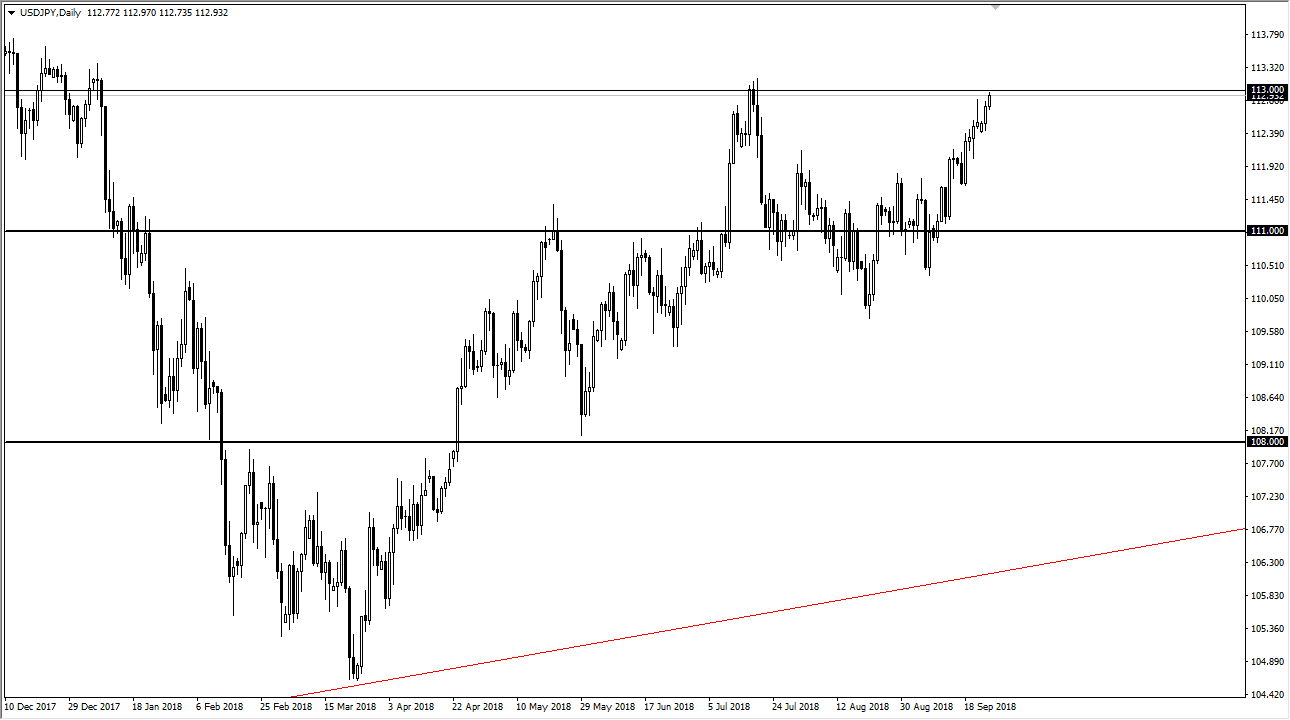

USD/JPY

The US dollar has rallied again against the Japanese yen, reaching towards the 113 handle. This is an area that is crucial, and I think at this point if we can continue to break above there, then we could very easily go to the ¥114.50 level. I believe at this point it’s likely that we may see a little bit of a pushback but I think that the bullish pressure is starting to come into play again. Eventually, I think that the ¥114.50 level would probably end up being a very difficult area to get past. If we do, then this pair becomes more of a “buy-and-hold” scenario. If the ¥111 level underneath is support, and I think that we shouldn’t break down below there. If we do, then we could have a serious break down for a longer-term move. Overall, this pair tends to move with the stock markets and as they seem to be resilient, it’s likely that the USD/JPY pair will be. Expect a pullback, but it should be a buying opportunity.

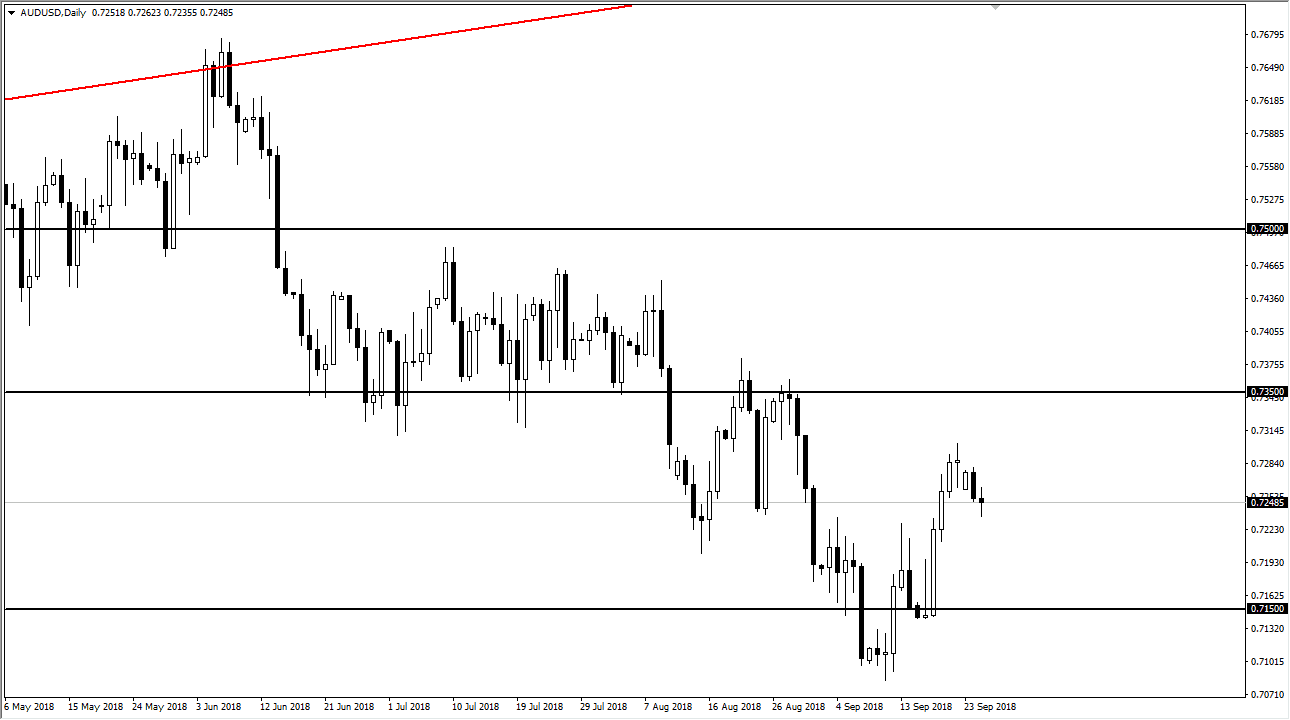

AUD/USD

The Australian dollar had a very choppy session during the day on Tuesday, essentially forming a neutral candle. This market looks very likely to make a decision shortly as to whether it can keep the uptrend going, but quite frankly after a short-term pullback I don’t truly know what to think. I think the easiest trade will be to simply take whichever side of the market breaks. A break above the highs of the day should send this market higher, perhaps reaching towards the 0.7350 level. Alternately, if we break down below the lows of the day it’s likely that we could revisit the 0.7150 level given enough time.