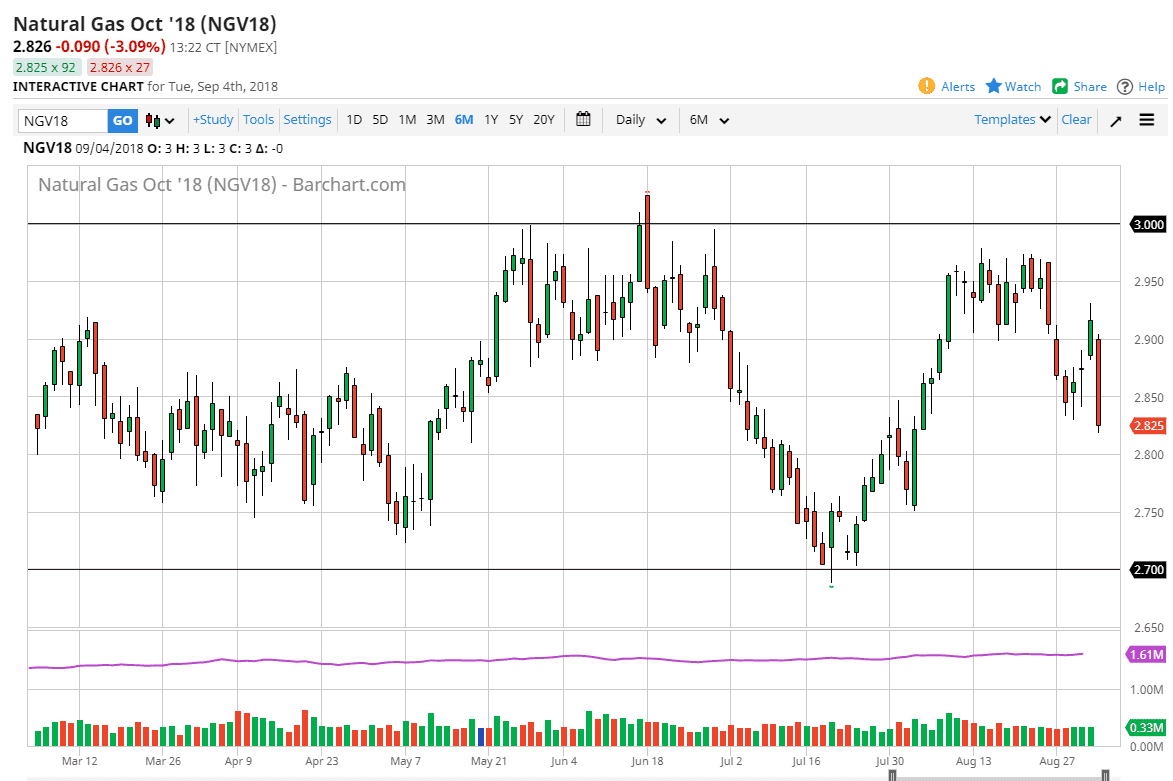

Natural Gas

Natural gas markets broke down rather significantly as the damage from the storm in the Gulf of Mexico seems to be a hurricane, but it doesn’t what to do major disruption to the natural gas markets. Because of this, we have rolled over and we look very likely to now go looking towards the $2.80 level, followed very rapidly by the $2.70 level which is the bottom of the longer-term consolidation area that we have been in for ages. Overall, I’m very bearish to this market and I think we will revisit that $2.70 level, but it may take some time to get there. The $3.00 level above continues to offer a significant ceiling, so therefore I think it will be difficult to hang onto a trade for any length of time if you are looking to buy this market. Quite frankly, I find it easier to sell rallies that show signs of exhaustion.