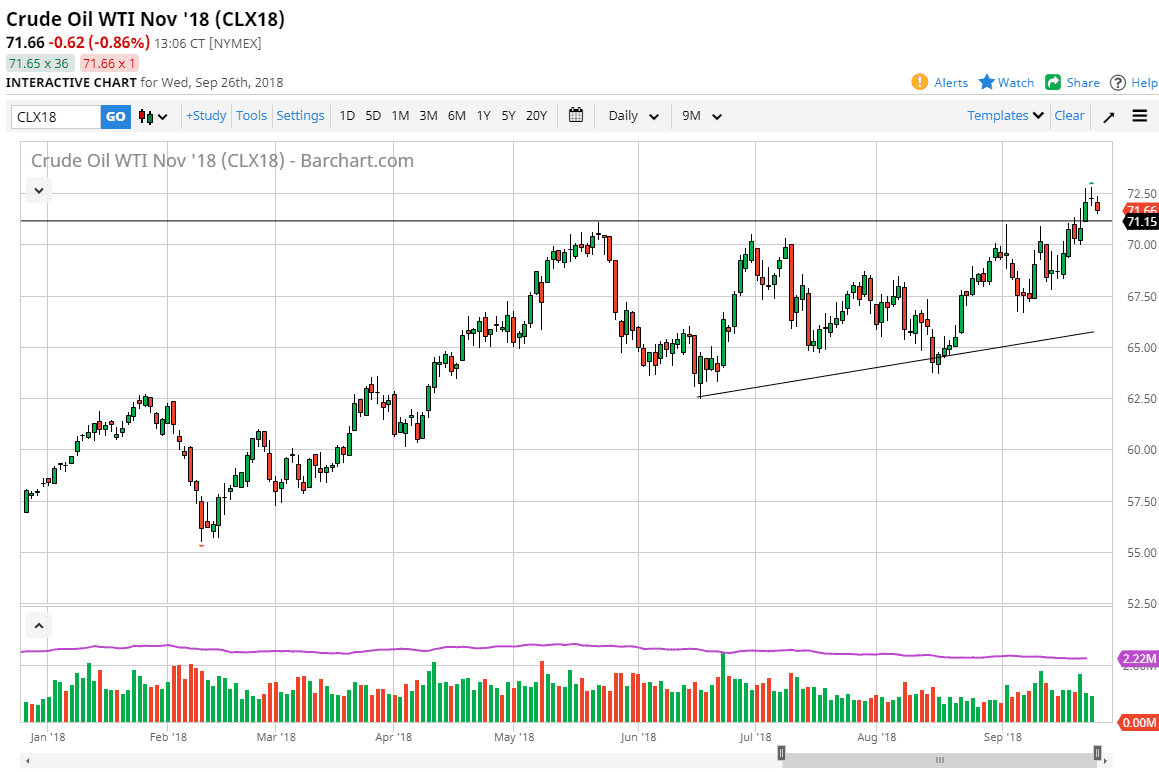

WTI Crude Oil

The WTI Crude Oil market tried to rally during the day on Wednesday but found too much resistance and rolled over a bit. We lost about 1%, and I think we may drift a little bit lower from here in order to try to find the previous high as a launching point. I’m still bullish of this market, and we have just had a significant break out to the upside. However, I recognize that quite often the breakout needs to be retested and I think that’s what’s happening here. In fact, I would not be worried about the break out until we broke down below the $70 level, something that doesn’t look very likely but you never know. Pay attention to the US dollar, if it suddenly starts to spike higher it could put downward pressure here but I think the tightening oil supply will continue to be the main story.

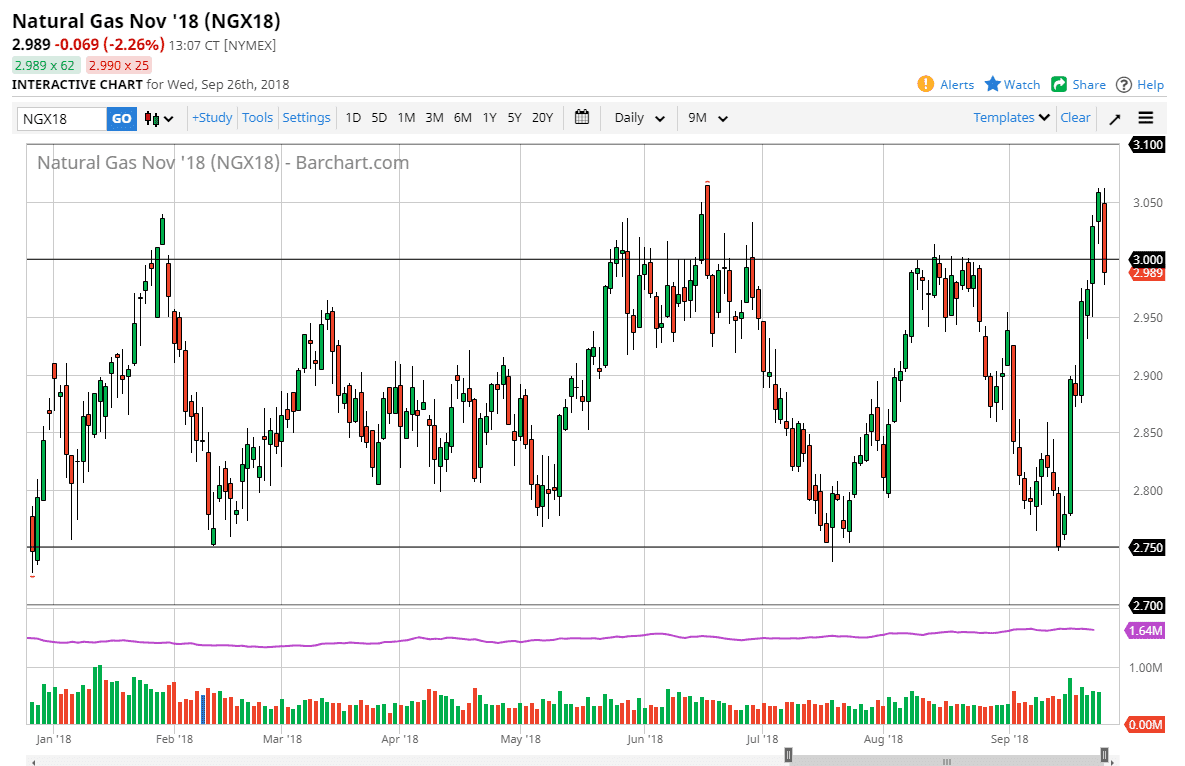

Natural Gas

Natural gas markets were really quiet during most of the session, but then broke through the $3.00 level later in the day. This is a horrific looking candle, and at this point I think that if we break down below the $2.95 level, the market is likely to continue to go lower. We are heading towards the colder months of the year in America, and that has a significant effect on this market. I also see that there is a lot of noise between here and $2.95, so I anticipate that it will take a lot of effort to get through that level. Once we do, the market is free to go much lower. Otherwise, I would anticipate the buyers will push this market back above the $3.00 level rather quickly. Keep in mind that Natural Gas Storage figures come out of America today, and that obviously will have a great influence as to where we go next. Perhaps some of the selling was due to preparation for that volatile announcement.