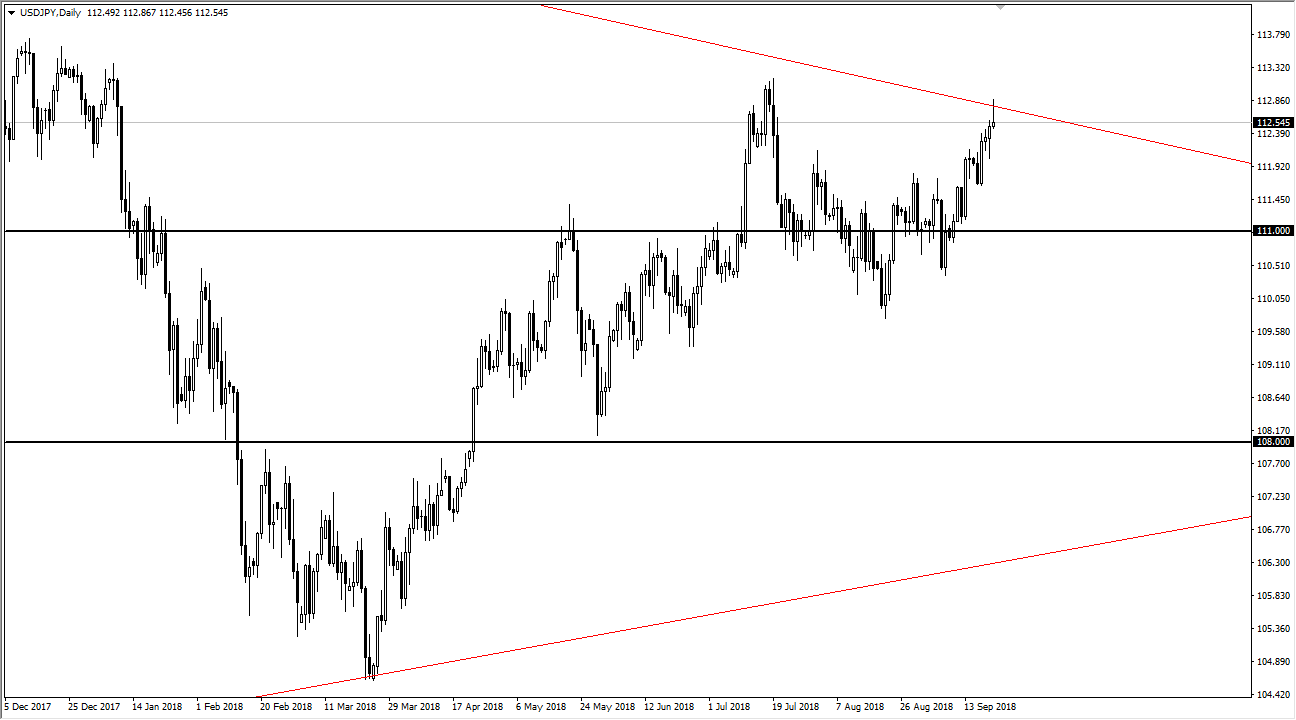

USD/JPY

The US dollar initially tried to rally during trading on Friday, but turned around of form a shooting star for the session at the downtrend line that forms the top of the major symmetrical triangle that we have been in. While this chart does look bullish to me longer term, I believe that the candle identifies that we need to pullback in order to build the necessary momentum to continue going higher. I would anticipate a bit of support at the ¥112 level, and then again at the ¥111.50 level. The alternate scenario would be breaking above the top of the shooting star, and if we can stay above the ¥113 level for any length of time, I would be very bullish and expect this market to go to the ¥114.50 level. One thing I think you can count on is a lot of volatility though.

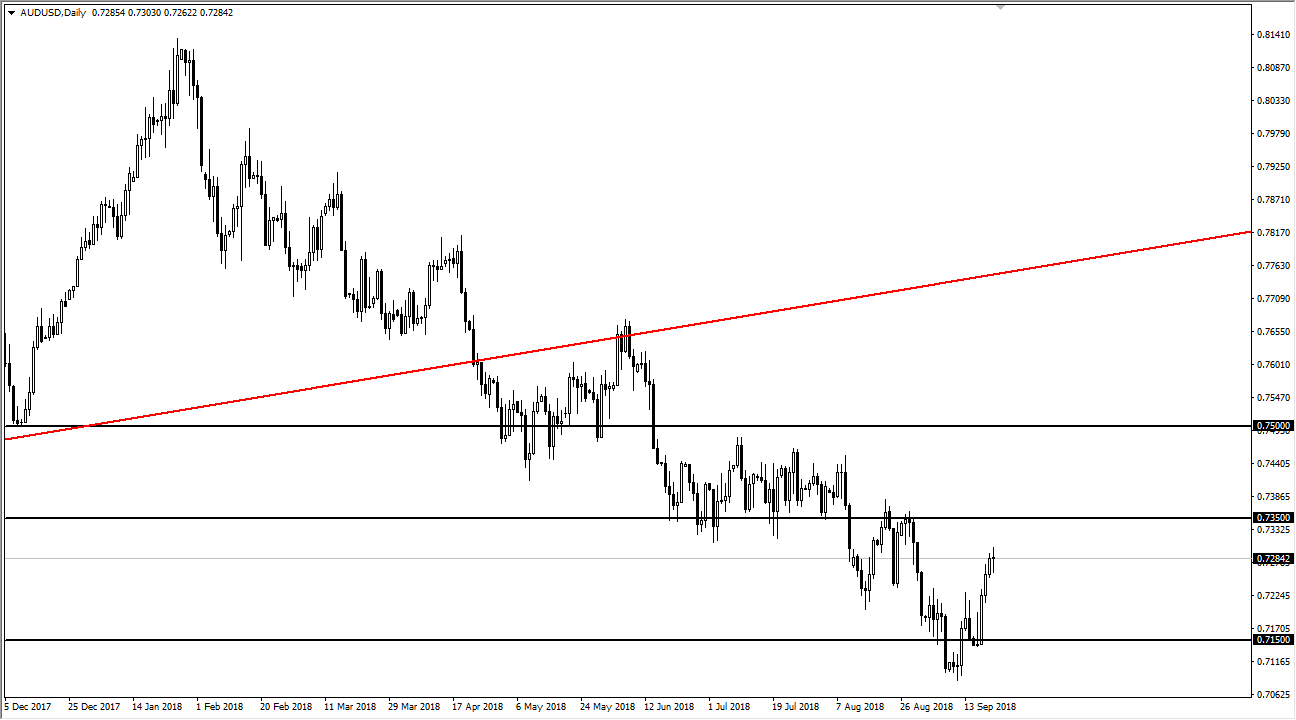

AUD/USD

The Australian dollar has gone back and forth during the trading session on Friday, forming a very neutral looking candle. We have had three very bullish sessions ahead of that candlestick, but we are most certainly in a negative trend. I think there is a massive amount of resistance at the 0.7350 level, so this point I think that we will probably see sellers step in and start shorting somewhere between here and there. I have one of two possible scenarios laid out in front of me: selling a break below the bottom of the candle stick for the session on Friday, as it would show a turnaround, or looking to sell signs of exhaustion near the 0.7350 level. I think at this point if you are looking to buy this pair, you may have missed your signal. Because at the 0.7350 level, I think that begins a massive amount of noise.