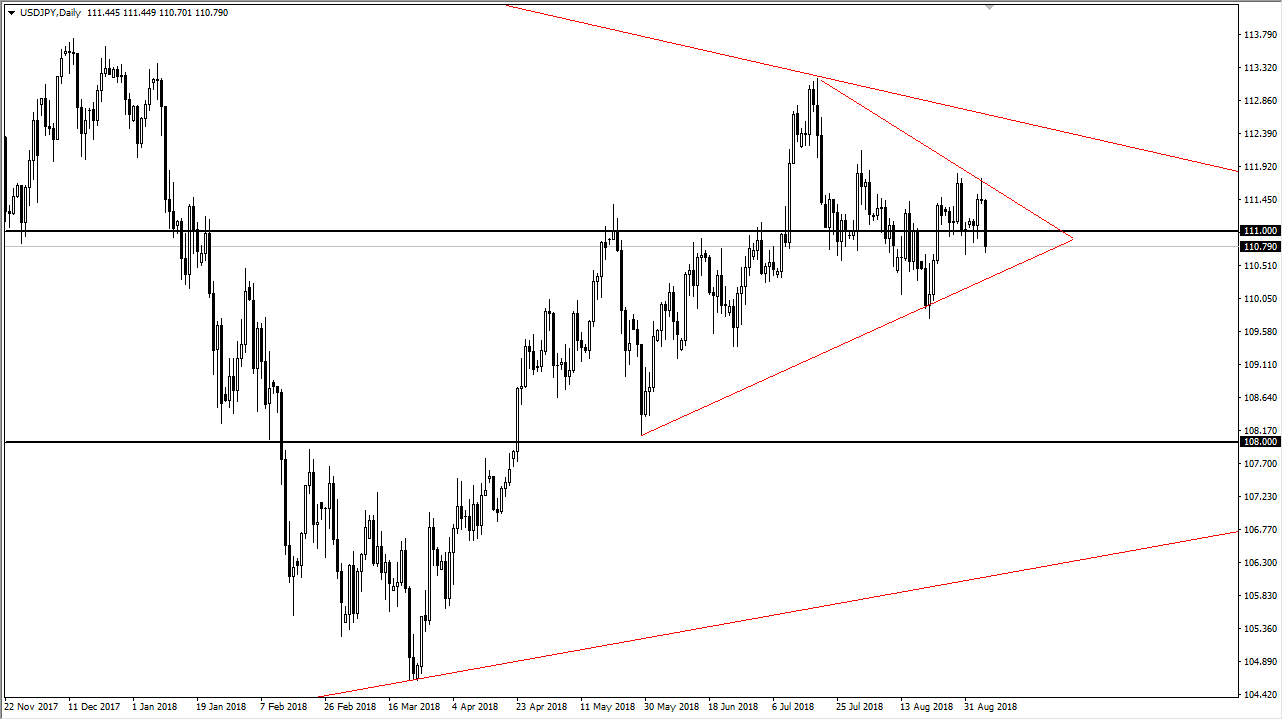

USD/JPY

The US dollar has broken down during the trading session on Thursday, slicing through the ¥111 level. The market breaking down below the shooting star for the Wednesday session was a sell signal, but at this point it looks like there is probably support just below. I think at this point, there’s a couple of triangles were bouncing around in, so at this point I think the market will have to make up its mind, and once it does we will get a significant move. Today being the jobs number could be a callous. However, this is a very difficult market to trade at the moment, so short term back and forth trading is probably as good as it gets currently.

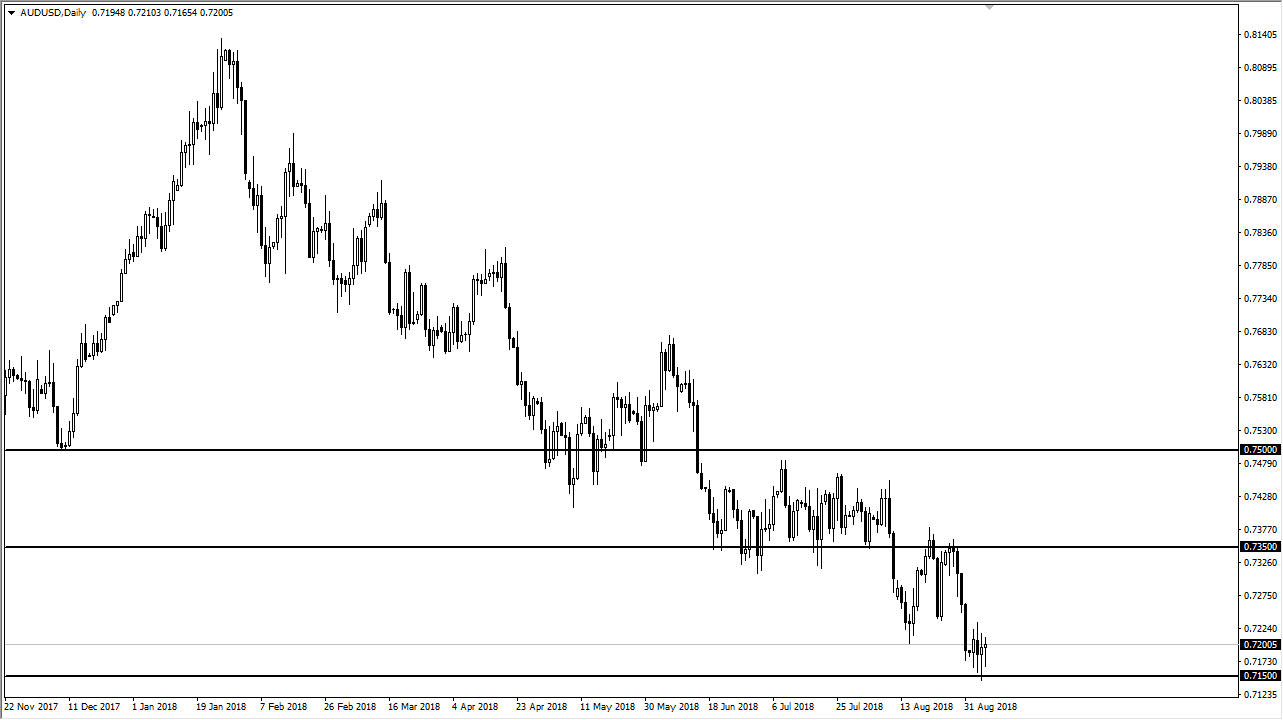

AUD/USD

The Australian dollar continues to rally every time it falls, but it cannot break out to the upside. As you can see, we continue to form several hammers in a row, and if we break down below them, specifically the 0.7150 level, the market will break down rather significantly. Otherwise, if we can rally from here we could go to the 0.7350 level, which has been resistance in the past. I do not like trading this market for a longer-term move yet, so all things being equal I would leave this one alone, because it is being moved by the Sino-American relations, which right now are rocky at best. However, if we break down below the 0.7150 level, it’s likely that we will go down to the 0.70 level rather quickly. That’s an area that is extraordinarily important, and I think at this point very likely if we get some type of worsening of the trade war.