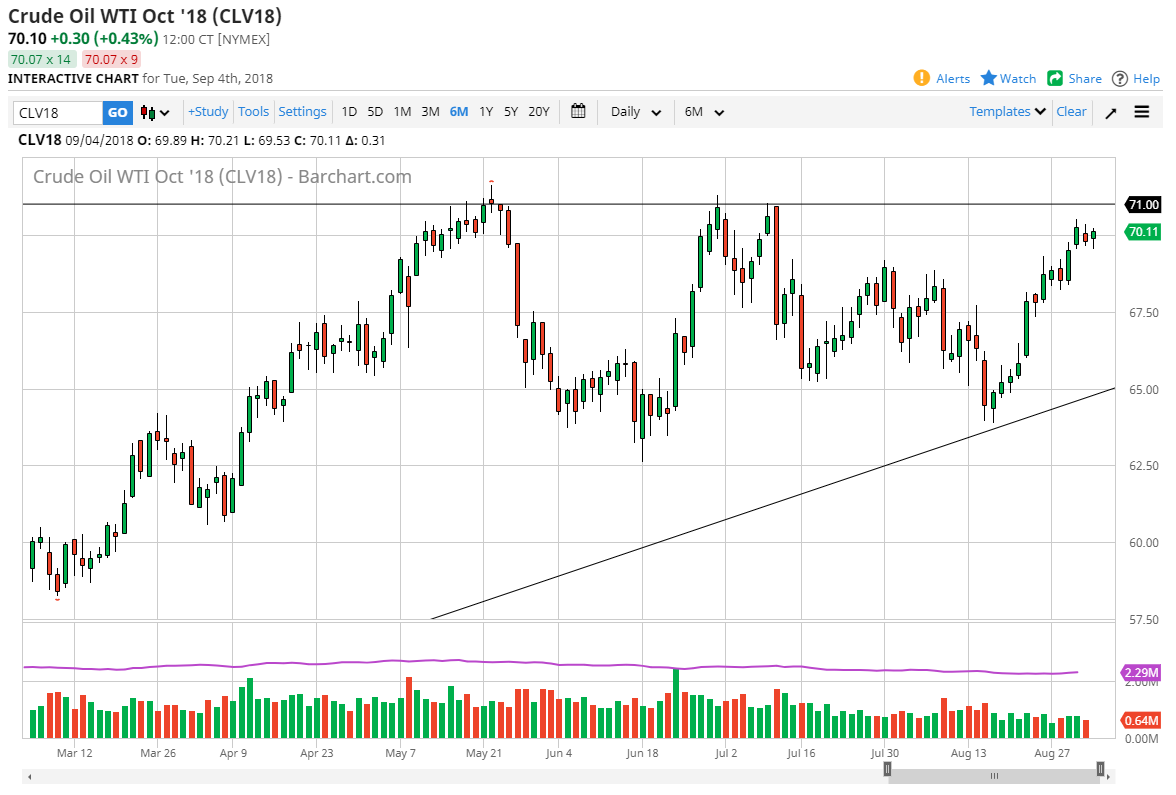

WTI Crude Oil

In what would have been relatively thin trading on Monday, the WTI Crude Oil market initially pulled back, but found buyers underneath the $70 level in order to support the market. I think at this point, the market will probably continue to find buyers on dips, as it represents a bit of value in a market that is obviously very bullish longer-term. In general, the market looks as if it is trying to break above significant resistance in the form of the $71 level, wiping out a very impulsive negative candle from early July. If we get that move, the market could very well go looking towards the $72.50 level, followed by the $75 level. Otherwise, we will probably pull back in order to find some type of footing or buying pressure underneath to support this market. I think there are plenty of candidates, namely the $69 level, and the $67.50 level.

Natural Gas

Natural gas markets were negative during the day, breaking below the $2.85 level in holiday trading. With the Labor Day holiday going on in the United States, there would not have been as many traders as the natural gas markets are heavily influenced by the US. The market still lost over 2%, but at this point it looks like we may be getting a bit of a reprieve. I think that the $2.90 level above will continue to offer resistance, so dialing up short-term charts and look at for signs of exhaustion might be the way to go. At that point, I believe the market will probably sell off and go looking towards the $2.80 level, and then eventually the $2.76 level after that. These markets were choppy but have consistently shown consolidation as marked by the lines on the chart.