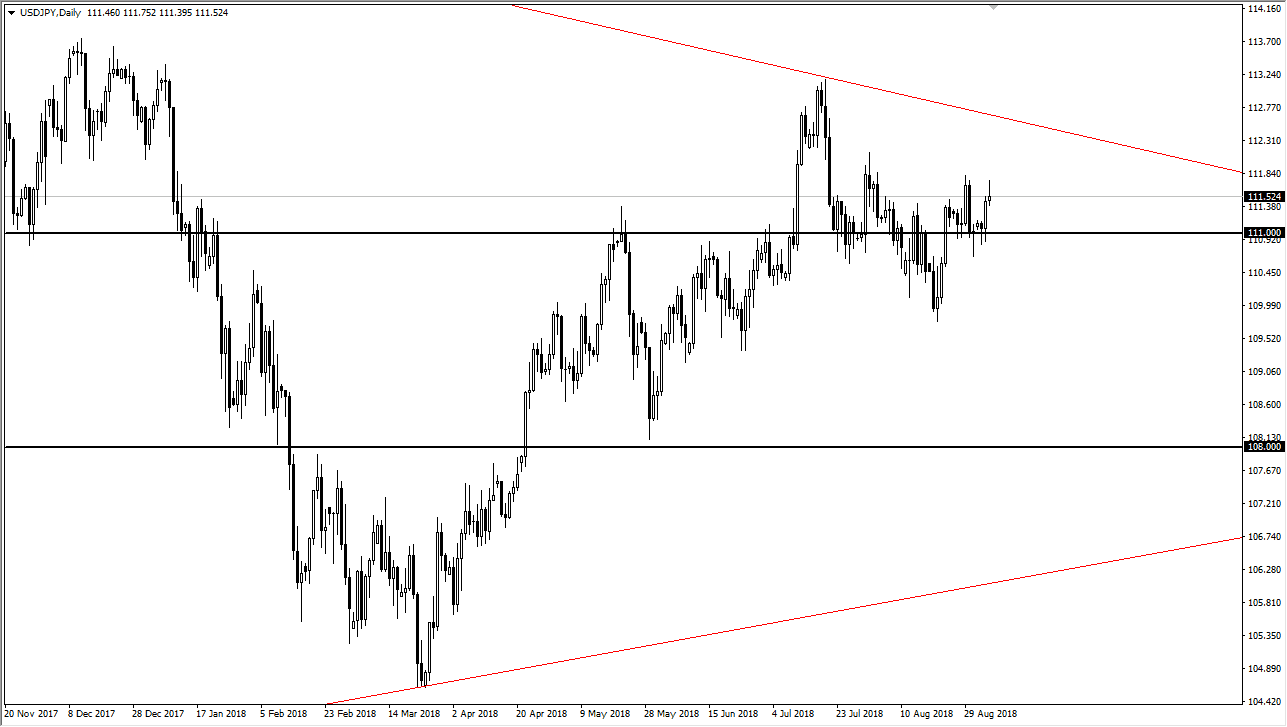

USD/JPY

The US dollar try to rally against the Japanese yen but ran into a significant resistance again near the ¥111.75 level. By forming a shooting star, that shows that the market isn’t ready to go anywhere, and therefore we continue to sideways chop on short-term charts. That doesn’t mean there isn’t money to be made, just that you will have to look at very short-term charts to play the market. If we can break above the top of the shooting star, then the market could go looking towards the ¥112 level, followed by the 112.33 and level which is where the downtrend line finds itself. The market looks likely to be very choppy and noisy, but quite frankly with all of the global trade issues, that’s not much of a huge surprise.

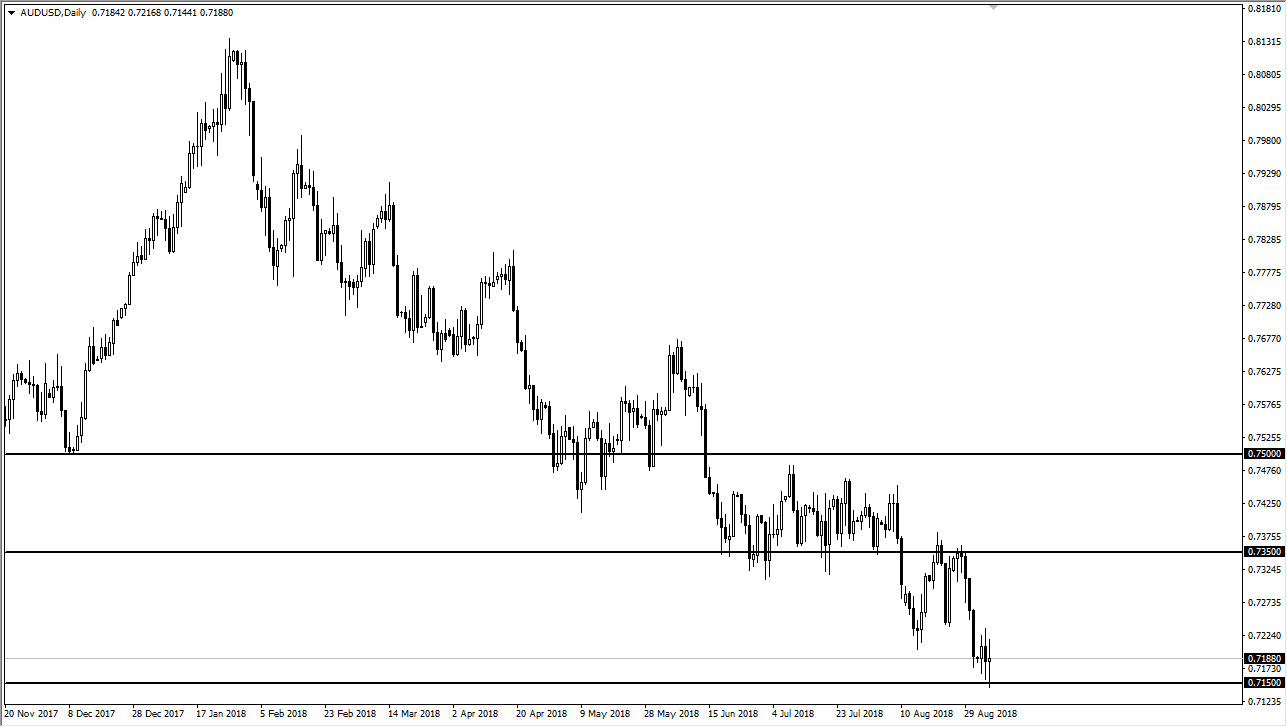

AUD/USD

The Australian dollar didn’t really know what to do during the day, as we continue to chop around between the 0.7150 level in the 0.7225 handle. The market looks very likely to be confused and I think at this point we are simply paying attention to the US/China trade relations. If they break down a bit from here, I think that at this point it’s likely that the Australian dollar will break down as well. However, if things do get better somehow, the market will probably go looking towards the 0.7350 level. Alternately, if the market breaks down from here, I think we will then go to the 0.70 level after that, an area that has been massive support more than once. In a general sense, this is a proxy for Sino-American relations, and I think this is simply going to react to headlines in general.