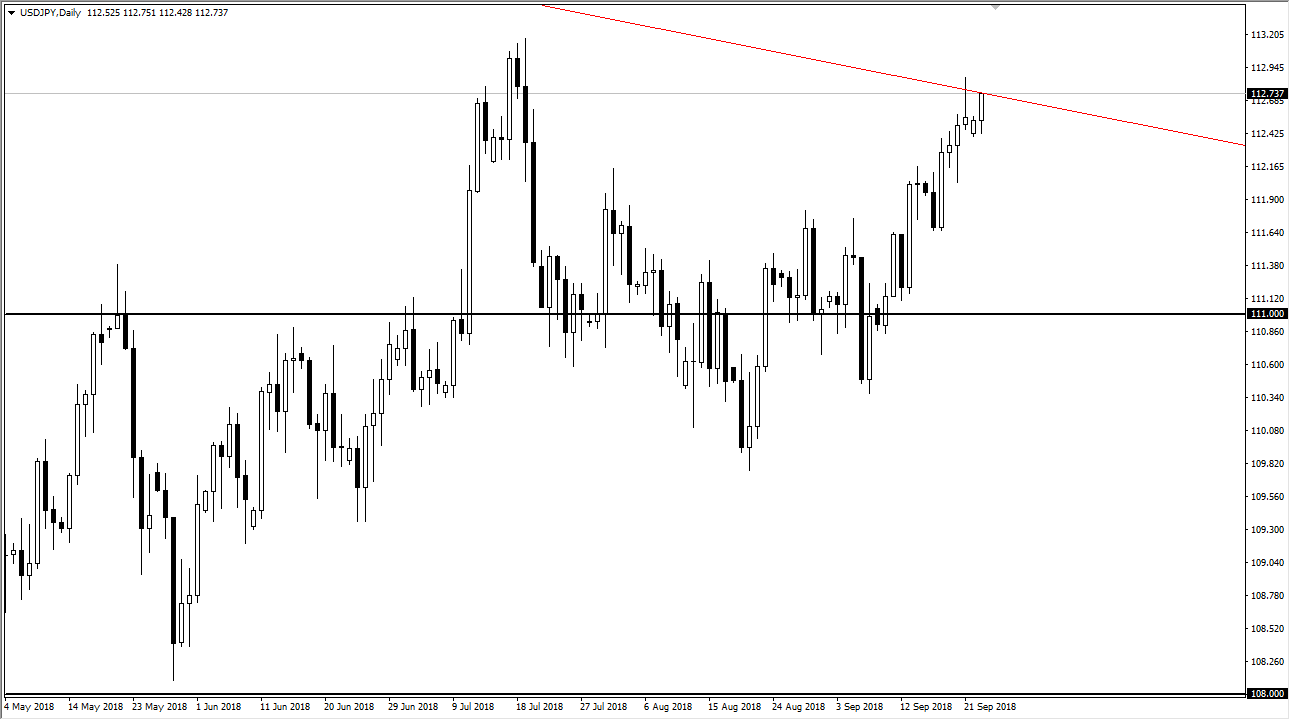

USD/JPY

The US dollar rallied against the Japanese yen during the trading session on Monday, reaching towards the highs of the Friday candle stick again, as we see US dollar strength overall. However, the market will continue to struggle with this major downtrend line, so at this point I don’t feel that it’s easy to buy this market for any length of time until we clear the ¥113 level. Once we get above there, I think the market probably goes to the resistance barrier at the ¥114.50 level. The alternate scenario of course is that we break down below the lows of the candle stick for the Monday session, and perhaps go looking to lower levels to pick up a bit of value. I do believe that we break out eventually, but there are so many moving pieces right now that anything involving the Japanese yen is going to be noisy.

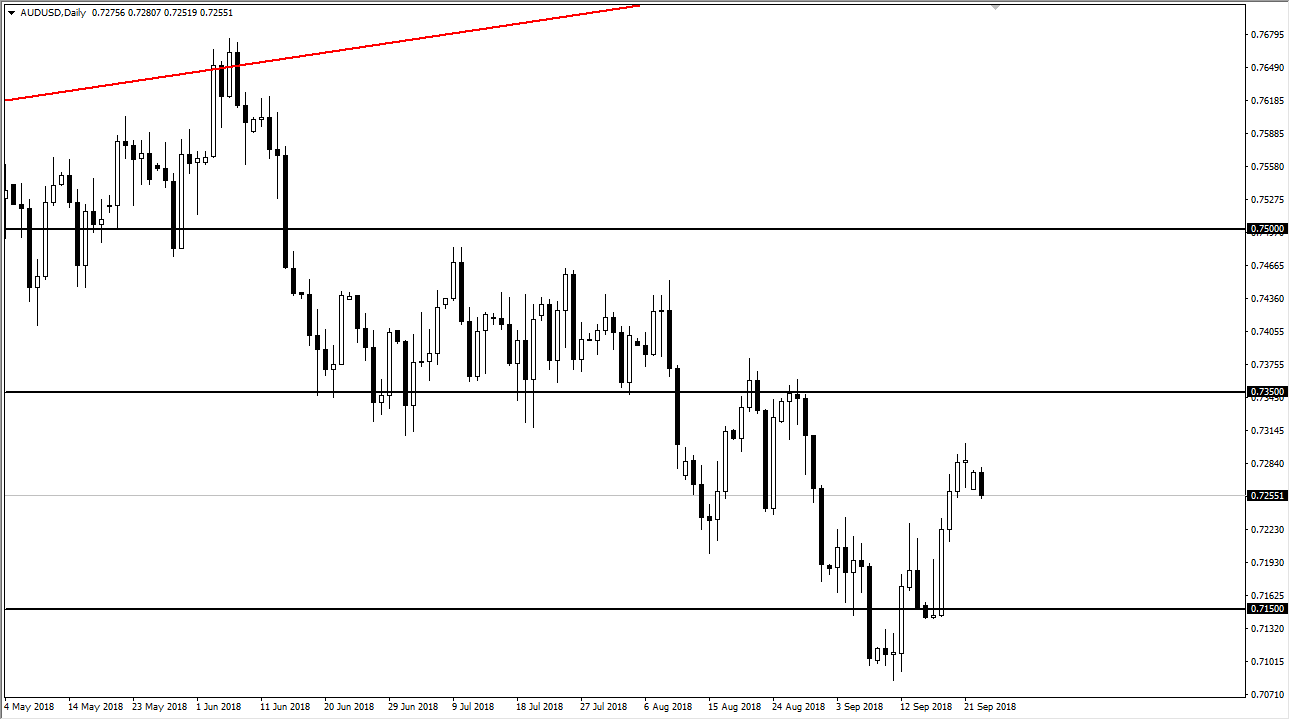

AUD/USD

The Australian dollar fell during the trading session on Monday, breaking below the bottom of the candle stick for the Friday session, which is a negative sign. We are in a downtrend anyway, so quite frankly it’s going be easier to short this market than it is to buy it, and any escalation between the US/China trade war will of course continue to punish the Australian dollar overall. I think at this point, it’s likely that we will continue to see very noisy trading, but certainly it is easier to sell this market than it is the buy it. If that does in fact end up being the case, the market will probably go looking towards the 0.7150 level again. A break out to the upside still has to deal with the 0.7350 level, an area that is massive resistance.