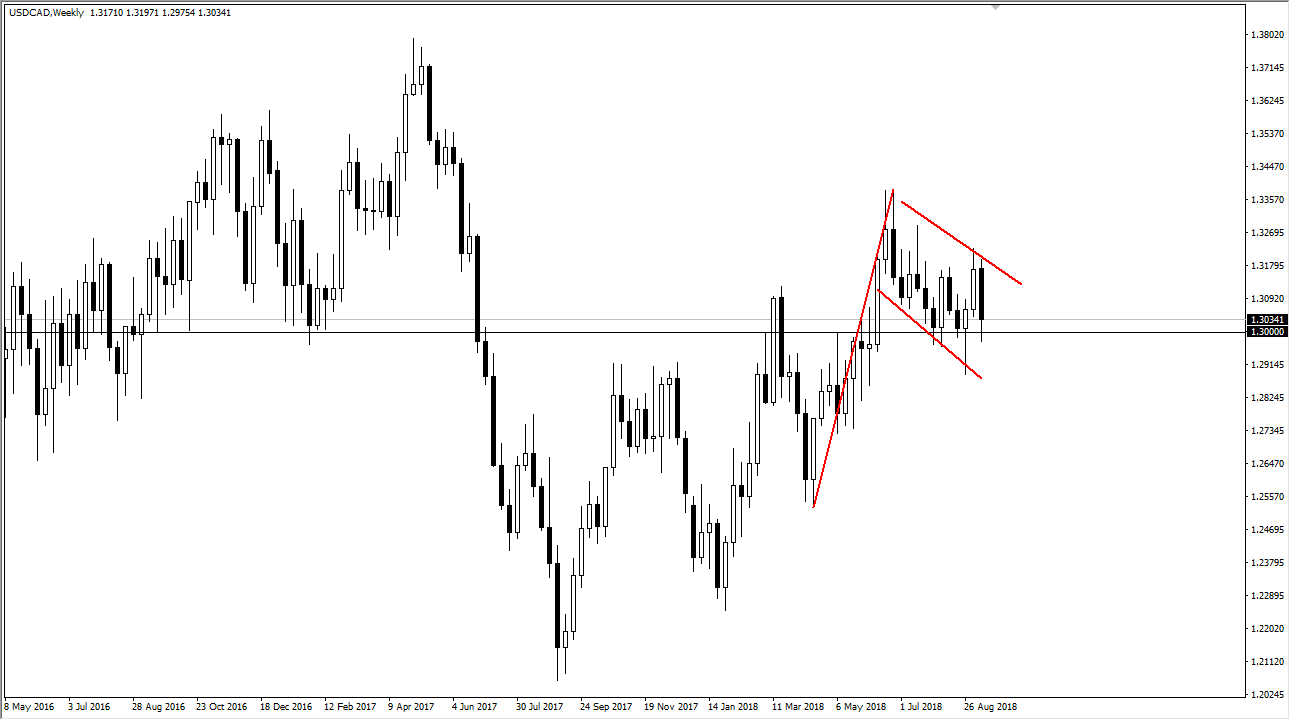

USD/CAD

The US dollar has been chomping around against the Canadian dollar for some time now, but it does look like we are trying to hold the 1.30 level as support. Beyond that, you could start to make an argument for a bit of a bullish flag, but I’m not completely convinced of it. I think the US dollar will continue to climb against the Canadian dollar if we do not have some type of solution between US and Canadian trade negotiators. In the short term, I suspect that we will see buyers coming in on dips.

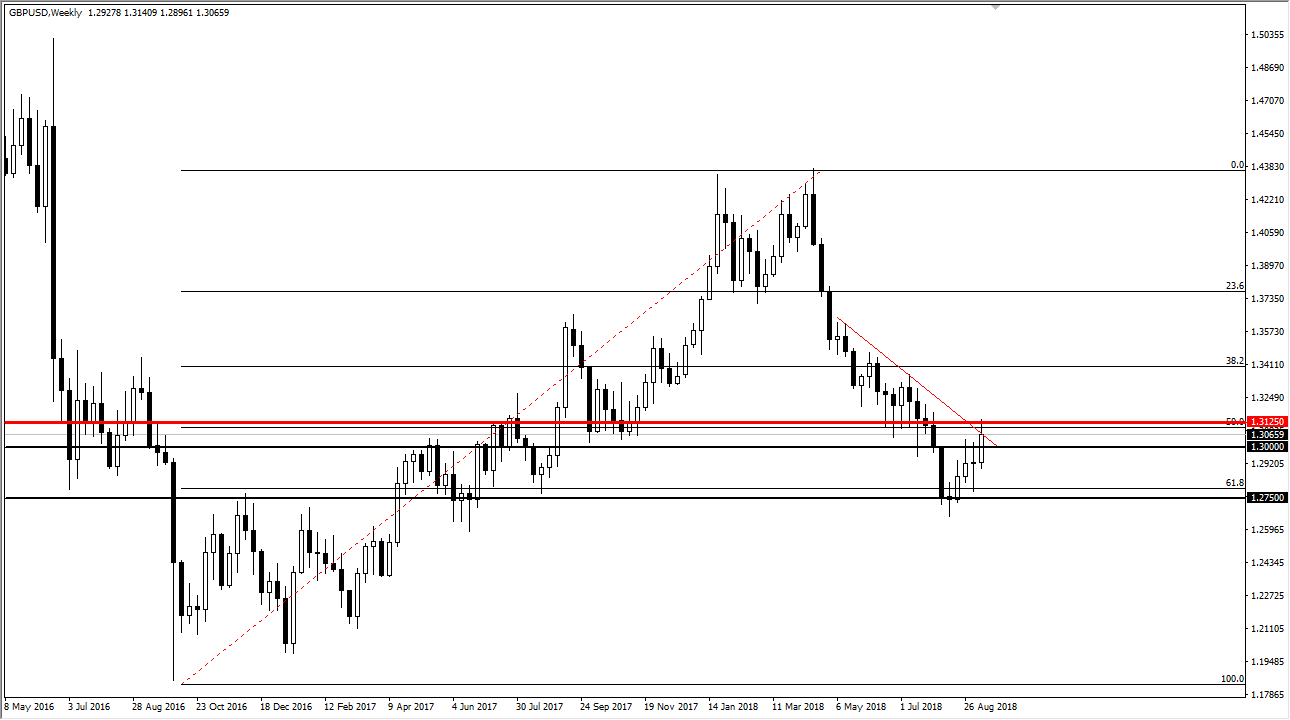

GBP/USD

The British pound rallied significantly during the week, reaching as high as 1.3125 at the highs, but gave back the gains to close right at the downtrend line that I have drawn on the chart. The downtrend line is based upon the daily chart, so it may not look as tight as it should on the weekly chart. However, I think it’s clear that the area the 1.3125 level is massive resistance, so I think it’s likely that we see a short-term pullback in order to offer value again. I do believe that this market has an upward bias though, as we have seen it explode to the upside every time there is an even remotely positive word uttered about the Brexit.

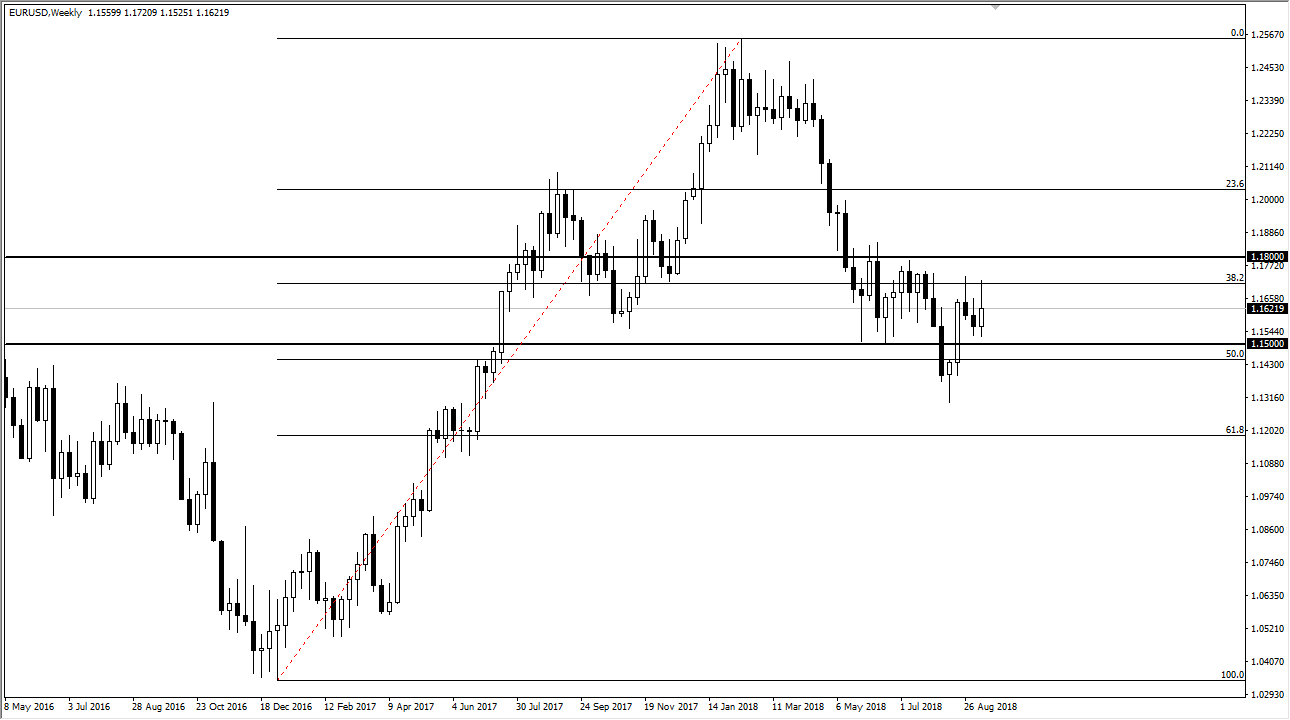

EUR/USD

The Euro has given back half of the gains for the week, and therefore I think it is not ready to break out to the upside. However, I think there is plenty of support underneath as well, so I think we are simply going to bang around between the 1.15 level and the 1.1725 level above. Expect more range bound trading.

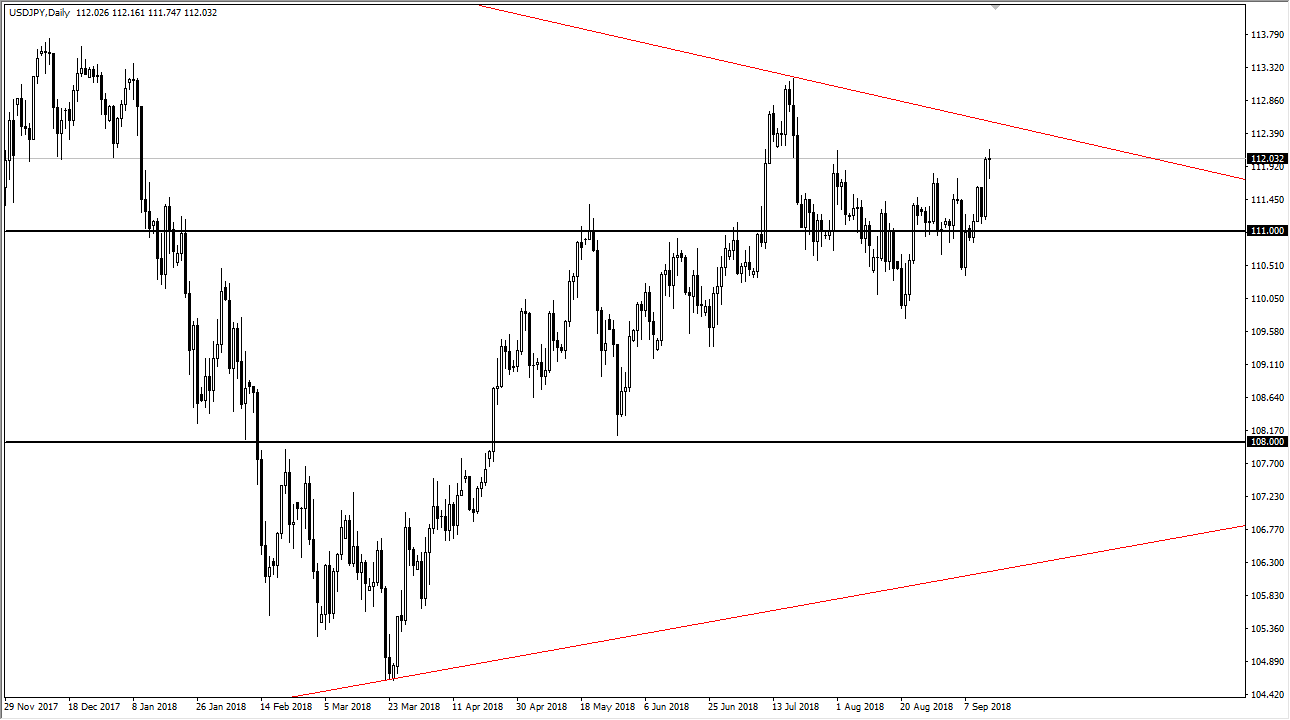

USD/JPY

The US dollar has gone back and forth during the week against the Japanese yen as we continue to see a lot of confusion. We closed at the ¥112 level, so I think that we are trying to go higher. However, this pair is going to be very sensitive to trade relations between the United States and China, and if they get worse it’s very likely that we will see a bit of a pullback. I do not expect that to be catastrophic, but rather an opportunity to buy this pair at a lower level.